Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies CSP Inc. (NASDAQ:CSPI) makes use of debt. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for CSP

How Much Debt Does CSP Carry?

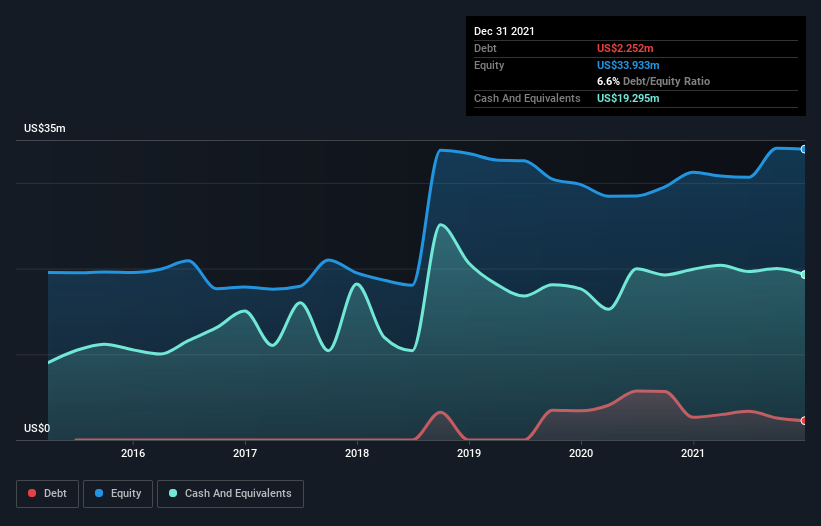

You can click the graphic below for the historical numbers, but it shows that CSP had US$2.25m of debt in December 2021, down from US$2.64m, one year before. However, its balance sheet shows it holds US$19.3m in cash, so it actually has US$17.0m net cash.

How Healthy Is CSP's Balance Sheet?

According to the last reported balance sheet, CSP had liabilities of US$17.6m due within 12 months, and liabilities of US$10.3m due beyond 12 months. Offsetting this, it had US$19.3m in cash and US$23.4m in receivables that were due within 12 months. So it can boast US$14.9m more liquid assets than total liabilities.

This excess liquidity is a great indication that CSP's balance sheet is almost as strong as Fort Knox. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, CSP boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is CSP's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year CSP had a loss before interest and tax, and actually shrunk its revenue by 11%, to US$50m. We would much prefer see growth.

So How Risky Is CSP?

We have no doubt that loss making companies are, in general, riskier than profitable ones. And we do note that CSP had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$141k of cash and made a loss of US$1.3m. But the saving grace is the US$17.0m on the balance sheet. That kitty means the company can keep spending for growth for at least two years, at current rates. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with CSP (including 1 which shouldn't be ignored) .

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:CSPI

CSP

Develops and markets IT integration solutions, security products, managed IT services, cloud services, network adapters, and cluster computer systems for commercial and defense customers worldwide.

Adequate balance sheet and overvalued.

Similar Companies

Market Insights

Community Narratives