- United States

- /

- Software

- /

- NasdaqGS:DDOG

Datadog (DDOG): Evaluating Valuation Following Rising AI Demand and Enterprise Software Momentum

Reviewed by Simply Wall St

Datadog (DDOG) is firmly in the spotlight after recent reports underlined its critical role in the enterprise software world. The company is not just powering observability and security for thousands of organizations; its momentum is being fueled by rapid customer expansion, especially among businesses deeply invested in AI and the cloud. With both hedge funds and customers increasing their stakes, Datadog’s commitment to innovation is catching the market’s eye and may raise fresh questions for anyone considering their next move with the stock.

Over the past year, Datadog’s price action has showcased its growth story, outpacing many of its peers with a 27% gain. The past quarter also saw renewed energy, as shares climbed 14%, despite a modest pullback earlier this year. This follows a stretch of significant revenue growth and a growing base of institutional investors. The pattern suggests that enthusiasm is building, not just for the company’s technology, but for its future prospects in an AI-driven software landscape.

With the spotlight shining on Datadog’s innovation and recent growth, the key question is whether the current share price truly reflects all that upside. Is there room for further gains, or has the market already priced in the company’s next chapter?

Most Popular Narrative: 14.7% Undervalued

According to the most widely followed narrative, Datadog is considered undervalued, with an estimated fair value notably above its current share price. This verdict is based on optimistic projections of future earnings, profit margins, and sector tailwinds.

Accelerating enterprise cloud migration and broader adoption of AI workloads are driving increased demand for unified observability and security platforms. This positions Datadog as a mission-critical vendor and supports continued topline revenue growth as digital transformation deepens across industries.

Curious about what’s really driving Datadog’s valuation? The main narrative is fueled by some bold growth assumptions—a high-stakes blend of future profits, margin expansion, and sector disruption. Want to find out which essential financial moves and strategic bets underpin this impressive price target? Dive deeper for the numbers that could shape Datadog’s next chapter.

Result: Fair Value of $159.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant reliance on large AI customers and intensifying competition could trigger volatility or create pressure on Datadog’s future growth expectations.

Find out about the key risks to this Datadog narrative.Another View: Price Tag Tells a Different Story

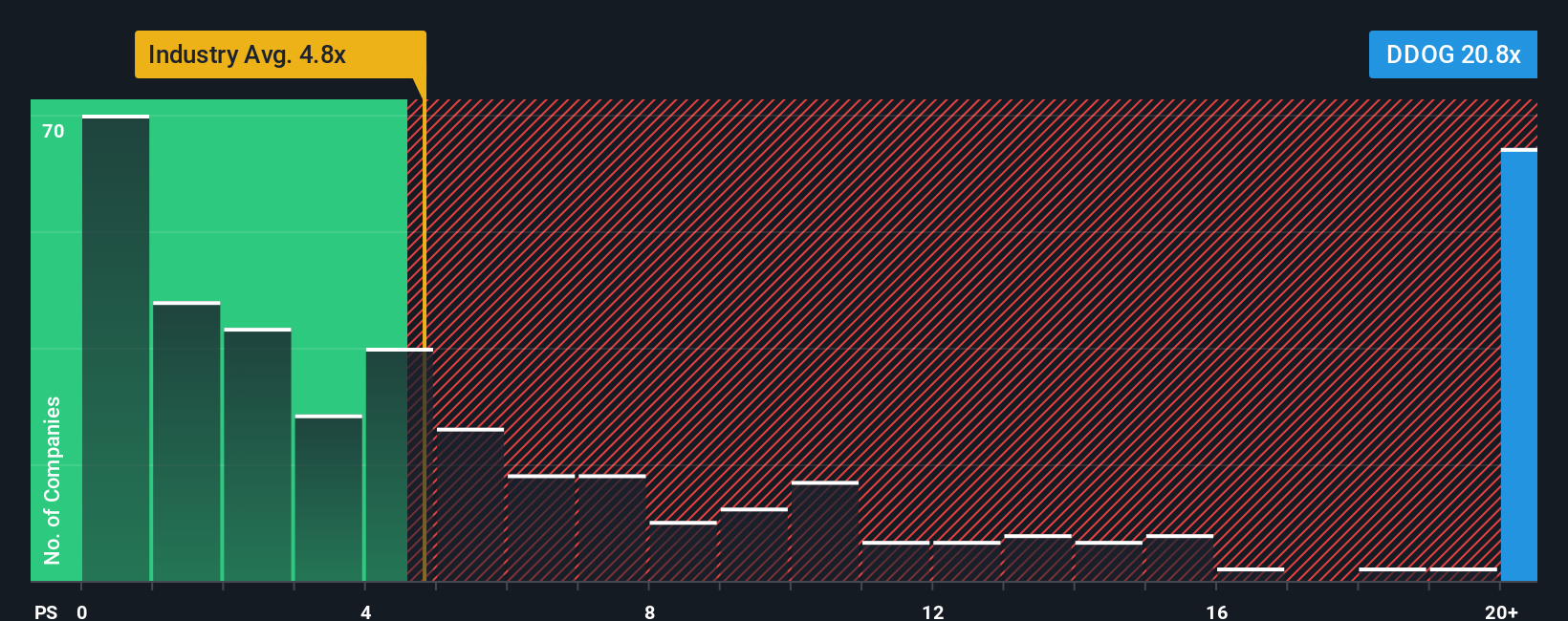

While the main narrative points to Datadog being undervalued, a quick glance at its share price compared to typical industry sales ratios reveals it actually looks expensive. Could these high expectations be setting up a risk, or is this a case of market optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Datadog Narrative

If you have a different take or want to dig into the details yourself, it’s quick and easy to craft your own perspective on Datadog. Do it your way.

A great starting point for your Datadog research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t stop at Datadog when there’s a world of standout opportunities waiting just beyond your watchlist. Let Simply Wall Street’s powerful screener reveal the market’s hidden gems. These ideas move fast, and you won’t want to miss what’s next.

- Unlock steady passive income by targeting market leaders offering dividend stocks with yields > 3% and robust yields above 3%.

- Stay ahead of the innovation curve by backing companies at the forefront of technological breakthroughs in quantum computing stocks.

- Seize real value plays with companies currently outpacing Wall Street’s expectations in undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:DDOG

Datadog

Operates an observability and security platform for cloud applications in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)