Vic Dellovo has been the CEO of CSP Inc. (NASDAQ:CSPI) since 2012. First, this article will compare CEO compensation with compensation at similar sized companies. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for CSP

How Does Vic Dellovo's Compensation Compare With Similar Sized Companies?

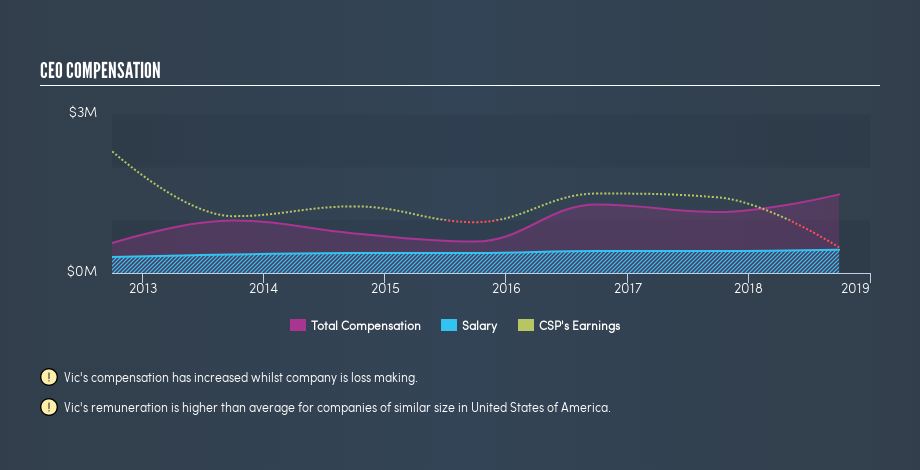

According to our data, CSP Inc. has a market capitalization of US$59m, and pays its CEO total annual compensation worth US$1.5m. (This number is for the twelve months until September 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$440k. We looked at a group of companies with market capitalizations under US$200m, and the median CEO total compensation was US$473k.

Thus we can conclude that Vic Dellovo receives more in total compensation than the median of a group of companies in the same market, and of similar size to CSP Inc.. However, this doesn't necessarily mean the pay is too high. We can better assess whether the pay is overly generous by looking into the underlying business performance.

You can see a visual representation of the CEO compensation at CSP, below.

Is CSP Inc. Growing?

Over the last three years CSP Inc. has shrunk its earnings per share by an average of 93% per year (measured with a line of best fit). It saw its revenue drop -15% over the last year.

Unfortunately, earnings per share have trended lower over the last three years. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration.

Has CSP Inc. Been A Good Investment?

Boasting a total shareholder return of 94% over three years, CSP Inc. has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

We compared total CEO remuneration at CSP Inc. with the amount paid at companies with a similar market capitalization. As discussed above, we discovered that the company pays more than the median of that group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us.But clearly there are some positives, because investors have done well over the same time frame. So on this analysis we'd stop short of criticizing the level of CEO compensation. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling CSP (free visualization of insider trades).

Important note: CSP may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGM:CSPI

CSP

Develops and markets IT integration solutions, security products, managed IT services, cloud services, network adapters, and cluster computer systems for commercial and defense customers worldwide.

Adequate balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)