- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG) Valuation: Is There Room for Upside After Recent Momentum?

Reviewed by Kshitija Bhandaru

See our latest analysis for Datadog.

Datadog’s share price momentum has been building, with a 1-month share price return of nearly 17% and a 1-year total shareholder return of 26%. While recent sessions saw a modest pullback, the broader trend points to strengthening long-term investor confidence.

If Datadog’s gains have you curious about what else is trending, this could be the perfect moment to explore cutting-edge software names and other high-growth digital innovators. See the full list for free: See the full list for free.

With shares up sharply and Datadog trading near its analyst price targets, the key question now becomes clear: Is more upside still left on the table for new investors, or has the market already priced in Datadog's future growth?

Most Popular Narrative: Fairly Valued

Datadog’s current price sits almost exactly in line with the narrative’s calculated fair value. This suggests the market already reflects optimistic growth and future profitability expectations in the share price.

Ongoing product innovation (such as autonomous AI agents, enhanced security modules, expanded log and data observability) is increasing platform breadth and relevance. This provides cross-selling opportunities and drives higher average revenue per user and net retention rate, which in turn improves recurring revenue predictability and gross margins.

Want to know exactly what powers this premium? The narrative leans on bold growth expectations, ambitious profitability forecasts, and a future profit multiple typically reserved for market leaders. Curious which numbers drive the story? Look closer and see what could be fueling this high-stakes calculation.

Result: Fair Value of $162.08 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent R&D spending and reliance on large AI customers could challenge Datadog's growth narrative if demand cools or margins tighten unexpectedly.

Find out about the key risks to this Datadog narrative.

Another Perspective: Discounted Cash Flow Model

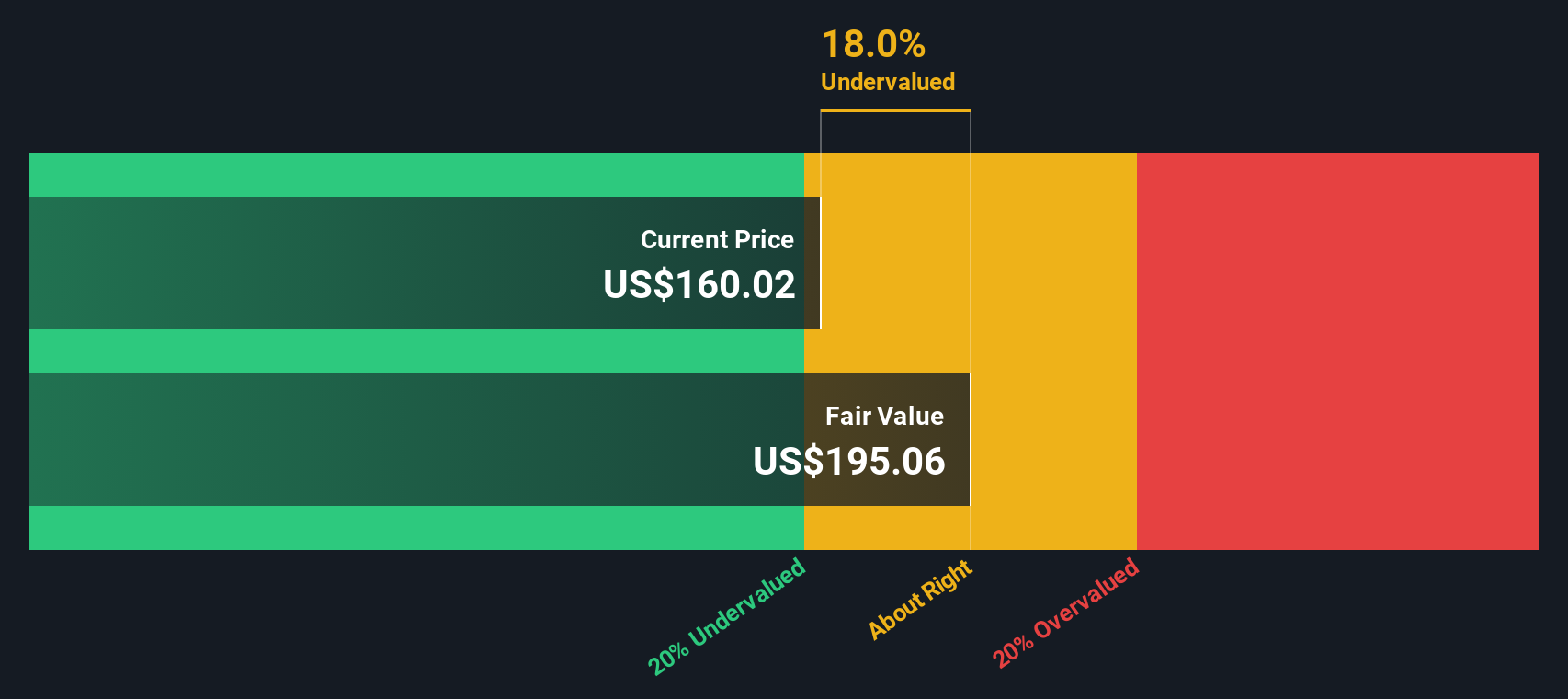

While Datadog’s share price aligns with fair value based on analyst estimates, our SWS DCF model uses a different method. According to this approach, Datadog is trading about 5.7% below its intrinsic value. This indicates a possible undervaluation by the market. Can the cash flow outlook provide further insights?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Datadog for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Datadog Narrative

If you have a different take or want to dig into the numbers yourself, crafting your own view is quick and easy. Do it your way: Do it your way

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why limit your strategy to just one stock? Discover additional prospects that could enhance your portfolio by exploring these tailored investment ideas today.

- Harvest income potential in your holdings by searching for reliable yields through these 18 dividend stocks with yields > 3% with current payouts above 3%.

- Uncover innovators shaping tomorrow’s technology by targeting these 26 quantum computing stocks as they advance breakthroughs in computing and security.

- Stay ahead of the trend and see which smart companies are embracing artificial intelligence through these 25 AI penny stocks for rapid growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives