- United States

- /

- Software

- /

- NasdaqGS:CVLT

How Investors Are Reacting To Commvault Systems (CVLT) New AI-Powered Cyber Resilience Milestones

Reviewed by Sasha Jovanovic

- Commvault announced it will showcase its latest cyber resilience and AI-enabled recovery innovations, including Synthetic Recovery and Identity Resilience, at the Gartner IOCS Conference 2025 and recently secured the AWS Resilience Competency with an expanded multi-product listing in the AWS Marketplace.

- Together, these milestones highlight growing recognition of Commvault Cloud’s AI-driven protection and recovery capabilities across hybrid and multi-cloud environments, especially for complex AWS workloads.

- We’ll now examine how Commvault’s AWS Resilience Competency and AI-enabled recovery focus may influence its existing investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Commvault Systems Investment Narrative Recap

To be a shareholder in Commvault, you need to believe that its pivot toward SaaS-based cyber resilience and data protection can offset margin pressure and volatility from large, lumpy deals. The new AWS Resilience Competency and AI-enabled recovery push appear to reinforce the near term catalyst of deepening cloud and security partnerships, but they do not materially change the key risk that growth may rely too heavily on expanding existing customers rather than adding new ones.

Among the latest announcements, the AWS Resilience Competency and expanded multi product listing in AWS Marketplace look most relevant, because they sit squarely at the intersection of cloud partnerships and Commvault Cloud’s AI driven protection story. If these AWS aligned offerings gain traction with complex workloads, they could support the company’s recurring SaaS and subscription transition, while potentially helping to smooth some of the revenue lumpiness tied to larger term software deals.

Yet beneath the AI and AWS momentum, investors should also be aware of the risk that...

Read the full narrative on Commvault Systems (it's free!)

Commvault Systems' narrative projects $1.5 billion revenue and $173.1 million earnings by 2028. This requires 12.2% yearly revenue growth and about a $92 million earnings increase from $81.1 million today.

Uncover how Commvault Systems' forecasts yield a $193.70 fair value, a 57% upside to its current price.

Exploring Other Perspectives

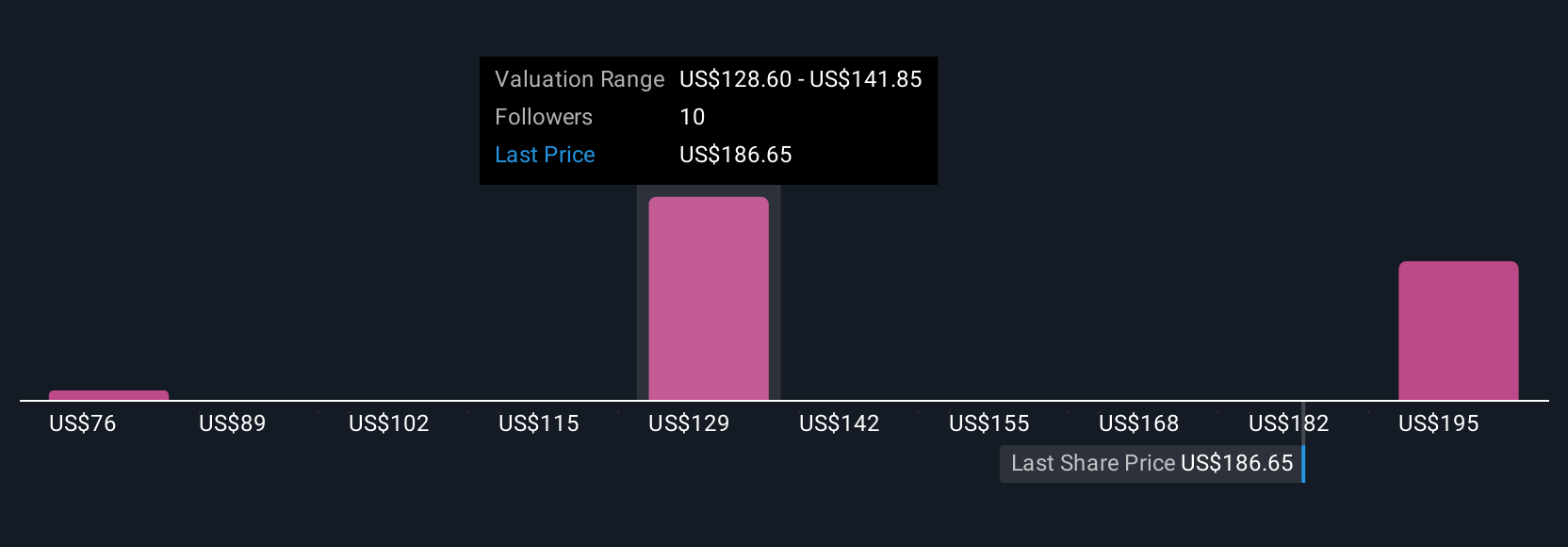

Four Simply Wall St Community valuations for Commvault span roughly US$75 to over US$200 per share, underscoring how far apart individual views can be. As you weigh these against the company’s growing cloud partnerships and cyber resilience focus, it is worth considering how much of future growth might still depend on upselling current customers rather than winning new ones.

Explore 4 other fair value estimates on Commvault Systems - why the stock might be worth as much as 68% more than the current price!

Build Your Own Commvault Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Commvault Systems research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Commvault Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Commvault Systems' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CVLT

Commvault Systems

Provides a cyber resilience platform for protecting and recovering data and cloud-native applications in the Americas and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026