- United States

- /

- Software

- /

- NasdaqGS:CLBT

ValueAct Capital’s Stake in Sun Corp Might Change The Case For Investing In Cellebrite DI (CLBT)

Reviewed by Sasha Jovanovic

- ValueAct Capital, a leading global investment firm, recently disclosed a substantial 7.8% ownership stake in SUNCORPORATION, Cellebrite’s primary sponsor, in a filing with Japanese regulators.

- ValueAct’s public expression of support for Sun Corp’s sponsorship of Cellebrite signals enhanced institutional confidence in Cellebrite’s position within the digital investigations sector.

- We’ll examine how ValueAct’s endorsement of Cellebrite’s sponsor could influence the company’s outlook and investment thesis going forward.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Cellebrite DI Investment Narrative Recap

For Cellebrite shareholders, the real draw is belief in the growing demand for digital investigations platforms as crime and data volumes soar, fueling rising adoption by law enforcement and intelligence agencies. ValueAct Capital’s new stake in SUNCORPORATION, Cellebrite’s sponsor, may support institutional confidence but does not directly affect the most important short-term catalyst: improved US federal contract flow, nor does it alleviate the near-term revenue risk from federal spending delays, which continues to limit growth visibility.

The most relevant recent announcement is Cellebrite’s updated financial guidance, reaffirming expected revenue of between US$465 million and US$475 million for 2025. This outlook incorporates management’s commentary on ongoing challenges in US federal procurement, making it highly pertinent for investors tracking catalysts tied to federal contract recovery and assessing the company’s execution discipline.

However, despite this boost in visible institutional backing, investors should keep in mind the continued revenue headwinds from slow US federal spending cycles and how...

Read the full narrative on Cellebrite DI (it's free!)

Cellebrite DI's narrative projects $671.4 million revenue and $128.8 million earnings by 2028. This requires 15.4% yearly revenue growth and a $279.7 million increase in earnings from the current earnings of $-150.9 million.

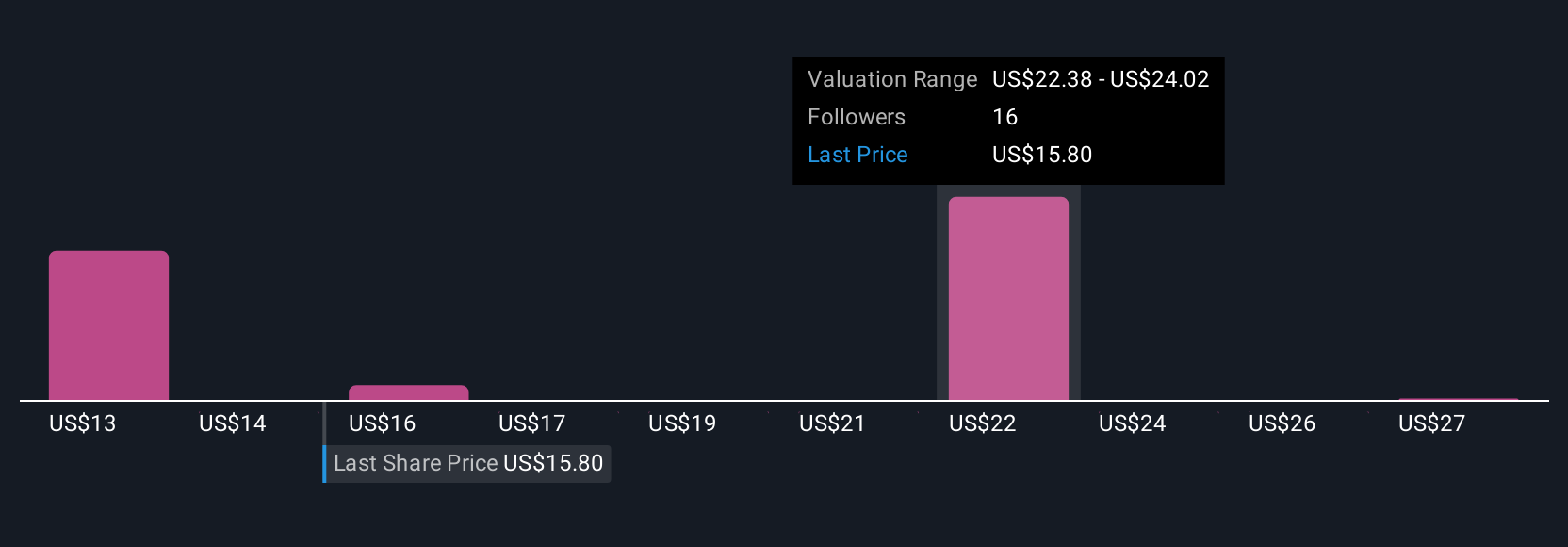

Uncover how Cellebrite DI's forecasts yield a $23.14 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Six community members at Simply Wall St have shared fair value estimates for Cellebrite, ranging widely from US$12.54 to US$32 per share. Given that ongoing federal procurement challenges remain a key source of revenue risk, these views reveal just how much market participants can differ in their outlook, so it’s worth exploring a few different approaches before making up your mind.

Explore 6 other fair value estimates on Cellebrite DI - why the stock might be worth as much as 69% more than the current price!

Build Your Own Cellebrite DI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cellebrite DI research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Cellebrite DI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cellebrite DI's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLBT

Cellebrite DI

Develops solutions for legally sanctioned investigations in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives