- United States

- /

- Software

- /

- NasdaqGS:DBX

Dropbox (DBX): Evaluating Valuation After New $1.5 Billion Buyback and Expanded Credit Facility

Reviewed by Simply Wall St

If you have been keeping an eye on Dropbox (DBX), this week’s news probably made you pause. The company just authorized a new share repurchase program worth up to $1.5 billion, while also amending its credit facility to expand borrowing power by $700 million. For investors, a buyback of this scale is an unmistakable hint at management’s confidence in the company’s underlying stability. It is also a sign that Dropbox is emphasizing shareholder return while shoring up its financial flexibility.

This twin announcement arrived after a year where Dropbox’s shares have returned 26 percent, outpacing many peers in the software sector. Momentum has been evident throughout 2025, with the stock gaining 11 percent over the past month alone. Even with annual revenue growth slightly negative, net income continues to inch higher and Dropbox can point to steady compounding performance over the past 3 and 5 years. This suggests that Wall Street is rewarding visible financial discipline and capital allocation.

With these moves making headlines and the stock’s year-to-date climb, some may wonder whether Dropbox remains undervalued or if investors are already factoring in every bit of growth and future buyback.

Most Popular Narrative: 9.9% Overvalued

According to the most widely followed narrative, Dropbox is currently trading above its estimated fair value. This suggests the stock is overvalued versus consensus expectations based on future earnings assumptions and risks.

The planned expansion and deeper integration of AI-driven productivity tools (Dash), including upcoming self-serve offerings and seamless bundling with Dropbox's existing file sync-and-share product, position the company to capture higher ARPU and accelerate recurring revenue growth. Digital transformation and hybrid work continue to drive demand for intelligent, collaborative cloud platforms.

What is the real secret behind Dropbox’s fair value calculation, and could a game-changing new technology tilt the scales? The narrative hints at a future where transformative product launches and strict financial discipline meet analyst expectations directly. Uncover what assumptions and bold projections are powering this valuation call, and find out what Wall Street could be betting on next.

Result: Fair Value of $28.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent revenue declines and intensifying competition from larger tech providers remain significant risks that could quickly undermine Dropbox’s current growth story.

Find out about the key risks to this Dropbox narrative.Another View: Discounted Cash Flow Paints a Different Picture

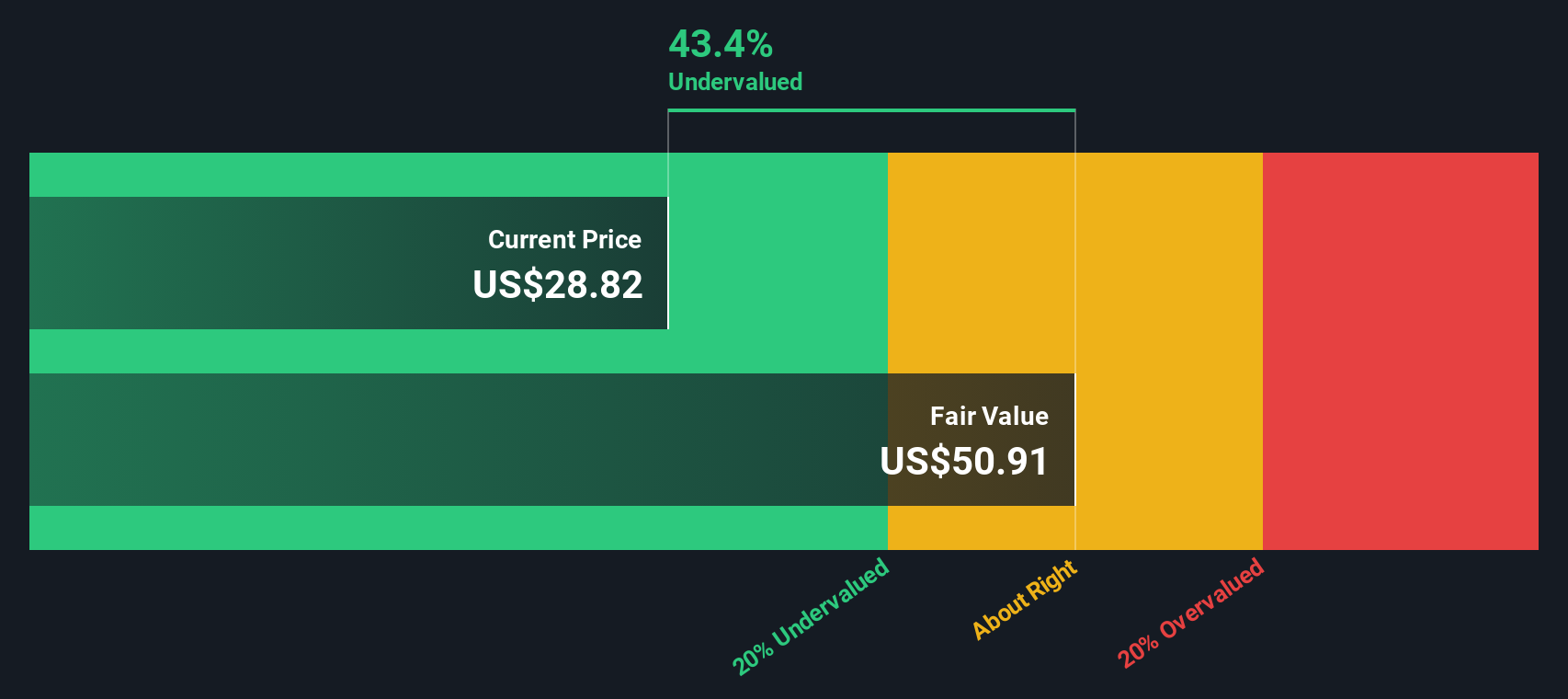

Our SWS DCF model comes to the opposite conclusion and suggests that Dropbox may actually be trading well below its estimated fair value. Could this long-term cash flow view reveal opportunity that multiples are missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Dropbox Narrative

If you are curious or prefer a hands-on approach, you can examine Dropbox’s story directly and assemble your own view in just a few minutes. Do it your way.

A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Stay ahead of the market by acting with confidence. These unique stock strategies could help you spot the next winner before everyone else notices.

- Maximize yield by targeting stable companies offering attractive returns. dividend stocks with yields > 3% leads the way for income-focused investors.

- Capitalize on the AI revolution and tap into rapidly growing tech trends by uncovering strong opportunities in AI penny stocks.

- Spot overlooked gems primed for value growth by searching for businesses trading below their true worth using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DBX

Dropbox

Provides a content collaboration platform in the United States and internationally.

Undervalued with questionable track record.

Similar Companies

Market Insights

Community Narratives