- United States

- /

- IT

- /

- NasdaqGS:CRWV

CoreWeave (CRWV): Reassessing Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

CoreWeave (CRWV) has had a volatile stretch lately, with the stock sliding about 4 % in the past day and over 23 % this month, even as its AI infrastructure business continues to scale.

See our latest analysis for CoreWeave.

The recent slide reflects investors reassessing near term risk after a strong run, with the share price at 69.5 dollars and the year to date share price return still firmly positive. This suggests long term momentum is cooling but not broken.

If CoreWeave’s swings have your attention, it could be a good moment to compare it with other high growth tech names and explore high growth tech and AI stocks.

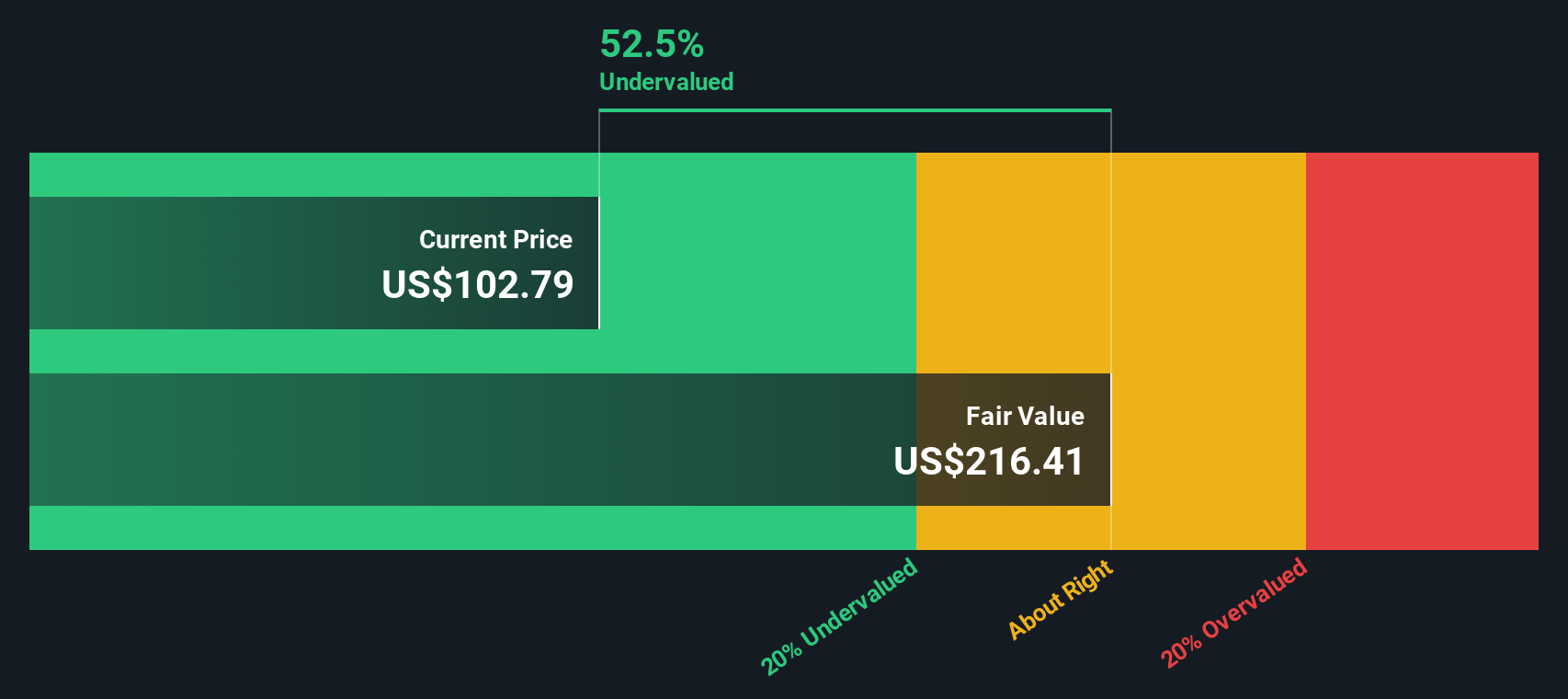

With CoreWeave still up sharply for the year but trading at a steep discount to analyst targets, the key question is clear: is this a rare mispricing to buy into, or is the market already discounting future growth?

Price-to-Sales of 8x: Is it justified?

On a price to sales basis, CoreWeave trades around 8x, positioning the current 69.5 dollars share price as rich versus the broader US IT sector.

The price to sales ratio compares the company’s market value to its revenue and is often used for high growth, loss making software and infrastructure platforms where earnings are not yet a reliable guide.

For CoreWeave, that 8x multiple looks demanding relative to the US IT industry average of 2.3x. However, it screens attractively when set against a peer group averaging 26.6x and an estimated fair price to sales ratio of 27x that our regression work suggests the market could eventually converge toward if growth plays out.

This contrast, trading well above the sector but far below peers and the implied fair ratio, underlines how sharply opinions are split on what CoreWeave’s AI driven growth is worth today.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 8x (UNDERVALUED)

However, CoreWeave’s steep losses and heavy reliance on continued AI demand growth mean that any slowdown in enterprise spending could quickly undermine the bullish case.

Find out about the key risks to this CoreWeave narrative.

Another View: Our DCF Model Flashes Caution

While the 8x price to sales ratio hints at upside versus peers, our DCF model pulls the other way, flagging CoreWeave as deeply overvalued with a fair value estimate near zero dollars. When one model indicates opportunity and another indicates risk, which signal do you trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you see the story differently or want to dive deeper into the numbers yourself, you can build a full narrative in just minutes: Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stop at a single opportunity, so use the Simply Wall Street Screener to uncover fresh stocks that match your strategy before the crowd gets there.

- Capture potential multi baggers early by scanning these 3632 penny stocks with strong financials that already show financial strength instead of speculation alone.

- Position yourself at the heart of the AI boom by targeting these 25 AI penny stocks with real revenue momentum and scalable tech.

- Lock in better risk reward profiles by focusing on these 916 undervalued stocks based on cash flows where cash flows suggest the market has not caught up yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)