- United States

- /

- IT

- /

- NasdaqCM:CXDO

Crexendo, Inc.'s (NASDAQ:CXDO) P/S Is Still On The Mark Following 28% Share Price Bounce

Crexendo, Inc. (NASDAQ:CXDO) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. The last month tops off a massive increase of 135% in the last year.

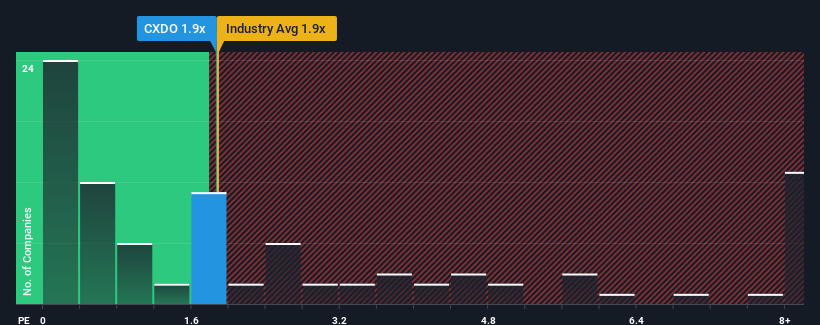

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Crexendo's P/S ratio of 1.9x, since the median price-to-sales (or "P/S") ratio for the IT industry in the United States is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Crexendo

How Crexendo Has Been Performing

Crexendo certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Crexendo.What Are Revenue Growth Metrics Telling Us About The P/S?

Crexendo's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The latest three year period has also seen an excellent 223% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 9.6% per year as estimated by the four analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11% per annum, which is not materially different.

With this in mind, it makes sense that Crexendo's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On Crexendo's P/S

Crexendo appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A Crexendo's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the IT industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

You always need to take note of risks, for example - Crexendo has 2 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on Crexendo, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CXDO

Crexendo

Provides cloud communication platform software and unified communications as a service in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives