- United States

- /

- IT

- /

- NasdaqGS:CRWV

CoreWeave (CRWV): Reassessing Valuation After a Volatile Year of Strong Gains and Sharp Pullback

Reviewed by Simply Wall St

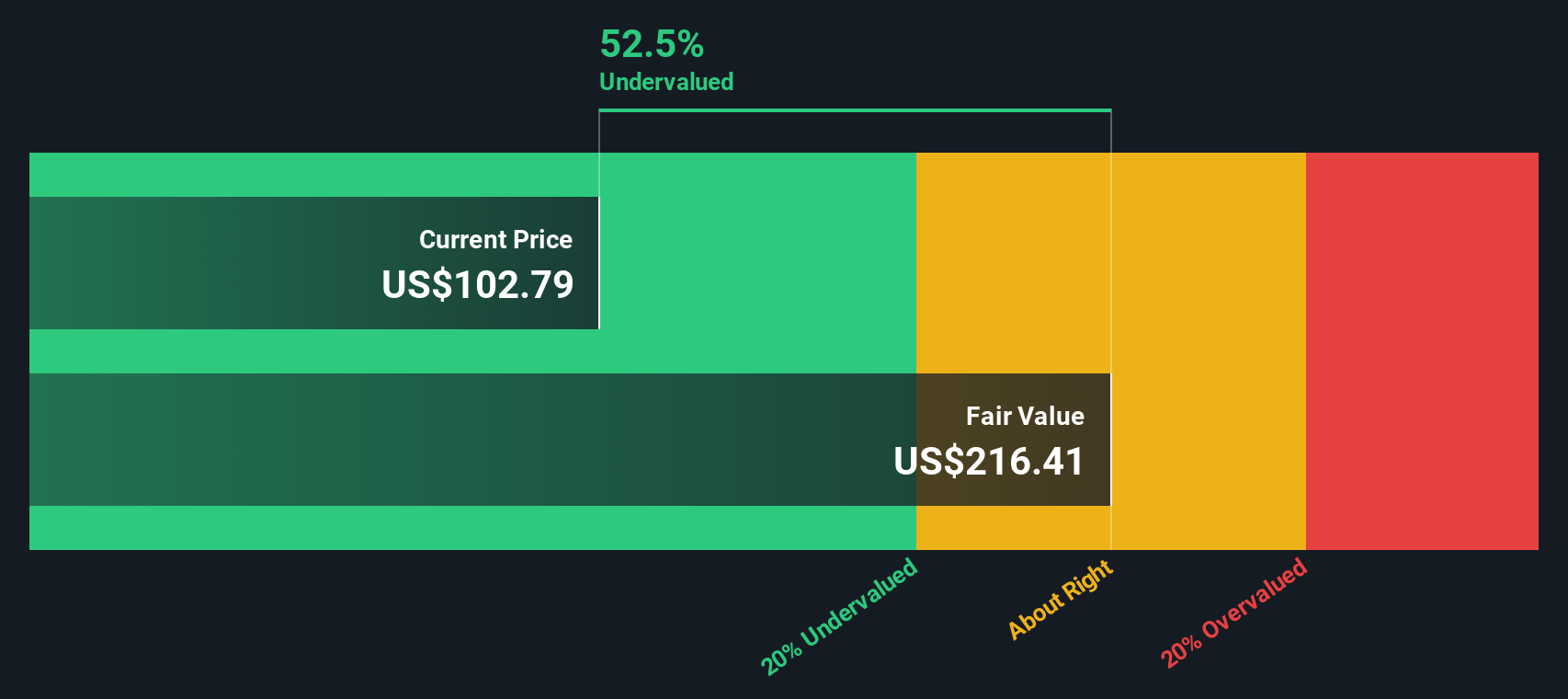

CoreWeave (CRWV) has had a wild run this year, with the stock up roughly 90% year to date but sliding about 40% over the past month. This has left investors reassessing its AI-driven growth story.

See our latest analysis for CoreWeave.

After a huge run earlier in the year, CoreWeave’s recent pullback and 30 day share price return of roughly minus 40% suggest momentum is fading in the short term, while its year to date share price return still points to a powerful longer term uptrend.

If CoreWeave’s swings have you rethinking your AI exposure, this could be a good moment to explore other high growth tech and AI names through high growth tech and AI stocks.

With the stock still up sharply this year but trading well below analyst targets, investors now face a pivotal question: Is CoreWeave an underappreciated AI infrastructure play, or has the market already priced in its future growth?

Preferred Price to Sales Ratio of 8.8x: Is it justified?

On a price to sales basis, CoreWeave trades at 8.8 times revenue, which screens as expensive against the broader US IT sector but still below many direct AI infrastructure peers.

The price to sales ratio compares the company’s market value to its annual revenue, a common yardstick for high growth, often unprofitable software and cloud names where earnings are not yet a reliable guide.

For CoreWeave, this 8.8 times multiple sits well above the US IT industry average of 2.4 times, implying investors are already paying a substantial premium for its rapid AI related growth. Yet it remains markedly cheaper than a peer average of 21.2 times and significantly below an estimated fair price to sales ratio of 27.1 times, a level the market could move toward if bullish growth and margin expectations are met.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 8.8x (UNDERVALUED)

However, CoreWeave’s heavy spending, ongoing losses, and dependence on buoyant AI demand mean that any slowdown or margin squeeze could quickly puncture the growth premium.

Find out about the key risks to this CoreWeave narrative.

Another View: Our DCF Model Flags Overvaluation

While the 8.8 times sales ratio suggests room to run versus peers and the fair ratio, our DCF model paints a starkly different picture, implying fair value near zero and flagging CoreWeave as severely overvalued. Is the market overestimating distant cash flows, or is the model missing an AI wildcard?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 933 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you see things differently or simply prefer to dig into the numbers yourself, you can build a custom CoreWeave thesis in just minutes, Do it your way.

A great starting point for your CoreWeave research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Do not stop at one AI name, use the Simply Wall Street Screener to hunt for fresh opportunities that match your strategy before the crowd gets there.

- Target high potential under the radar names by scanning these 3569 penny stocks with strong financials that pair speculative upside with improving fundamentals.

- Lock in stronger income potential by reviewing these 14 dividend stocks with yields > 3% that can support long term, yield focused portfolios.

- Position ahead of structural tech shifts by analyzing these 27 quantum computing stocks building real businesses around next generation computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026