- United States

- /

- Software

- /

- NasdaqGS:CHKP

A Look At Check Point Software Technologies (CHKP) Valuation After New Apono Zero Standing Privilege Integration

Reviewed by Simply Wall St

Apono’s new integration with Check Point Software Technologies (CHKP) introduces a SASE-based Zero Standing Privilege model that focuses on temporary, task specific access in cloud environments, which could matter for investors watching Check Point’s security portfolio.

See our latest analysis for Check Point Software Technologies.

Against this backdrop, Check Point’s share price sits at US$190.76, with a 1-day share price return of 0.63% and a year to date share price return of 5.37%. Its 3 year total shareholder return of 51.35% points to stronger longer term momentum than the recent 30 day share price return decline of 1.77% and 90 day share price return decline of 2.45%.

If this type of cybersecurity story has your attention, it could be a useful moment to scan other high growth tech and AI names using high growth tech and AI stocks.

With Check Point trading at US$190.76 and sitting about 19% below the average analyst price target, yet screening with a mid-range value score of 3, are you looking at a genuine opportunity here, or is future growth already baked in?

Most Popular Narrative: 16.5% Undervalued

Compared to the last close at US$190.76, the most widely followed narrative points to a higher fair value anchored around long term cash generation.

The analysts have a consensus price target of $223.054 for Check Point Software Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $285.0, and the most bearish reporting a price target of just $173.0.

Want to see what sits behind that valuation gap? The narrative leans on steady revenue gains, resilient margins, and a future earnings multiple usually reserved for premium software names. Curious which specific growth and profitability assumptions have to hold for that view to stack up? The full story breaks down those moving parts in detail.

Result: Fair Value of $228.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still questions around how sustainable billings growth really is and whether margin pressure from AI spend or Taiwan related costs could squeeze returns.

Find out about the key risks to this Check Point Software Technologies narrative.

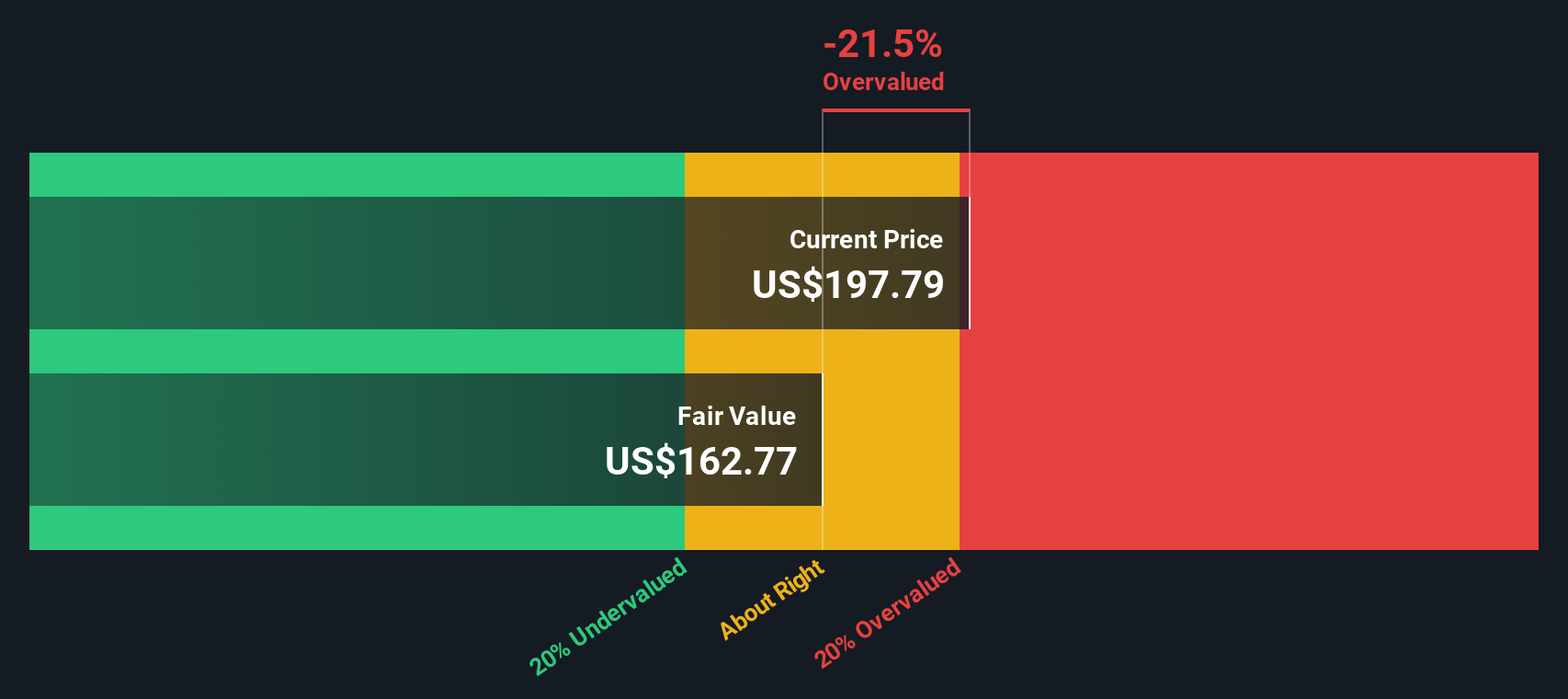

Another View: DCF Flips The Story

Our DCF model paints a very different picture, with an estimated fair value of US$166.21 per share, which would make Check Point look overvalued at the current US$190.76 price. If cash flow assumptions are this sensitive, which set of expectations do you trust more?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Check Point Software Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Check Point Software Technologies Narrative

If you interpret the numbers differently or want to test your own assumptions, you can create a complete Check Point view in just a few minutes by starting with Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Check Point Software Technologies.

Ready for more investment ideas?

If Check Point has you thinking harder about risk, reward, and price, do not stop here, the next opportunity you shortlist could come from a fresh angle.

- Spot potential high risk, high reward setups by scanning these 3545 penny stocks with strong financials that pair smaller market caps with solid financial checks.

- Target future facing themes by filtering for these 28 AI penny stocks that link artificial intelligence stories with listed companies.

- Hunt for mispriced names using these 881 undervalued stocks based on cash flows to surface shares that look cheap on cash flow based metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CHKP

Check Point Software Technologies

Develops, markets, and supports a range of products and services for IT security worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

GameStop will ace the financial crisis wave with its strategic Bitcoin investment and cash reserves

BABA Analysis: Buying the Fear, Holding the Cloud

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026