- United States

- /

- Software

- /

- NasdaqGS:CHKP

Check Point Software Technologies (CHKP): Evaluating Valuation Following Guardz Partnership and Enhanced Email Security Integration

Reviewed by Simply Wall St

Check Point Software Technologies (CHKP) shares drew attention after Guardz announced a strategic partnership to integrate Check Point’s Harmony Email into its unified cybersecurity platform. The move aims to boost email security for managed service providers who are facing evolving email-borne threats.

See our latest analysis for Check Point Software Technologies.

Check Point’s recent jump in investor interest comes alongside news of its partnership with Guardz, a move that could expand its presence in the cybersecurity space for managed service providers. The stock’s momentum has picked up, as reflected by a 6.7% 7-day share price return and a strong 1-year total shareholder return of 15%. This suggests that the market is seeing both near-term appeal and sustained progress.

If you’re watching cybersecurity innovation closely, the next step is to explore the full universe of high-growth tech and AI stocks See the full list for free.

But with Check Point’s stock posting steady returns and analyst targets set higher, investors have to ask: does this recent momentum signal an undervalued opportunity, or is the market already factoring in the company’s future growth potential?

Most Popular Narrative: 10.5% Undervalued

With Check Point Software Technologies closing at $204.54, the most widely followed narrative estimates fair value at $228.56, suggesting notable upside for investors weighing recent momentum against fundamental prospects.

The company's ability to consistently beat major performance metrics underscores effective execution and operational efficiency. Sustained margins, including a best-in-class operating margin profile, contribute to Check Point's valuation appeal and support its reputation for financial discipline.

Want to know what’s fueling this bullish outlook? The story centers on ambitious revenue growth assumptions and margin control, combined with a profit multiple befitting market leaders. Get the details that could change your view of Check Point’s true value. See the narrative’s full case and all its make-or-break projections.

Result: Fair Value of $228.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty around competitive pressures and exposure to international manufacturing risks could challenge Check Point’s upward momentum if these headwinds become stronger.

Find out about the key risks to this Check Point Software Technologies narrative.

Another View: What Do Multiples Say?

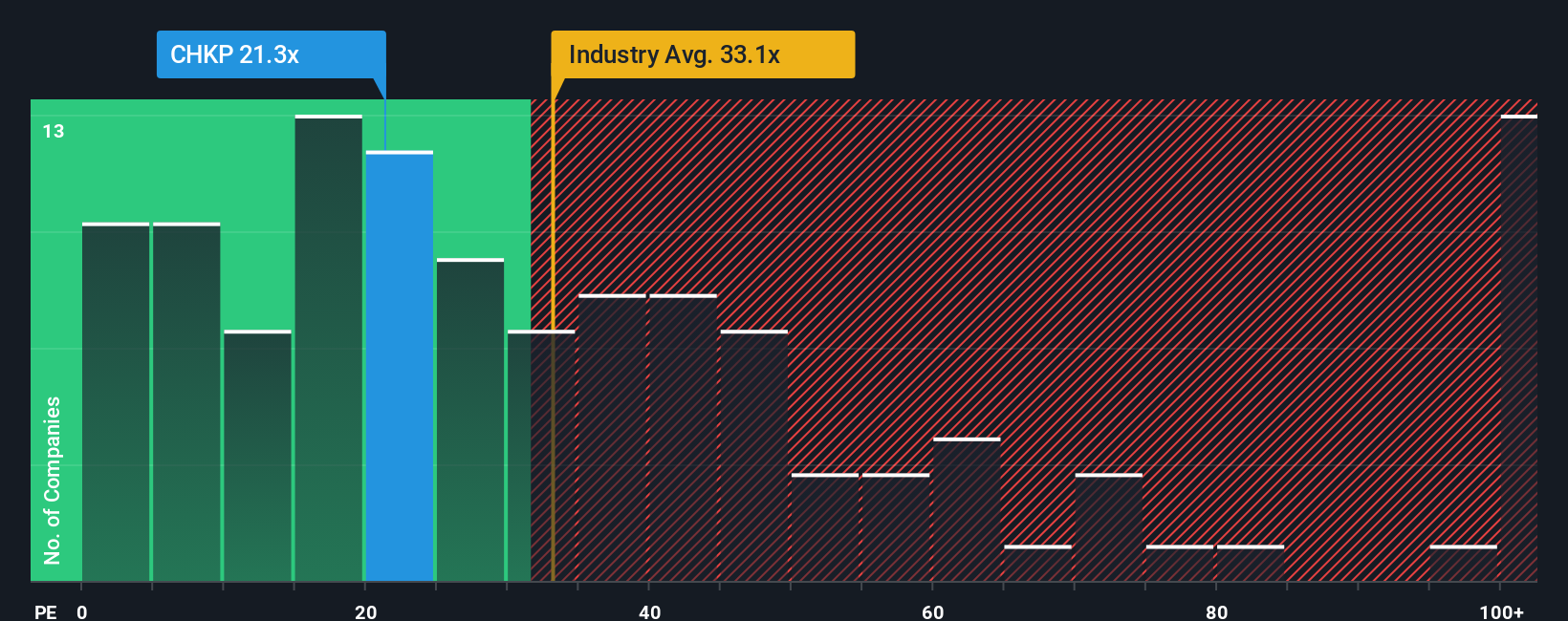

While the narrative points to undervaluation, a look at the company's price-to-earnings ratio tells a different story. Check Point is trading at 21.7 times earnings, which is much lower than both the US Software industry average of 32.5x and its peer average of 39.3x. It is also under the fair ratio of 26.5x, suggesting the stock could be priced more attractively than many rivals. However, does this lower multiple reflect hidden risks, or is it an overlooked opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you see things differently or enjoy taking a hands-on approach to your research, you can put together your own perspective in just minutes. Do it your way

A great starting point for your Check Point Software Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Great investors don't just stop at one opportunity, and neither should you. Power up your next move with these handpicked stock ideas for every kind of strategy:

- Uncover untapped potential with these 872 undervalued stocks based on cash flows that the market may be overlooking. This could give you an edge on value plays.

- Capture steady income by heading straight to these 15 dividend stocks with yields > 3%, which offers robust yields for long-term growth and resilience.

- Ride the wave of innovation and find tomorrow’s leaders among these 26 AI penny stocks, featuring AI breakthroughs and significant growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Ferrari's Intrinsic and Historical Valuation

Recently Updated Narratives

Looking to be second time lucky with a game-changing new product

Adobe - A Fundamental and Historical Valuation

Probably the best stock I've seen all year.

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Trending Discussion