- United States

- /

- Software

- /

- NYSE:QTWO

US High Growth Tech Stocks To Watch In April 2025

Reviewed by Simply Wall St

As the U.S. market faces a downturn with major indices like the S&P 500 and Nasdaq Composite experiencing declines following a weak GDP report, investors are closely monitoring economic indicators and upcoming tech earnings to gauge future trends. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate resilience through innovation and adaptability amid economic uncertainties.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.27% | 29.79% | ★★★★★★ |

| Alkami Technology | 20.46% | 85.16% | ★★★★★★ |

| Travere Therapeutics | 28.65% | 66.06% | ★★★★★★ |

| TG Therapeutics | 26.06% | 37.39% | ★★★★★★ |

| Arcutis Biotherapeutics | 26.11% | 58.46% | ★★★★★★ |

| Clene | 62.08% | 64.01% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.14% | 58.85% | ★★★★★★ |

| AVITA Medical | 27.81% | 55.17% | ★★★★★★ |

| Lumentum Holdings | 21.34% | 120.49% | ★★★★★★ |

| Ascendis Pharma | 32.75% | 59.64% | ★★★★★★ |

Click here to see the full list of 237 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Cellebrite DI (NasdaqGS:CLBT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Cellebrite DI Ltd. provides solutions for legally sanctioned investigations across various regions including Europe, the Middle East, Africa, the Americas, and the Asia-Pacific with a market cap of $4.74 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $401.20 million.

Cellebrite DI showcases a promising trajectory in the tech sector, with its revenue forecast to grow at 15.2% annually, outpacing the US market's average of 8.2%. This growth is supported by a significant turnaround in profitability; from a net loss of $283.01 million last year to a net income of $19.27 million in the latest quarter, reflecting an impressive control over operational efficiencies and market adaptation. The company's commitment to innovation is evident from its R&D investments, aligning with industry shifts towards more secure and comprehensive digital forensics solutions. As Cellebrite continues to expand its technological capabilities and market reach, it stands well-positioned to capitalize on increasing global demands for cybersecurity products, despite current unprofitability compared to industry growth rates.

- Click here to discover the nuances of Cellebrite DI with our detailed analytical health report.

Understand Cellebrite DI's track record by examining our Past report.

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kiniksa Pharmaceuticals International, plc is a biopharmaceutical company that develops and commercializes novel therapies for diseases with unmet needs, particularly focusing on cardiovascular indications, with a market cap of $1.57 billion.

Operations: Kiniksa Pharmaceuticals focuses on developing and commercializing therapies for diseases with unmet needs, emphasizing cardiovascular conditions. The company operates in the biopharmaceutical sector with a market cap of approximately $1.57 billion.

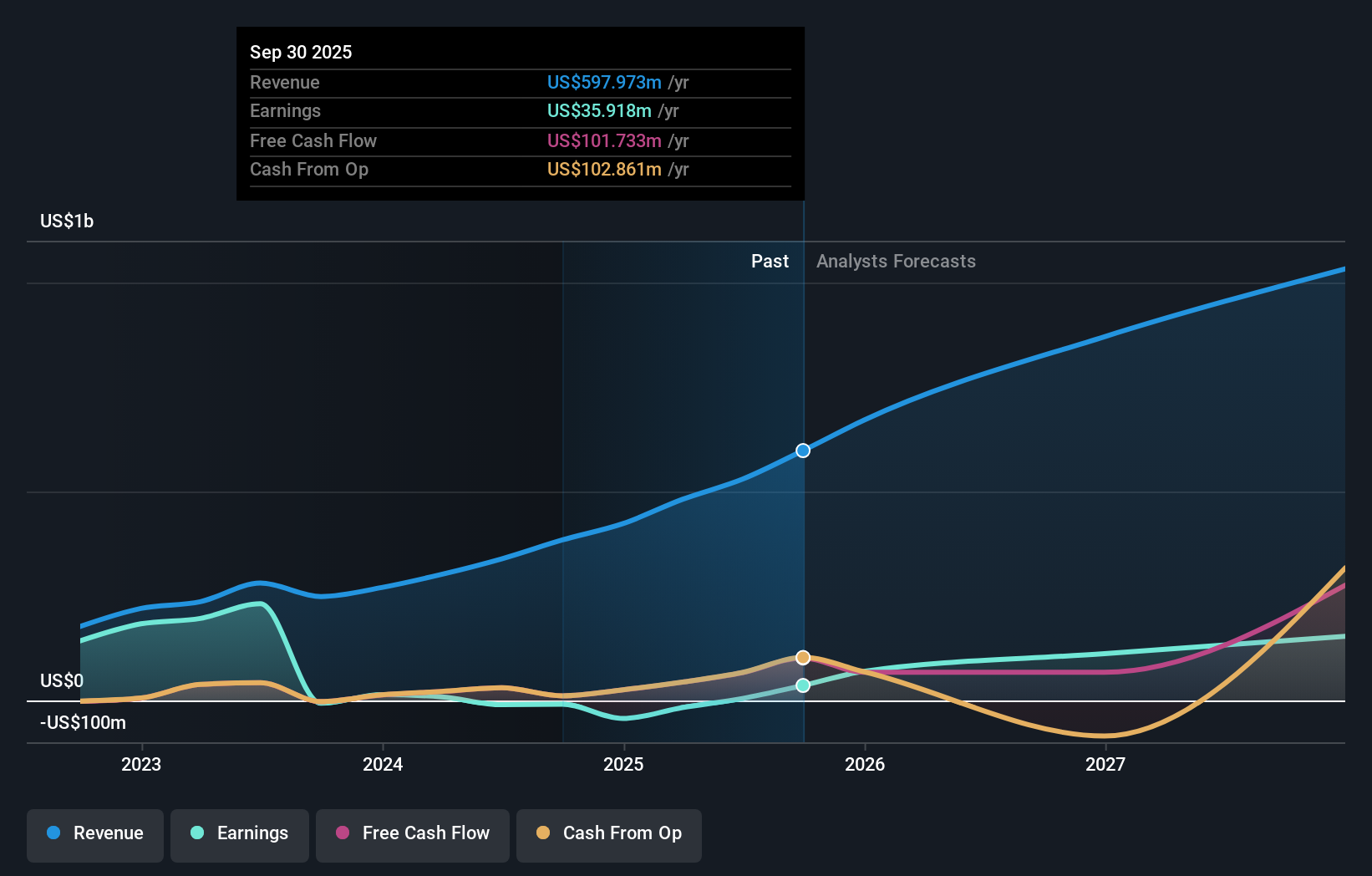

Kiniksa Pharmaceuticals International has demonstrated a robust turnaround, with its recent quarterly revenue surging to $137.79 million from $79.86 million year-over-year, and shifting from a net loss to a profit of $8.54 million. This performance is underpinned by an upward revision in 2025 revenue forecasts to between $590 million and $605 million, reflecting confidence in sustained growth. The firm's strategic focus on innovative therapies for diseases with unmet needs, like the development of KPL-387 for recurrent pericarditis, aligns with industry trends towards targeted healthcare solutions. With R&D investments tailored to address specific medical challenges, Kiniksa is not only enhancing its market position but also contributing significantly to advancements in biotechnology.

Q2 Holdings (NYSE:QTWO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Q2 Holdings, Inc. offers digital solutions tailored for financial institutions, FinTechs, and alternative finance companies in the United States with a market capitalization of approximately $4.90 billion.

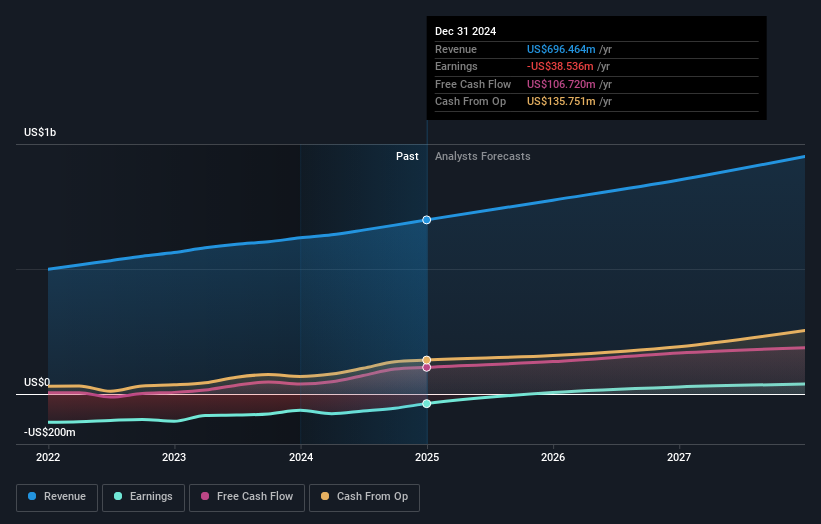

Operations: Q2 Holdings generates revenue primarily through the sale, implementation, and support of its digital solutions, totaling $696.46 million.

Q2 Holdings has been actively enhancing its digital banking platform, evidenced by recent integrations like Ninth Wave, which enriches financial data connectivity for banks. This aligns with the broader industry shift towards secure and efficient SaaS models. Despite a challenging past with a net loss of $38.54 million in 2024, Q2's strategic acquisitions and board enhancements signal a robust pivot towards profitability and market adaptability. With an expected annual revenue growth of 10.1% outpacing the US market average of 8.2%, coupled with an anticipated earnings growth surge to 103.08% per year, Q2 is positioning itself as a resilient contender in the tech sector, ready to capitalize on evolving financial service demands.

Summing It All Up

- Explore the 237 names from our US High Growth Tech and AI Stocks screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q2 Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:QTWO

Q2 Holdings

Provides digital solutions to financial institutions, financial technology companies, FinTechs, and alternative finance companies (Alt-FIs) in the United States.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives