- United States

- /

- Software

- /

- NasdaqGS:CFLT

Health Check: How Prudently Does Confluent (NASDAQ:CFLT) Use Debt?

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that Confluent, Inc. (NASDAQ:CFLT) does use debt in its business. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Confluent

What Is Confluent's Net Debt?

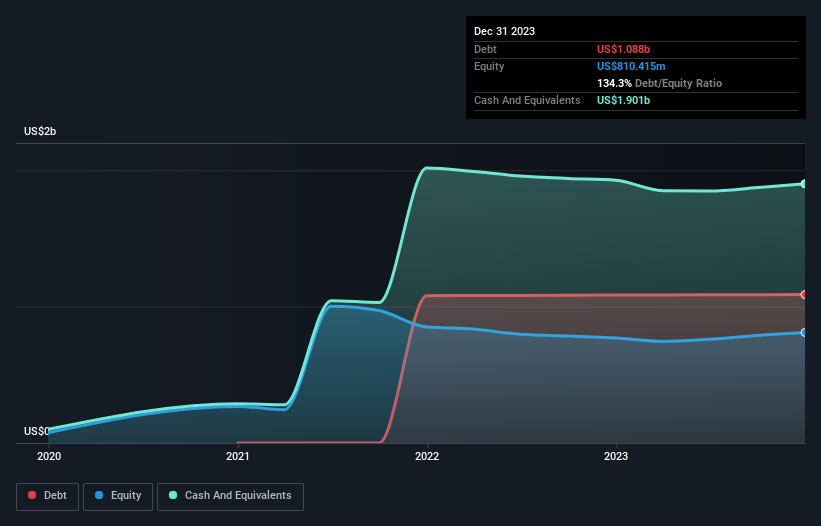

As you can see below, Confluent had US$1.09b of debt, at December 2023, which is about the same as the year before. You can click the chart for greater detail. But on the other hand it also has US$1.90b in cash, leading to a US$812.5m net cash position.

How Strong Is Confluent's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Confluent had liabilities of US$487.0m due within 12 months and liabilities of US$1.16b due beyond that. Offsetting these obligations, it had cash of US$1.90b as well as receivables valued at US$230.0m due within 12 months. So it actually has US$480.3m more liquid assets than total liabilities.

This short term liquidity is a sign that Confluent could probably pay off its debt with ease, as its balance sheet is far from stretched. Simply put, the fact that Confluent has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Confluent can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Confluent wasn't profitable at an EBIT level, but managed to grow its revenue by 33%, to US$777m. With any luck the company will be able to grow its way to profitability.

So How Risky Is Confluent?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Confluent had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through US$124m of cash and made a loss of US$443m. While this does make the company a bit risky, it's important to remember it has net cash of US$812.5m. That kitty means the company can keep spending for growth for at least two years, at current rates. With very solid revenue growth in the last year, Confluent may be on a path to profitability. Pre-profit companies are often risky, but they can also offer great rewards. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Confluent that you should be aware of before investing here.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion