- United States

- /

- Software

- /

- NasdaqGS:CYBR

CyberArk Software (NasdaqGS:CYBR) Soars 14% In One Week

Reviewed by Simply Wall St

CyberArk Software (NasdaqGS:CYBR) launched new identity security solutions during its IMPACT 2025 Conference, including tools for AI agents and machine identities, and partnered with Accenture to enhance AI security. These developments coincide with CyberArk achieving SOC 2 Type 2 compliance. Over the last week, CyberArk's share price increased by 14%. This rise aligns with broader market gains driven by a positive market trend, as evidenced by the strong performance of major indices like the Dow and S&P 500, which posted significant weekly gains amidst news of tariff exemptions for tech products.

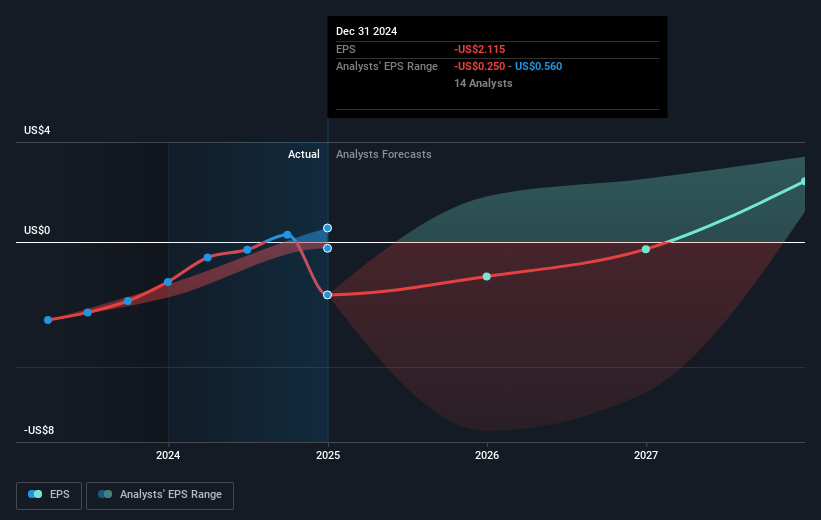

CyberArk Software's recent launch of identity security solutions, including AI tools, and its partnership with Accenture, is expected to reinforce its position in the identity security market. These initiatives could drive future revenue growth, given the industry's increasing need for sophisticated security measures. Despite the company's negative earnings of US$93.46 million, its strategic focus on AI-driven identity security might be a potential catalyst for improving profitability over time.

Over the past five years, CyberArk's total shareholder return, including share price appreciation and dividends, was 267.83%, highlighting significant long-term growth. However, in the past year, the company's performance has been more modest, yet it exceeded both the US software industry, which returned 1%, and the broader US market, up 4.8% year-over-year.

The recent positive movements in CyberArk’s stock price, which has risen by 14% in a week, bring it closer to analyst consensus price targets. Analysts estimate a fair value of US$444.42, a 29.1% increase from the current price of US$315.29, influenced by future revenue projections of US$1.9 billion and a potential shift to profitability. While the consensus suggests optimism, the stock remains priced at a significant discount relative to analyst expectations, partially reflecting integration and market competition risks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CYBR

CyberArk Software

Develops, markets, and sells software-based identity security solutions and services in the United States, Israel, the United Kingdom, Europe, the Middle East, Africa, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives