- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (NasdaqGS:DDOG) and Chainguard Partnership Amid 13% Weekly Share Decline

Reviewed by Simply Wall St

The recent partnership between Chainguard and Datadog (NasdaqGS:DDOG) to boost container security and observability comes amid a challenging market backdrop, highlighted by Datadog’s share price decline of 13% over the past week. This performance aligns with the broader market turmoil, with the S&P 500 and Nasdaq posting weekly declines of 9% and 10%, respectively, driven largely by fears of a global trade war following new tariffs. While the Chainguard partnership offers long-term strategic benefits, it seems overshadowed by immediate market pressures affecting tech stocks, contributing to the negative sentiment around Datadog's shares.

Buy, Hold or Sell Datadog? View our complete analysis and fair value estimate and you decide.

Looking back over the last five years, Datadog's shares have delivered a total return of 137.97%, underscoring a strong performance that places it in a prominent position despite recent short-term challenges. This impressive growth reflects Datadog's continual innovation and adaptation within the rapidly evolving tech landscape. Notable developments during this period include the introduction of new products like Cloud SIEM and enhancements in database monitoring as of December 2024. These advancements are pivotal, facilitating improved threat detection and database performance insights, thereby enhancing Datadog's service offering and customer value proposition.

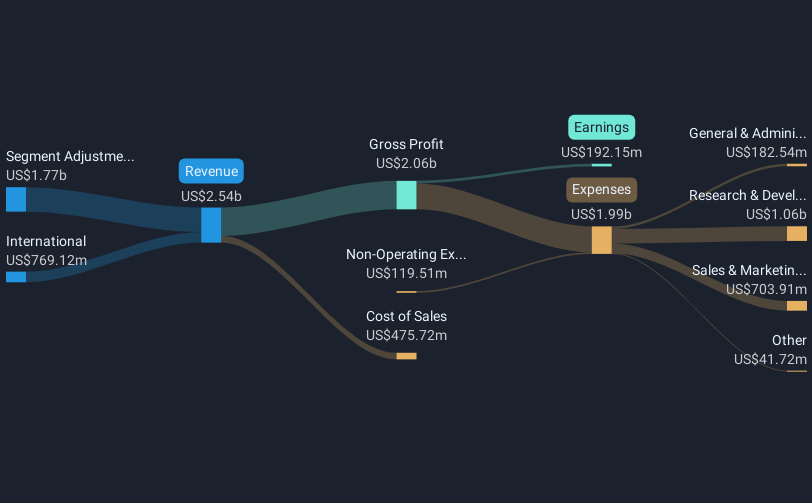

Additionally, strategic partnerships were instrumental in fortifying Datadog's market standing. The collaboration with Akamai Technologies in May 2024 to enhance cloud security highlights such efforts. However, competitive pressures and customer cost optimization have introduced challenges, reflected in their Q4 2024 earnings report, where net income was US$183.75 million on revenues of US$2.68 billion. Although these factors have pressured short-term performance, the broad adoption of AI and expansion into underserved geographies remain key growth levers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Datadog, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives