- United States

- /

- Software

- /

- NasdaqGS:CRWD

Is CrowdStrike Still a Smart Pick After Strong Earnings and Recent Price Rally in 2025?

Reviewed by Bailey Pemberton

If you’re holding CrowdStrike Holdings stock or even just eyeing it for your watchlist, you’re probably wondering if now is the time to make a move. After all, this is a name that has dramatically outperformed the broader market. Just look at these numbers: up 39.5% year-to-date, 65.4% over the past year, and an impressive 217.2% gain in five years. Even in the last month, CrowdStrike climbed 16.0%, before dipping slightly by 1.2% in the last week as market jitters swept the tech sector. This kind of price action shows real investor confidence, mixed with some caution about where things go next.

Of course, every rapid climb brings questions about risk and whether the company’s growth story justifies the current price tag. In particular, news of increased demand for cybersecurity solutions, the environment CrowdStrike thrives in, has only added to the buzz as organizations worldwide double down on digital protection. But high momentum does not always mean a stock is a bargain. If you are looking for a quick answer on valuation: based on standard checks, CrowdStrike scores 0 out of 6, suggesting many analysts see it trading at a premium right now.

But before we jump to conclusions, let’s dig into how that value score is calculated, how traditional metrics can help (or mislead) investors, and why there may be an even smarter way to assess whether CrowdStrike is a buy or a wait. Let’s break down what really goes into a fair valuation.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular method for estimating a company’s worth by projecting its future cash flows and discounting them back to their present value. This technique is especially useful for businesses like CrowdStrike Holdings, where growth prospects and future profitability play a big part in valuation.

Currently, CrowdStrike reports a Free Cash Flow of about $1.04 Billion. Analysts estimate that annual Free Cash Flow could reach approximately $4.58 Billion by 2030, reflecting strong anticipated growth in its core markets. It’s important to note that while analyst forecasts provide data for the next five years, projections beyond that rely on reasonable extrapolation methods.

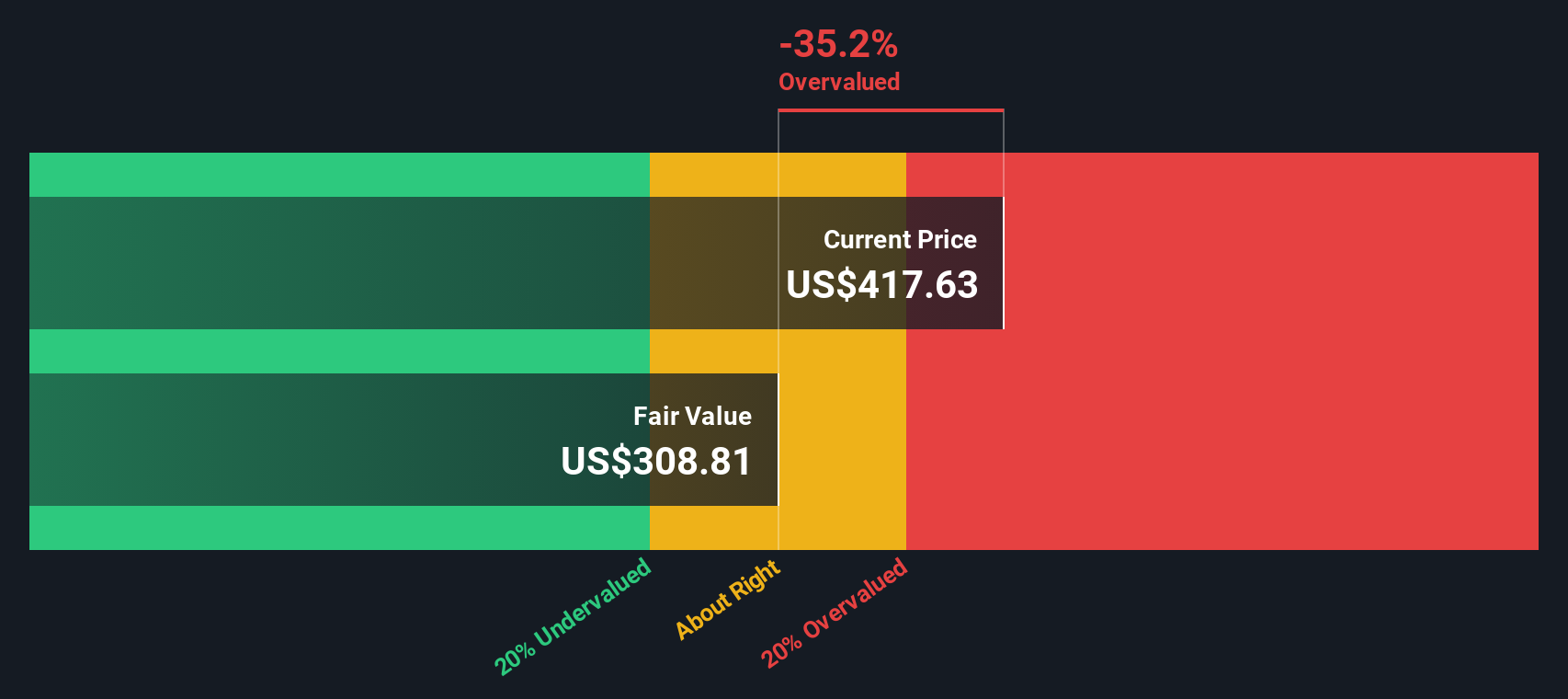

Based on these projections, the DCF model calculates an intrinsic fair value of $412.87 per share for CrowdStrike. Comparing this to the current market price, the DCF implies that the stock is trading at a premium, around 17.4% above its calculated value. This means the stock price is higher than what the discounted cash flow analysis would justify today.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CrowdStrike Holdings may be overvalued by 17.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CrowdStrike Holdings Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation approach for high-growth technology companies like CrowdStrike Holdings, especially when consistent profitability is still ramping up. It compares a company’s market value to its sales, providing insight into how investors value each dollar of revenue. For profitable, growing businesses, a higher P/S ratio can be justified if robust sales growth is expected well into the future.

Growth expectations and perceived risk both play a role in determining what a “fair” P/S multiple should be. Companies with expanding market share, strong recurring revenues, and lower risk profiles generally trade at higher multiples. In contrast, slower growth or more uncertainty pushes multiples down toward industry norms.

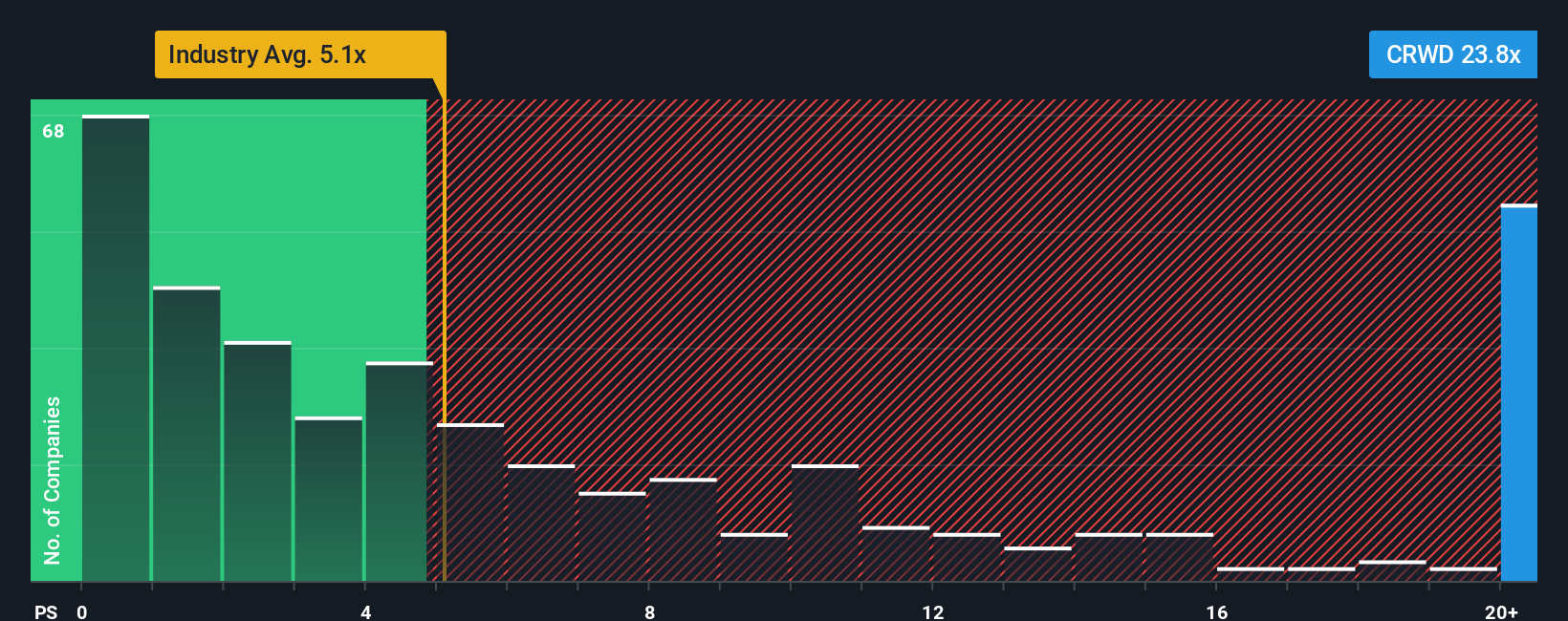

Currently, CrowdStrike trades at a P/S ratio of 28.0x. By comparison, the average for its software industry peers is 14.6x, and the sector-wide average is even lower at 5.3x. However, a higher multiple alone does not signal overvaluation if the company’s future prospects are exceptional.

This is where Simply Wall St’s Fair Ratio comes in. Unlike standard benchmarks, the Fair Ratio adjusts for the company’s specific growth rates, profit margins, risk factors, industry group, and market cap characteristics. For CrowdStrike, the Fair Ratio is 17.5x. This figure reflects a premium appropriate for its impressive growth outlook, scale, and profitability, while also factoring in expected risks.

Comparing CrowdStrike’s actual P/S ratio of 28.0x to its Fair Ratio of 17.5x suggests that the market price is significantly above what is justified by fundamentals and growth alone.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple yet powerful tool. It’s your personal story of how you think a company like CrowdStrike Holdings will perform in the future, combining your expectations for revenue, profit margins, and market dynamics to arrive at a fair value estimate.

Rather than relying solely on blunt ratios or static models, Narratives connect a company’s real-world story by considering how it innovates, grows, or overcomes setbacks, linking these factors to a dynamic financial outlook and valuation. This approach enables you to factor in new information, such as fresh earnings results or industry announcements, and immediately see how your view on fair value might shift.

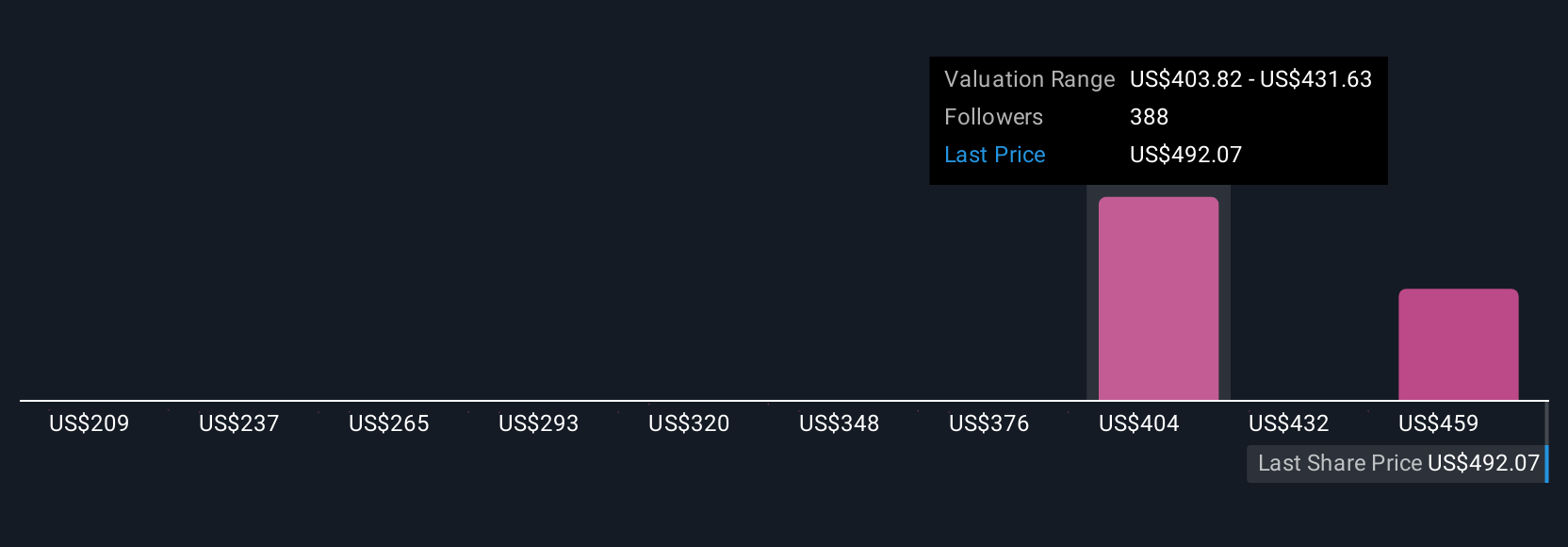

On Simply Wall St’s Community page, millions of investors are already using Narratives. They help you decide when to buy or sell by comparing your own fair value with the current market price, and they update automatically as new data comes in so you’re always informed. For example, some investors see CrowdStrike Holdings as trading 23% below fair value due to resilient growth, while others believe a premium is justified only if future earnings targets are met and execution risks are managed. Narratives let you turn your perspective into a clear, actionable plan for smarter investment decisions.

For CrowdStrike Holdings, we’ll make it easy for you with previews of two leading CrowdStrike Holdings Narratives:

- 🐂 CrowdStrike Holdings Bull Case

Fair Value: $495.45

Current price is 2.2% below the narrative fair value.

Projected revenue growth: 21.91%

- Strategic innovations like Falcon Flex and AI solutions are boosting customer loyalty and operational efficiency, and could drive higher revenue and margins.

- Strong partnerships and investments in next-generation security products and cloud offerings position CrowdStrike for sustained market expansion and demand.

- Analyst price targets reflect expected robust growth; however, reaching these expectations depends on effective execution in emerging products and maintaining high client retention.

- 🐻 CrowdStrike Holdings Bear Case

Fair Value: $431.24

Current price is 12.4% above the narrative fair value.

Projected revenue growth: 18.0%

- The Falcon platform's modular, cloud-native approach has gained customer loyalty, but recent incidents highlight product risks and execution challenges.

- CrowdStrike is financially robust, with more equity than debt and fast-improving profitability metrics, though valuation concerns are emerging as ARR targets become more ambitious.

- Despite a recent technical outage, continued customer growth and strong recurring revenue have kept sentiment positive, yet current pricing may be ahead of underlying fair value.

Do you think there's more to the story for CrowdStrike Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026