- United States

- /

- Software

- /

- NasdaqGS:CGNT

Cognyte Software Ltd. (NASDAQ:CGNT) Stock Catapults 27% Though Its Price And Business Still Lag The Industry

Cognyte Software Ltd. (NASDAQ:CGNT) shares have had a really impressive month, gaining 27% after a shaky period beforehand. The last 30 days bring the annual gain to a very sharp 55%.

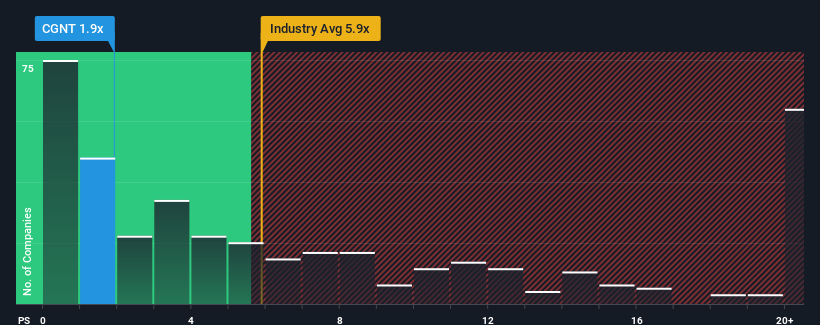

Even after such a large jump in price, Cognyte Software may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.9x, since almost half of all companies in the Software industry in the United States have P/S ratios greater than 5.9x and even P/S higher than 14x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Cognyte Software

How Has Cognyte Software Performed Recently?

Recent times haven't been great for Cognyte Software as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Cognyte Software's future stacks up against the industry? In that case, our free report is a great place to start.How Is Cognyte Software's Revenue Growth Trending?

Cognyte Software's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 29% overall drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 8.5% as estimated by the three analysts watching the company. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Cognyte Software's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Even after such a strong price move, Cognyte Software's P/S still trails the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Cognyte Software's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Cognyte Software (1 makes us a bit uncomfortable) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CGNT

Cognyte Software

A software-led technology company, focuses on solutions for data processing and analytics worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026