- United States

- /

- Software

- /

- NasdaqGS:DBX

Dropbox (DBX) Valuation Under the Spotlight as Analyst Opinions Diverge on Growth Prospects

Reviewed by Simply Wall St

If you’re following Dropbox (DBX), you’ve likely noticed the growing debate around its future. In the past week, opposing commentaries have surfaced: one flags worsening fundamentals, while another points to solid earnings and cash flow as signs of strength. This back-and-forth has kept investors on their toes, fueling speculation about whether Dropbox is bracing for new challenges or gearing up for its next chapter.

With the stock rising nearly 19% over the past year but lagging in the current year-to-date window, momentum seems mixed. While Dropbox’s annual net income has ticked upward, revenue has slipped very slightly, and much of the share price lift rides on cost-cutting and buybacks rather than top-line growth. Recent upgrades and downgrades have not led to sharp moves, hinting at a market still undecided about long-term value here.

So where does this leave potential buyers? Is Dropbox offering a margin of safety at today’s prices, or has Wall Street already factored in all future growth? Let’s look closer at what the valuation data tells us.

Most Popular Narrative: Fairly Valued

According to community narrative, Dropbox is considered fairly valued by analysts and is trading close to consensus expectations based on future earnings and growth assumptions. The current market price is closely aligned with analyst targets, reflecting balanced views on its potential.

“Ongoing investments in onboarding improvements, streamlined product experiences, and personalized retention (for example, cancellation flow redesign, Simple plan targeting mobile-first consumers) are already reducing churn and increasing user engagement. This sets the stage for greater user retention and potential user base growth, positively impacting revenue stability and reducing customer acquisition costs.”

Curious what lies beneath Dropbox’s apparent fair value? The narrative centers on a blend of cautious optimism and ambitious long-term growth moves. Are you eager to see which financial assumptions and future profitability targets are lifting analyst confidence and creating this balance? The specifics just might surprise you.

Result: Fair Value of $28.13 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue declines and mounting competition from larger tech giants could quickly change the current narrative and challenge future growth assumptions.

Find out about the key risks to this Dropbox narrative.Another View: SWS DCF Model

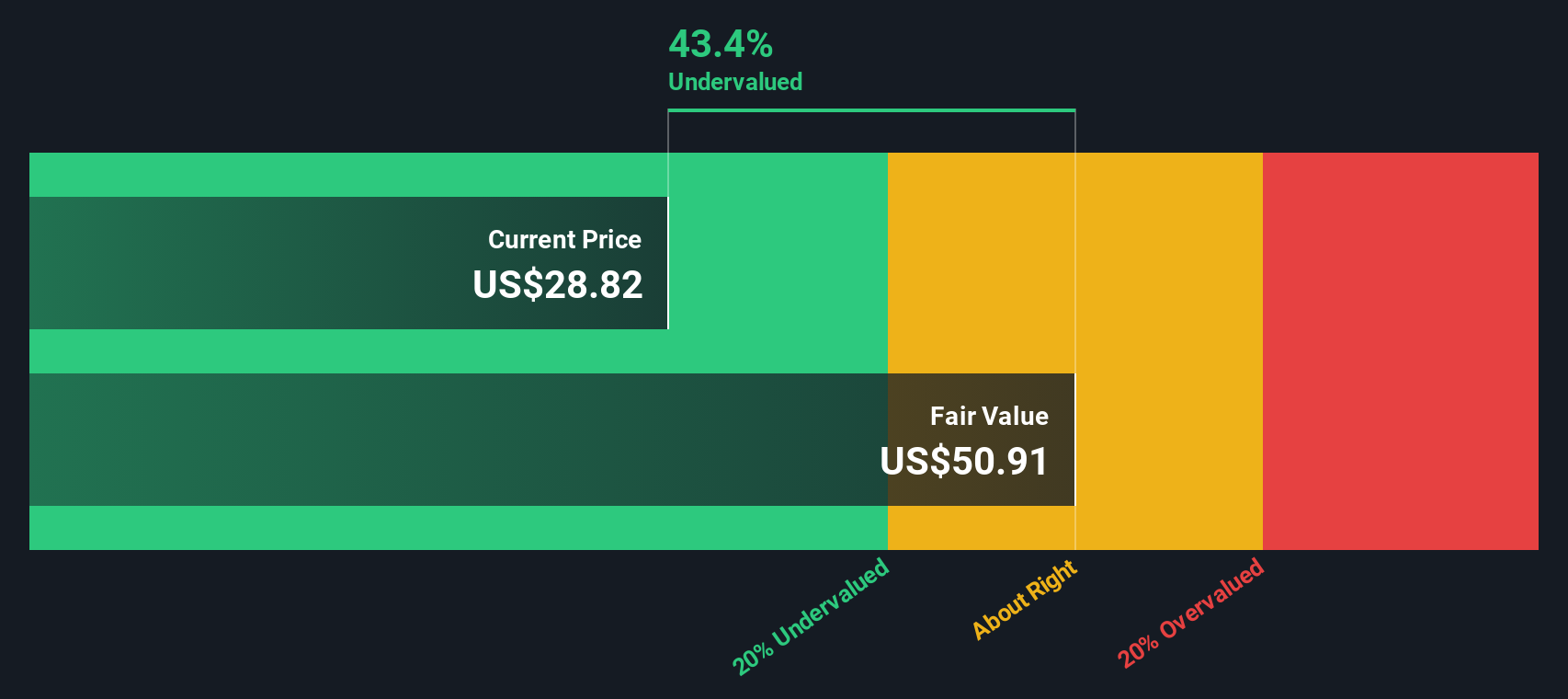

While multiples suggest Dropbox is fairly valued relative to peers, our DCF model points to a different possibility. This model indicates the stock could be more attractively priced than it seems. Which outlook ultimately holds true?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dropbox Narrative

If the current perspectives do not match your own, or you would rather dive into the numbers yourself, you can assemble your own view in just a few minutes, and do it your way.

A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for Your Next Opportunity?

Smart investors never settle for what is right in front of them. Take charge of your portfolio and uncover promising stocks that align with your goals. Let the Simply Wall Street Screener help you seize opportunities that others might overlook. Your next winner could be just a click away.

- Boost your income potential by scanning the market for reliable payers through dividend stocks with yields > 3%, and see which companies are offering consistently strong yields above 3%.

- Catch the momentum in healthcare innovation when you use healthcare AI stocks to pinpoint companies harnessing artificial intelligence to drive medical breakthroughs and smarter patient care.

- Uncover undervalued gems by tapping into undervalued stocks based on cash flows, highlighting stocks rich in cash flows that could be poised for a breakout.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives