- United States

- /

- Software

- /

- NasdaqGS:DOCU

Low Cost to Produce, and High Reinvestment. Here is why DocuSign (NASDAQ:DOCU) has a Great Expense Structure

DocuSign (NASDAQ:DOCU) is wrestling with itself after the last earnings report. When looking at this company, here is what we can see: they have a cost-cutting product that targets an old service which was in the domain of law firms and possibly overpriced. Their cloud alternative offers a much faster, cheaper and more customizable alternative for both parties of an agreement. This US$57.3b Market Cap company is automatizing away something people needed to pay lawyers for.

The company reported a solid second quarter result with reduced losses, improved revenues and improved control over expenses.

Second quarter 2022 results:

- Revenue: US$511.8m (up 50% from 2Q 2021).

- Net loss: US$25.5m (loss narrowed 61% from 2Q 2021).

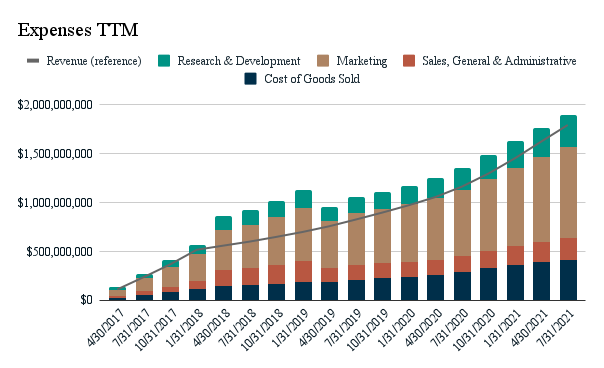

It is interesting to consider how the company is structuring expenses, and after some analysis we come up with the following structure:

The great part about this is that the company already has 1 billion+ users and about 1 million paying customers. It's indicative that the large marketing spend has been highly effective in growth and can be scaled down in times of need.

Specifically, the company has a median sales to capital ration of 300% - Which means that they get $3 for every $1 they put in the business.

Another important point is the very low COGS expense, which gives way to higher profit margins in the future.

Research and Development seem to be a key component in the cost structure, which is satisfying to see that the company is spending a significant portion of funds in improving their product.

View our latest analysis for DocuSign

Now we turn to the stock performance, and we can see that over the last 3 years on average, earnings per share has increased by 54% per year, but the company’s share price has increased by 70% per year, which means it is tracking significantly ahead of earnings growth. This can scare off some investors, as it might seem that the stock is a bit ahead of the company performance, but analysts are clearly optimistic in the stock and are increasing price targets. They recently posted a target upgrade, up from US$285 - as an average from 21 analysts:

- New target price is increased to US$323

- Stock is up 33% over the past year

In their last report's press release, DocuSign explained the technical achievements that have been made this year to date, as well as their new connectors with Salesforce (NYSE:CRM) and SAP Ariba (XTRA:SAP) for DocuSign Insight. These updates show us that the company is operating at scale, and has a good probability to be the market leader in this disrupted category.

Key Takeaways

Growth has to be backed by reinvestment, and that is precisely what we see in DocuSign, a company that pours cash in development and marketing. The company is scaling up and optimizing their functionalities for large corporations such as SAP and Salesforce.

More importantly, it seems that the growth scales up in relation to the cost of selling their service, which is a great indicator of high future profit margins.

When growth is followed by reinvestment, investors have more assurance that the company can keep up the high growth rates and expand their market share.

The price target was increased to US$323, and while the company valuation is heavily reliant on future growth and margins, it is great to see a potentially undervalued growth stock in the cloud service industry.

At Simply Wall St, we found 2 warning signs for DocuSign that deserve your attention before buying any shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion