- United States

- /

- Software

- /

- NasdaqGS:DBX

Dropbox (DBX) Is Down 6.4% After Beating Revenue Estimates Despite Customer Losses Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- Dropbox recently exceeded analysts' revenue forecasts and delivered robust EBITDA estimates for the quarter, despite a 1.4% year-on-year revenue decline and a loss of 30,000 customers.

- What stands out is the company's stronger-than-expected financial execution even as it contends with customer contraction and ongoing market competition.

- We'll assess how Dropbox's ability to surpass revenue expectations, despite customer losses, informs its investment narrative moving forward.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Dropbox Investment Narrative Recap

To own Dropbox stock, you need to believe that the company can successfully transition beyond its legacy cloud storage core and reignite growth by monetizing its large user base and expanding into new digital collaboration tools like Dash. The most recent earnings surprise demonstrates Dropbox’s resilient financial discipline, but the modest revenue decline and shrinking customer count suggest that the top short-term catalyst, adoption of new AI-driven offerings, remains challenged, while the biggest risk around ongoing user churn and pricing pressure has not materially changed.

Among recent announcements, Dropbox’s April update to Dash, its AI-driven search and productivity suite, stands out, especially as AI integration is a key potential revenue driver moving forward. Enhanced app integrations and content search capabilities reinforce the company’s focus on product innovation at a critical juncture where near-term revenue growth is under scrutiny.

In contrast, shareholders should be mindful of the persistent decline in paying users and what that means for...

Read the full narrative on Dropbox (it's free!)

Dropbox's outlook forecasts $2.5 billion in revenue and $494.6 million in earnings by 2028. This reflects an annual revenue decline of 1.1% and an earnings increase of $9.2 million from current earnings of $485.4 million.

Uncover how Dropbox's forecasts yield a $28.12 fair value, a 4% downside to its current price.

Exploring Other Perspectives

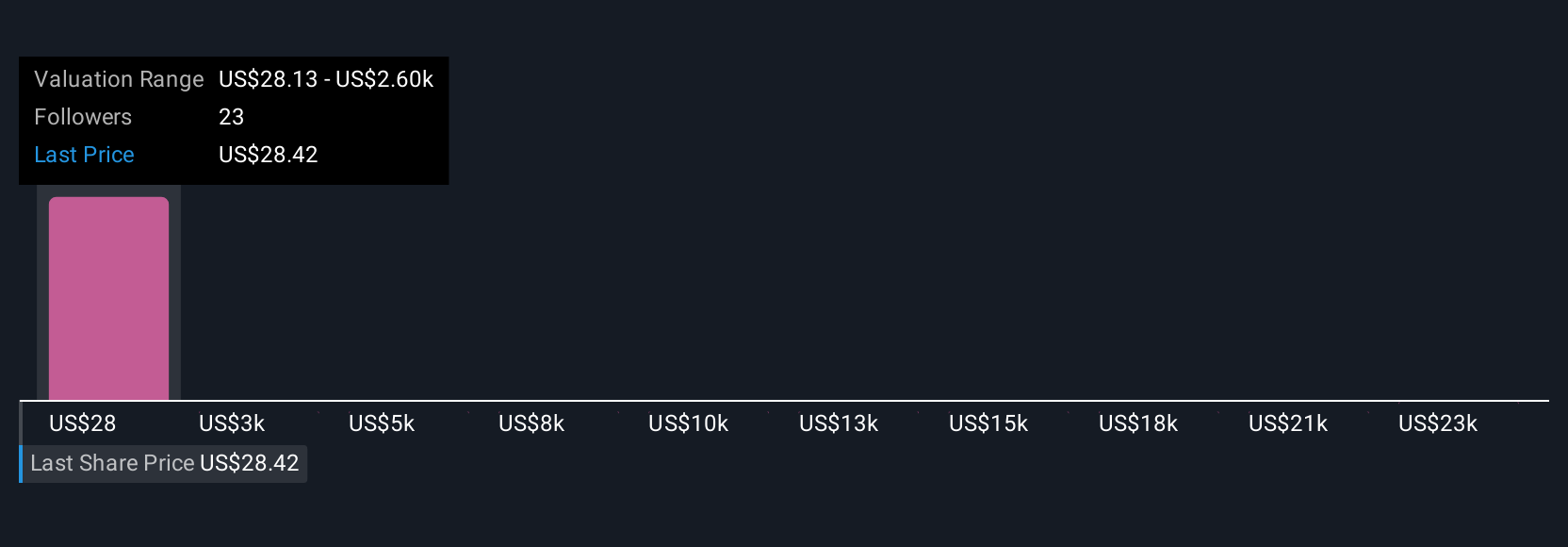

The Simply Wall St Community shared four fair value estimates for Dropbox, ranging from US$28.13 to an outlier of US$25,709.96. With growth challenges and pressure on paying users in focus, explore how other investors are interpreting potential outcomes.

Explore 4 other fair value estimates on Dropbox - why the stock might be a potential multi-bagger!

Build Your Own Dropbox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dropbox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dropbox's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives