- United States

- /

- Software

- /

- NasdaqGS:DOCU

What are Investors Worried About from the Latest DocuSign (NASDAQ:DOCU) Earnings

Key takeaways:

- With an expected 17.5% annual growth, DOCU is on track, but the costs of funding it may increase as management has challenges incentivizing the salesforce.

- Net retention is slowly declining to 114%, prompting investors to reevaluate the built-up barriers to entry and the necessity of the service.

- The cash balance of $638m still gives the company enough room to fund growth, but the risk may be higher.

DocuSign (NASDAQ:DOCU) just released the latest Q1 earnings, and it seems like many investors are selling the stock. We will review the earnings and analyze why investors may have changed their position on the company.

View our latest analysis for DocuSign

The goal is to examine what can investors expect from the financials in the future, and what are some concerns unveiled from the earnings call.

We start with the business highlights:

- Customer base increased from 1.17m in FY 2022 to 1.24 in Q1 2023, up 6%.

- Enterprise and commercial customers are up 7%, from 170k to 182k.

- Large customers ($300k+ annual contract value), are up 4%, from 852 to 886.

If we extrapolate the quarterly growth to an annual value, we get about a 25% total customer growth expectation.

The company has already scaled well, and it is realistic to assume some deceleration of growth in the future. However, we would expect the established customers to maintain or even grow dollar retention as an indirect indicator of the quality of service - and for DocuSign the net dollar retention fell from 125% in Q1 FY22 to 114% this quarter. This may indicate that the service isn't holding up against budget cuts in client organizations, or that some clients are finding it below expectations.

Next, we look at current financial performance:

- Q1 revenue at $589m, up 37% from the last trailing 12 months.

- Gross margin held up well around 81%, but a key expense is the Salesforce, which we will analyze below.

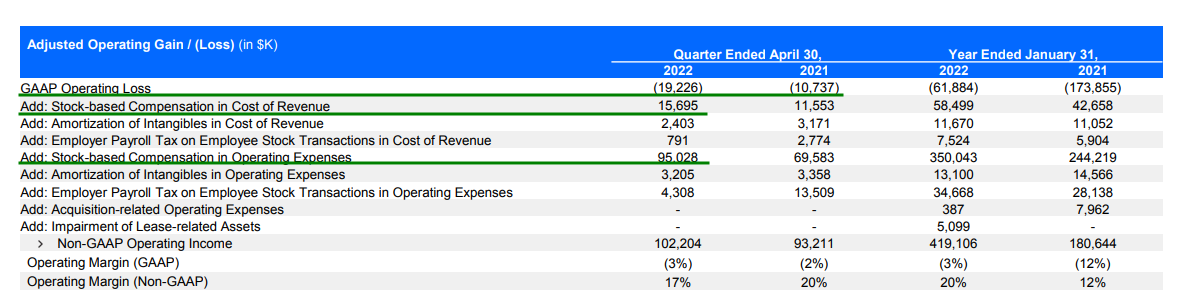

- Non-GAAP operating margin fell to 17% from 20%, however GAAP numbers which include stock based compensation show a -3% margin.

- Free cash flow margin is 30%, an increase from 26% a year ago.

- GAAP sales and marketing expenses are 51% of revenue.

In the table below, we will break down why some numbers are concerning for investors:

We can see that employees have been compensated with stocks to a large extent - Q1 stock compensation is equivalent to $110m. This was ok while the stock was trading at $270+ per share, but the 75% drop in the last 12 months means that employees lost a lot of their value from the stock.

A Fintwit insight points out the importance of this drop: In essence, as more employees quit, the company will be pressured to switch either to more cash compensation or to further dilute shareholders (if employees are on board with that).

As we mentioned, the sales and marketing expense is 51% of revenue - which means DocuSign's salesforce is a key component of their growth strategy. The company may find itself in more financial stress if the salesforce is hard to incentivize and increased cash compensation hits the income statement.

While management may find alternatives and balance out the impact, it is likely that DocuSign will have a harder time selling in the future and growth may dampen.

Finally, the issued outlook indicates:

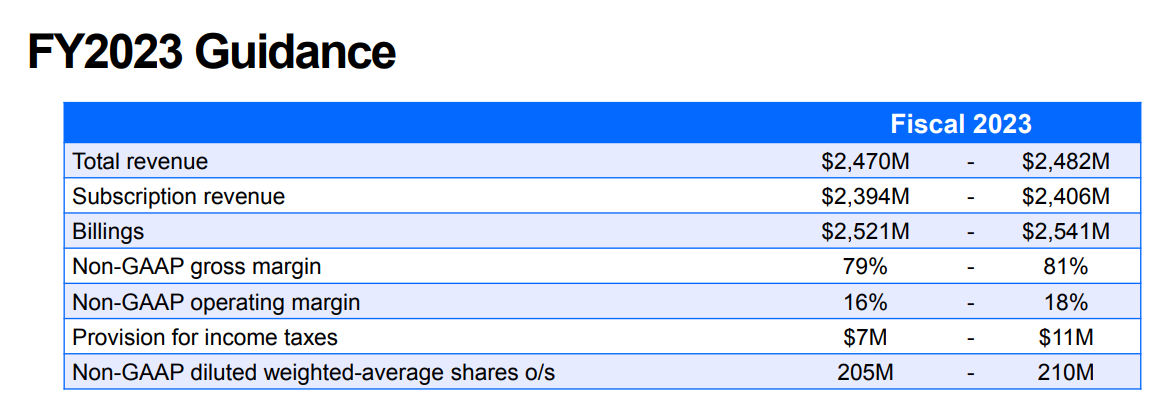

- Expected revenue growth of 17.5% - from $2.107b in FY 2022 to an estimated 2.475b in FY 2023, in line with estimates.

- A maintained gross and operating margin at 80% & 17% respectively.

DocuSign needs to keep the long-term growth expectation of becoming a $5b revenue company, while finding a way to mitigate operating expenses.

The company has a cash balance of $638m, and a GAAP loss from operations of $19.2m, giving it a rough cash runway of 8 years with the current expense structure. It seems that DocuSign has more than enough cash capacity to fund growth, but investors may be left holding the risk as the company digs into reserves when scaling the business.

If you want to dive deeper, you can view the Q1 2023 full earnings call transcript along with the investor Q&A.

Conclusion

Growth is on track but slowly dampening, while the costs of maintaining it may increase as employees are harder to incentivize and the sales cycle becomes longer. The company is on track with expectations, but may find it more expensive to reach its goals.

There is also some business risk to consider, as DOCU may not have built up enough barriers to entry in order to become an irreplaceable service for clients. Net dollar retentions are also starting to decline, which could mean that the service does not meet expectations, smaller companies found cheaper alternatives, or the financial tightening is forcing clients to implement cost-cutting measures which may lead to contract cancelations.

Additionally, we've discovered 2 warning signs that you should run your eye over to get a better picture of DocuSign.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives