- United States

- /

- Software

- /

- NasdaqGS:CRWD

CrowdStrike Remains an Industry Leader with Strong Revenue Growth and Improving Profitability

Key Takeaways from This Analysis:

- The net loss margin is improving, and the free cash flow margin is positive

- Growth prospects look solid, but this is reflected in the share price

- CrowdStrike remains a high beta stock and is unlikely to be immune to further market weakness

CrowdStrike’s (NASDAQ: CRWD) share price has performed well compared to the sector and market since first-quarter earnings were released two weeks ago. We recently looked at Palo Alto Networks (NASDAQ: PANW) and concluded that it compares favorably to its peers because it trades on a lower price-to-sales ratio and has a narrower net loss margin. CrowdStrike is another cybersecurity company that has managed to significantly improve its margin over the last few quarters. So how does CrowdStrike measure up against the other companies in the cybersecurity industry?

First Quarter Results

CrowdStrike’s results for the first quarter which ended in April were better than the market expected. Revenue was up 61% and normalized EPS rose 210% from a year ago. GAAP EPS is still negative but narrowed to -$0.14 from -$0.38 a year ago.

Annual recurring revenue also increased 61% to $1.92 bln. Full-year guidance was raised with the company expecting revenue to be ~51% higher at about $2,197 bln and non-GAAP EPS to rise about 76%.

CrowdStrike vs Peers

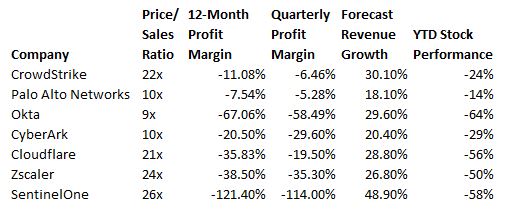

The following table includes the price-to-sales ratio, net loss margins, and forecast growth rates for the peer group.

CrowdStrike’s price-to-sales ratio of 22x is at the higher end for the group - however its net loss margin is substantially narrower than the other companies with ratios above 20x. Analysts are also expecting revenue growth to be higher than all its peers apart from SentinelOne (NASDAQ: S). Palo Alto Does still trade on a much lower P/S ratio relative to its margin and expected growth rate.

While CrowdStrike is still reporting a net loss each quarter, on a free cash flow basis the company is profitable and actually has an impressive margin. The difference between the net loss and free cash flow can be attributed to non-cash items like stock-based compensation.

CrowdStrike is seeing continued demand, and its customers are signing up for more products, which has enabled the company to maintain a net dollar retention rate above 120%. This indicates that customers are spending more each year while the customer base is also growing.

What this means for Investors

CrowdStrike remains a market leader in an industry seeing continued demand. Cybersecurity spending is likely to be one of the last budget items a company will cut during a recession, so it's not surprising to see that the stock trades on a price-to-sales ratio that is still high in absolute terms and extremely high compared to the average stock.

While the stock price has performed well compared to the market and sector since the results were released, it remains a high beta stock. This means the stock price is unlikely to be immune to further market weakness, but that could bring it back to a really attractive valuation.

You can keep track of analyst estimates and other key metrics by referring to our full analysis for CrowdStrike which is updated daily.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NasdaqGS:CRWD

CrowdStrike Holdings

Provides cybersecurity solutions in the United States and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives