- United States

- /

- Software

- /

- NasdaqGS:DDOG

Reassessing Datadog (DDOG) Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Datadog (DDOG) has been under pressure lately, with the stock sliding about 24% over the past month even as revenue grew roughly 17% and net income climbed more than 34% year over year.

See our latest analysis for Datadog.

That steep 30 day share price return of minus 24.3 percent has taken the stock back near where it started the year, despite a slightly positive 90 day share price return and a still impressive three year total shareholder return of 84.3 percent. This suggests momentum has cooled even as the long term story remains intact.

If Datadog has you rethinking where the next wave of growth might come from, this could be a good moment to explore other high growth tech and AI stocks that are reshaping software and infrastructure.

With shares sliding even as profits and revenue rise, investors now face a pivotal question: Is Datadog trading at a meaningful discount to its growth prospects, or has the market already priced in the next leg of expansion?

Most Popular Narrative Narrative: 33.9% Undervalued

Datadog’s most followed narrative pegs fair value around 34 percent above the last close of $140.05, framing the recent share pullback as potential mispricing.

Ongoing product innovation (e.g., autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance, providing cross-selling opportunities and driving higher average revenue per user and net retention rate, which in turn improves recurring revenue predictability and gross margins.

Want to see what kind of revenue runway and margin expansion this valuation is banking on, and how far future earnings multiples are stretched to get there? Dive into the full narrative to unpack the exact growth path behind that higher fair value.

Result: Fair Value of $211.97 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated AI customer exposure and intensifying competition from hyperscalers and open source tools could quickly undermine these optimistic growth and valuation assumptions.

Find out about the key risks to this Datadog narrative.

Another View on Valuation

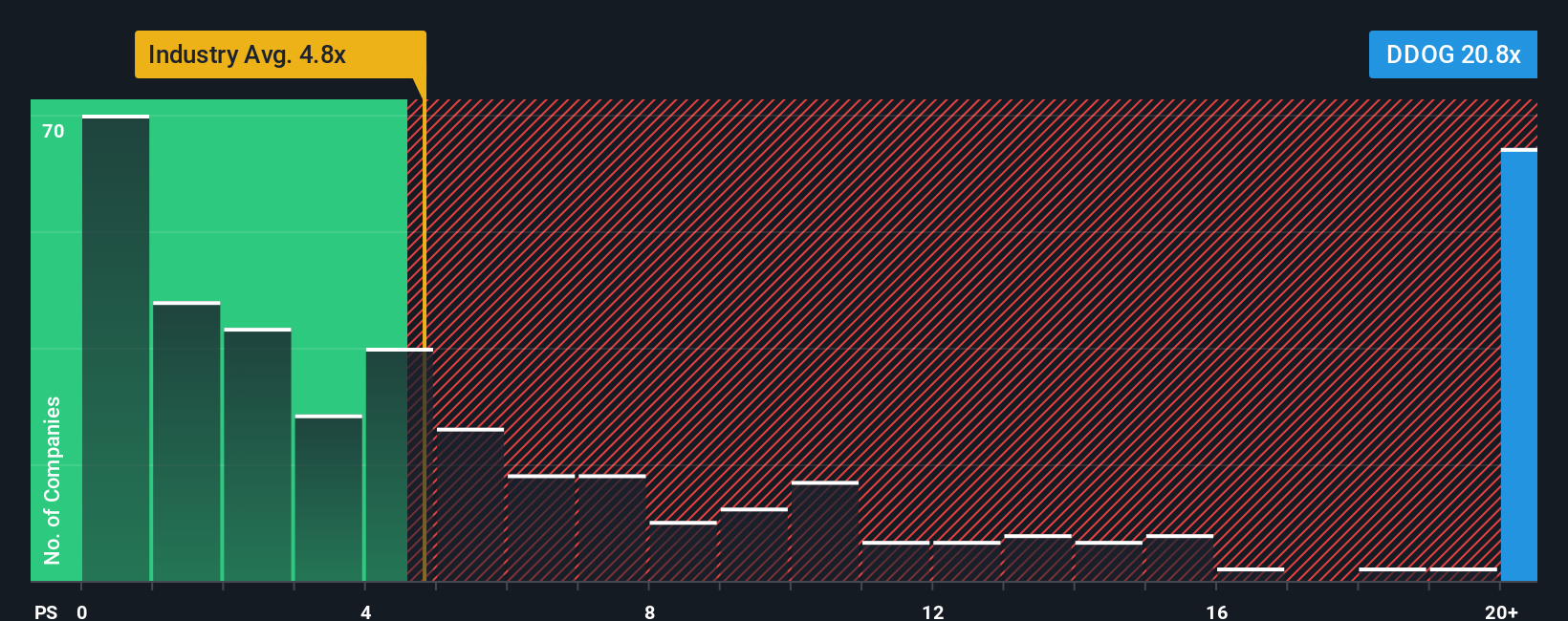

While the narrative driven fair value suggests Datadog is 33.9 percent undervalued, its 15.3 times price to sales ratio looks demanding against US software peers at 4.9 times and an estimated fair ratio of 13.1 times. That premium hints at valuation risk if growth stumbles, or it may simply reflect a category leader premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If you see Datadog’s story differently or want to stress test these assumptions with your own inputs, you can build a fresh view in minutes: Do it your way.

A great starting point for your Datadog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before markets shift again, put Simply Wall St’s powerful screener to work right now and build a pipeline of fresh, data driven stock ideas.

- Explore high potential growth by scanning these 3625 penny stocks with strong financials that pair smaller market caps with real financial strength.

- Consider the AI transformation by targeting these 25 AI penny stocks positioned in automation, data, and intelligent software.

- Research tomorrow’s opportunities today by focusing on these 908 undervalued stocks based on cash flows that appear mispriced based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)