- United States

- /

- IT

- /

- NasdaqGS:CTSH

Will Industry Awards and Analyst Upgrade Shift Cognizant's (CTSH) Digital Transformation Investment Narrative?

Reviewed by Sasha Jovanovic

- In September 2025, Cognizant Technology Solutions was recognized as Duck Creek Technologies’ Systems Integrator Partner of the Year for Innovation and was upgraded by Ambit Capital, reflecting recent operational improvements and industry accolades.

- This combination of analyst recognition and industry awards highlights Cognizant’s strengthened capabilities in digital transformation and its rising profile in insurance technology services.

- We'll explore how Cognizant's industry leadership recognition and improved analyst outlook may influence its investment narrative and future performance.

Find companies with promising cash flow potential yet trading below their fair value.

Cognizant Technology Solutions Investment Narrative Recap

To be a shareholder in Cognizant Technology Solutions, you need to believe in the company's capacity to drive enterprise digital transformation and sustain its competitive edge amid rapid AI adoption. The recent appointment of a new Chief Learning Officer and continuing industry awards reinforce operational strength, but do not fundamentally shift the most immediate catalyst: Cognizant's ability to win and retain large, multi-year AI transformation projects. The key risk, client automation reducing demand for traditional services, remains largely unchanged by these developments.

Among recent announcements, Cognizant’s new AI-powered claims partnership with Venbrook Group stands out for its relevance. This initiative highlights near-term opportunities to leverage AI in core industry processes, which ties directly to the company’s short-term growth prospects by broadening both its recurring revenue base and technology capabilities.

However, investors should also be aware that as enterprise AI adoption accelerates, the risk of automation cannibalizing existing revenue streams persists...

Read the full narrative on Cognizant Technology Solutions (it's free!)

Cognizant Technology Solutions is projected to achieve $23.5 billion in revenue and $2.9 billion in earnings by 2028. This outlook is based on an annual revenue growth rate of 4.7% and a $0.5 billion increase in earnings from the current $2.4 billion level.

Uncover how Cognizant Technology Solutions' forecasts yield a $86.95 fair value, a 30% upside to its current price.

Exploring Other Perspectives

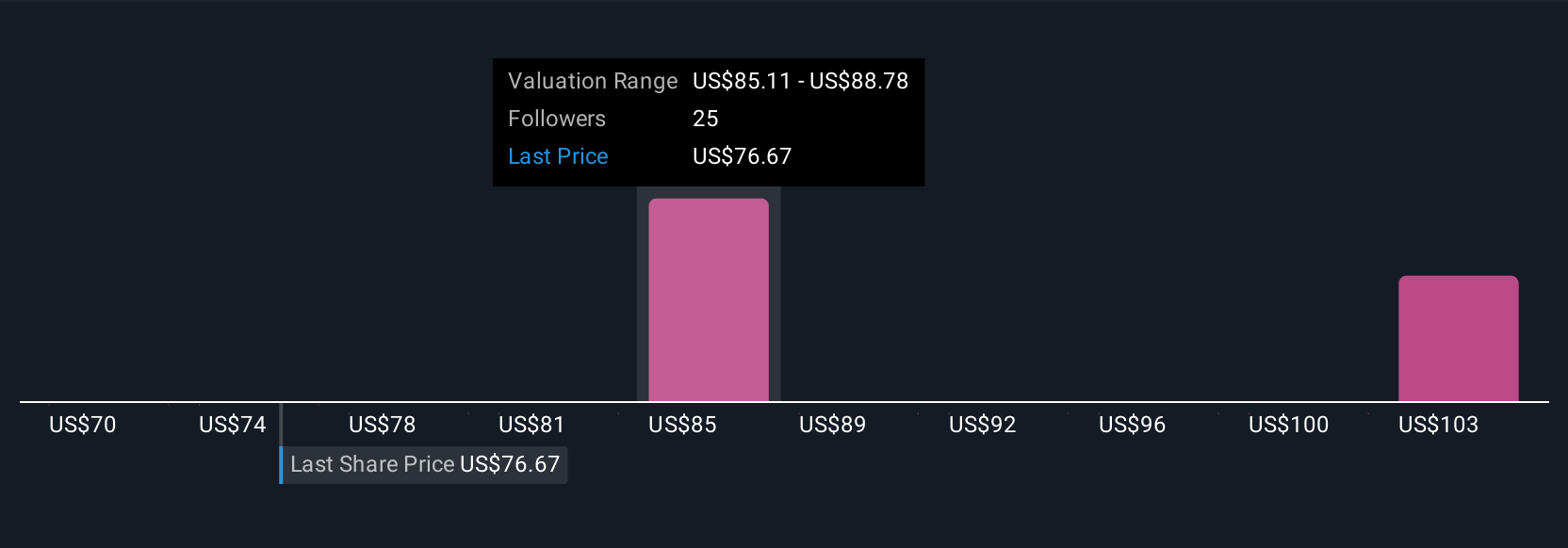

Six members of the Simply Wall St Community estimate Cognizant’s fair value between US$70.42 and US$117.19. With automation’s potential to disrupt traditional revenue, your outlook could vary widely, consider reviewing other viewpoints.

Explore 6 other fair value estimates on Cognizant Technology Solutions - why the stock might be worth as much as 75% more than the current price!

Build Your Own Cognizant Technology Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cognizant Technology Solutions research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cognizant Technology Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cognizant Technology Solutions' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CTSH

Cognizant Technology Solutions

A professional services company, provides consulting and technology, and outsourcing services in North America, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives