- United States

- /

- IT

- /

- NasdaqGS:CRWV

CoreWeave (CRWV): A Fresh Look at Valuation Following 43% One-Month Share Price Gain

Reviewed by Kshitija Bhandaru

See our latest analysis for CoreWeave.

CoreWeave’s rapid 42.8% 1-month share price return comes after several quarters of head-turning growth and a steady parade of investor attention. With its 257.7% year-to-date share price return, momentum appears to be building, and the market is clearly signaling higher expectations for the company’s future potential.

If you're watching this story unfold and want to see what else is catching attention, now is a great time to discover See the full list for free.

But with CoreWeave shares now trading just above their average analyst price target, investors may be wondering if there is still room for upside or if the company’s recent momentum is already fully reflected in its valuation.

Price-to-Sales of 21x: Is it justified?

CoreWeave is currently trading at a price-to-sales (P/S) ratio of 21x, which lines up closely with its last close of $143.08. According to recent data, this represents better value than the peer average of 22.3x, but comes with important context for investors to consider.

The price-to-sales multiple shows how much investors are willing to pay for each dollar of the company’s annual sales. For rapidly growing technology firms like CoreWeave, a higher P/S can often reflect the market's strong confidence in future revenue streams, even when current profits are negative or volatile.

At 21x, CoreWeave looks attractively priced beside peers and dramatically more attractive than its estimated “fair” P/S ratio of 47.8x. This could suggest room for future rerating if growth holds up. However, the company’s P/S is still sharply higher than the broader US IT industry average of 2.3x, meaning the market is clearly baking in exceptional ongoing growth and a strong competitive position. The presence of a fair P/S multiple much higher than both the current and peer average could indicate analyst expectations for superior expansion by CoreWeave in the coming years.

Explore the SWS fair ratio for CoreWeave

Result: Price-to-Sales of 21x (UNDERVALUED)

However, CoreWeave’s rising valuations face risk if revenue growth slows or profitability remains elusive. Both of these factors could challenge the market’s optimism.

Find out about the key risks to this CoreWeave narrative.

Another View: Our DCF Model Shows a Bigger Discount

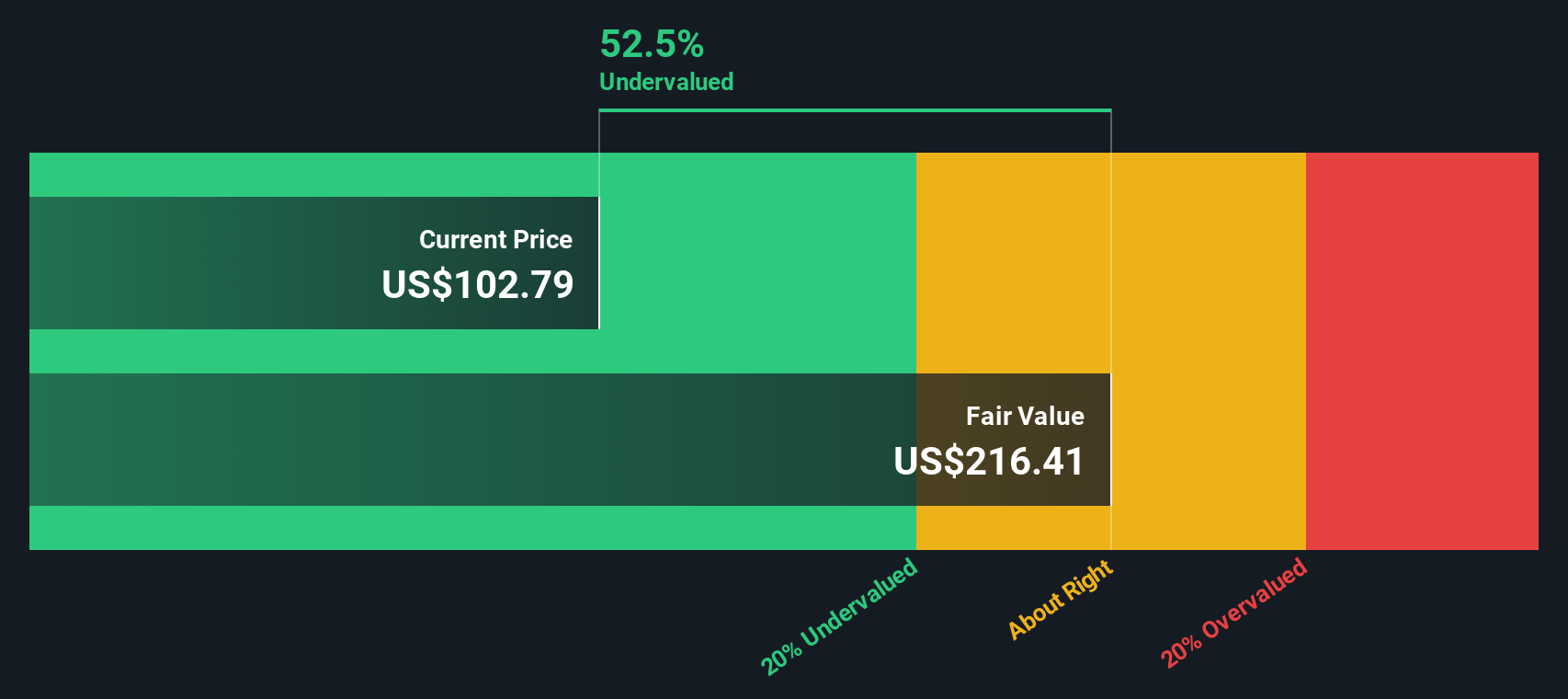

Taking a different approach, our SWS DCF model suggests CoreWeave could be trading at a substantial discount, with shares roughly 30% below our estimate of fair value ($204.81 vs. $143.08 today). This paints an even more optimistic picture than the price-to-sales method. Which lens gives a clearer signal for investors?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CoreWeave for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CoreWeave Narrative

If you’re eager to dig into the numbers or shape your own perspective, you have the flexibility to construct a personal view of CoreWeave in just a few minutes. Do it your way

A great starting point for your CoreWeave research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always have a few fresh picks on their radar. Before you make your next move, check out unique stocks shaking up the market right now.

- Capture the potential of high-yield opportunities by reviewing these 18 dividend stocks with yields > 3% paying reliable income at rates far above the market average.

- Target major growth waves in artificial intelligence by checking out these 25 AI penny stocks which are reshaping entire industries through innovation.

- Uncover powerful, overlooked value with these 888 undervalued stocks based on cash flows identified as trading well below their intrinsic worth based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWV

CoreWeave

Operates a cloud platform that provides scaling, support, and acceleration for GenAI.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives