- United States

- /

- Software

- /

- NasdaqGS:CORZ

How CoreWeave’s $8.7 Billion HPC Deal Will Impact Core Scientific (CORZ) Investors

Reviewed by Sasha Jovanovic

- CoreWeave recently announced a major high-performance computing (HPC) contract with Core Scientific, providing a potential US$8.7 billion in revenue over a 12-year period and prompting Core Scientific to shift resources into expanding its HPC infrastructure.

- This agreement highlights Core Scientific’s significant transition away from Bitcoin mining and reinforces its position in the rapidly expanding data center sector.

- We'll examine what this long-term CoreWeave contract could mean for Core Scientific's growth strategy and future financial profile.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Core Scientific Investment Narrative Recap

To be a shareholder in Core Scientific today, you need to believe in the transformation from Bitcoin mining to high-performance computing (HPC) services as a durable value driver. The recent CoreWeave contract gives the company a significant multi-year revenue opportunity, but the most immediate catalyst, successful deployment of new HPC capacity, remains tightly linked to timely infrastructure expansion. The greatest near-term risk continues to center on execution: if buildouts are delayed, or the full contract ramp is slower than expected, near-term revenues could still fall short.

The company’s announcement in February 2025 of a new HPC facility in Auburn, Alabama, is particularly relevant in light of the CoreWeave deal, as it directly supports this accelerated shift into data center services. Expansion projects like these are critical to unlocking the contract’s growth potential and addressing concerns around capacity bottlenecks, which could otherwise stall revenue gains from new service agreements.

In contrast, while large contracts look promising, investors should really be aware of what could happen if demand from a single major client suddenly changes direction...

Read the full narrative on Core Scientific (it's free!)

Core Scientific's narrative projects $1.5 billion in revenue and $334.4 million in earnings by 2028. This requires 60.9% annual revenue growth and an earnings increase of $929.6 million from the current earnings of -$595.2 million.

Uncover how Core Scientific's forecasts yield a $19.95 fair value, a 17% upside to its current price.

Exploring Other Perspectives

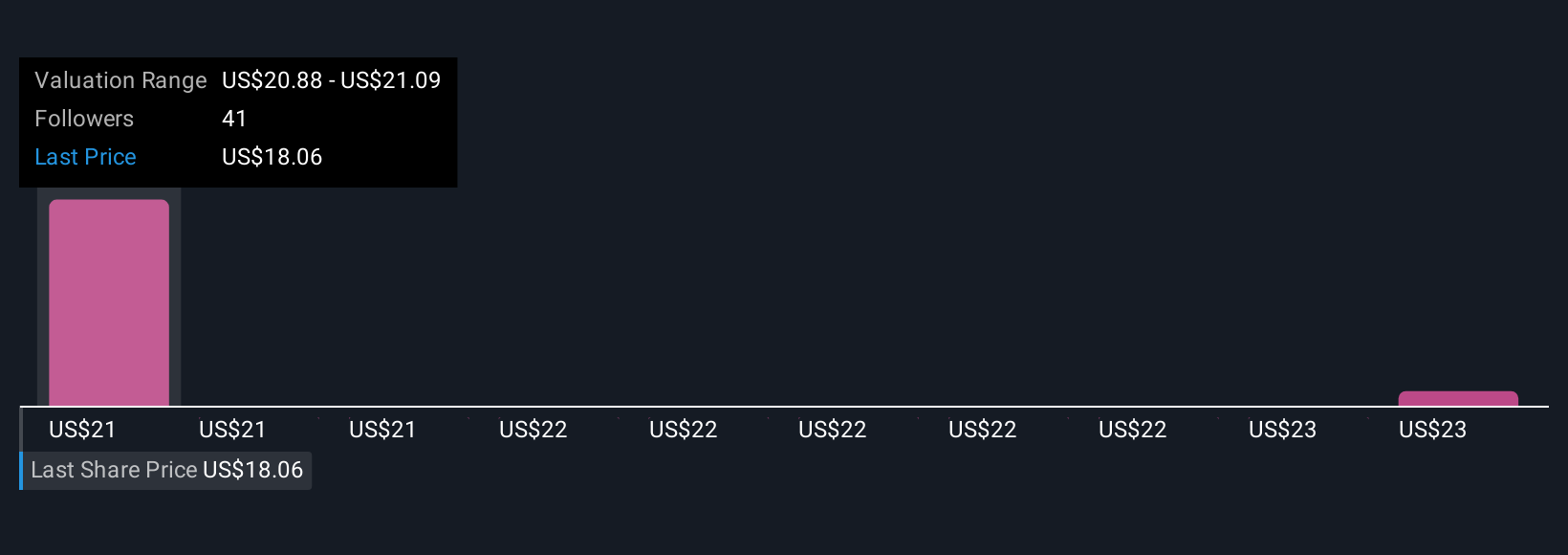

Three Community members on Simply Wall St estimate Core Scientific’s fair value between US$19.50 and US$23.00 per share. While this optimism reflects the promise of HPC growth, execution risk around facility buildouts could influence whether such targets are met, so you’ll want to consider other viewpoints that capture this range of expectations.

Explore 3 other fair value estimates on Core Scientific - why the stock might be worth just $19.50!

Build Your Own Core Scientific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Core Scientific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Core Scientific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Core Scientific's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CORZ

Core Scientific

Provides digital asset mining services in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives