- United States

- /

- Software

- /

- NasdaqGS:DOCU

DocuSign (DOCU) Sets Revenue Goals and Welcomes New Leadership in Governance Update

Reviewed by Simply Wall St

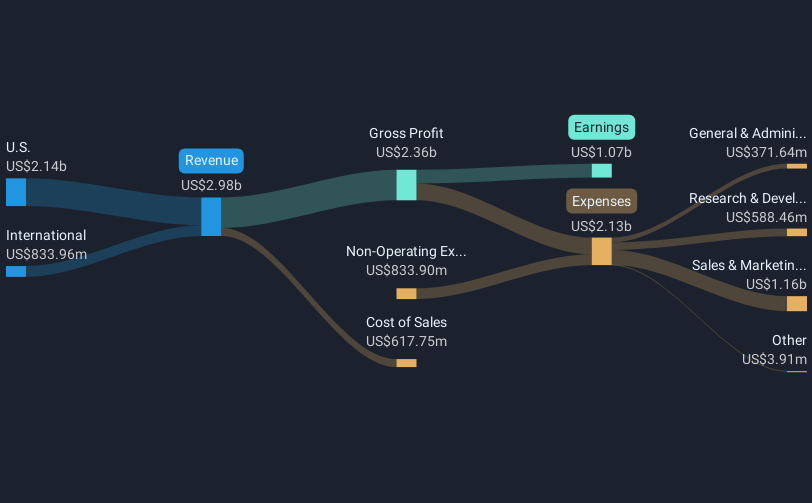

DocuSign (DOCU) witnessed a price movement of 3% over the last month, reflecting several key developments. With second-quarter revenue rising to $801 million from $736 million year-over-year, and a forward revenue guidance confirming expectations of stable growth, the company's financial updates provided a solid backdrop. Additionally, the strategic board changes, including the appointment of Mike Rosenbaum and James Beer, appear to align with the company's strengthened governance focus. The combination of these elements likely added weight to the broader market's overall performance, as major indexes posted modest gains, against a backdrop of fluctuating market signals and economic data focused on potential interest rate cuts.

We've identified 2 weaknesses for DocuSign that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

DocuSign's recent developments, including strategic board changes and revenue growth, align with its ongoing push into international markets and enhanced partner channels. The launch of Intelligent Agreement Management (IAM) targets the SMB and mid-market segments, potentially driving significant revenue gains. However, this move occurs amidst AI and economic uncertainties that could impact projected revenue and profit margins. Although analysts anticipate a growth in revenue, concerns around declining profit margins and competitive pressures remain. These strategic initiatives, combined with the board's new appointments, are intended to bolster governance and performance.

Over the longer term, DocuSign's total return, including share price movements and dividends, was 33.92% over the past year. This performance suggests a strong resilience compared to broader market trends. Over the shorter one-year horizon, the company's performance outpaced the US Software industry, which returned 28% during the same period, pointing to a favorable market position. However, projections of future earnings suggest a potential annual decline, posing risks to maintaining this trend.

With a current share price of $76.24 and a consensus price target of $89.57, there remains a 17.49% discount to the projected fair value. Analyst estimates assume potential challenges and risks in meeting the forecasted revenue of approximately $3.8 billion by 2028, alongside a decline in earnings. The focus on expanding federal market opportunities and technology investments will be crucial in mitigating these risks and supporting the company's path towards the stated price target. As always, investor confidence will weigh heavily upon these expectations and external economic factors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DOCU

DocuSign

Provides electronic signature solution in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives