- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT): Evaluating Valuation as New Executives Drive Global Growth Strategy

Reviewed by Simply Wall St

Confluent (CFLT) just made some interesting executive moves by naming Kamal Brar to lead its global partnerships and bringing Greg Taylor on board to oversee Asia-Pacific operations. Both have solid track records in expanding tech businesses internationally.

See our latest analysis for Confluent.

While Confluent’s recent leadership moves signal renewed focus on growth and global reach, the latest share price stands at $22.25. The 90-day share price return of 12% suggests some upward momentum has returned, even as the total shareholder return over one year remains down nearly 28%. Momentum appears mixed, with volatility influenced by challenging tech market conditions.

If Confluent’s big-picture growth story has you intrigued, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

Yet with shares trading at a meaningful discount to analyst targets and the company showing double-digit revenue growth, the big question is whether Confluent remains undervalued or if the market is accurately pricing in future gains.

Most Popular Narrative: 20.2% Undervalued

Confluent’s current share price of $22.25 sits well below the most popular narrative’s fair value estimate of $27.87. This highlights a potential gap the market has yet to close. The narrative points to long-term drivers that may not be fully captured in today’s price, setting the stage for a catalyst worth exploring.

Expanding adoption of Confluent Cloud and new offerings like WarpStream and Flink, which are showing exponential ARR growth, contribute to higher recurring revenues, improved gross margins, and growing opportunities for multi-product upsell. These factors directly support net margin and long-term earnings.

Want to know which bold growth plays and margin forecasts are behind this valuation? The most-watched narrative calculates its price target using some ambitious revenue, profitability, and future PE expectations. If you want the full forecast and see how far Confluent could go, now’s the time to read more.

Result: Fair Value of $27.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing customer optimization and slower adoption by large clients could limit cloud revenue growth. This poses a real test for Confluent's bullish thesis.

Find out about the key risks to this Confluent narrative.

Another View: Testing the Fair Value by Sales Ratio

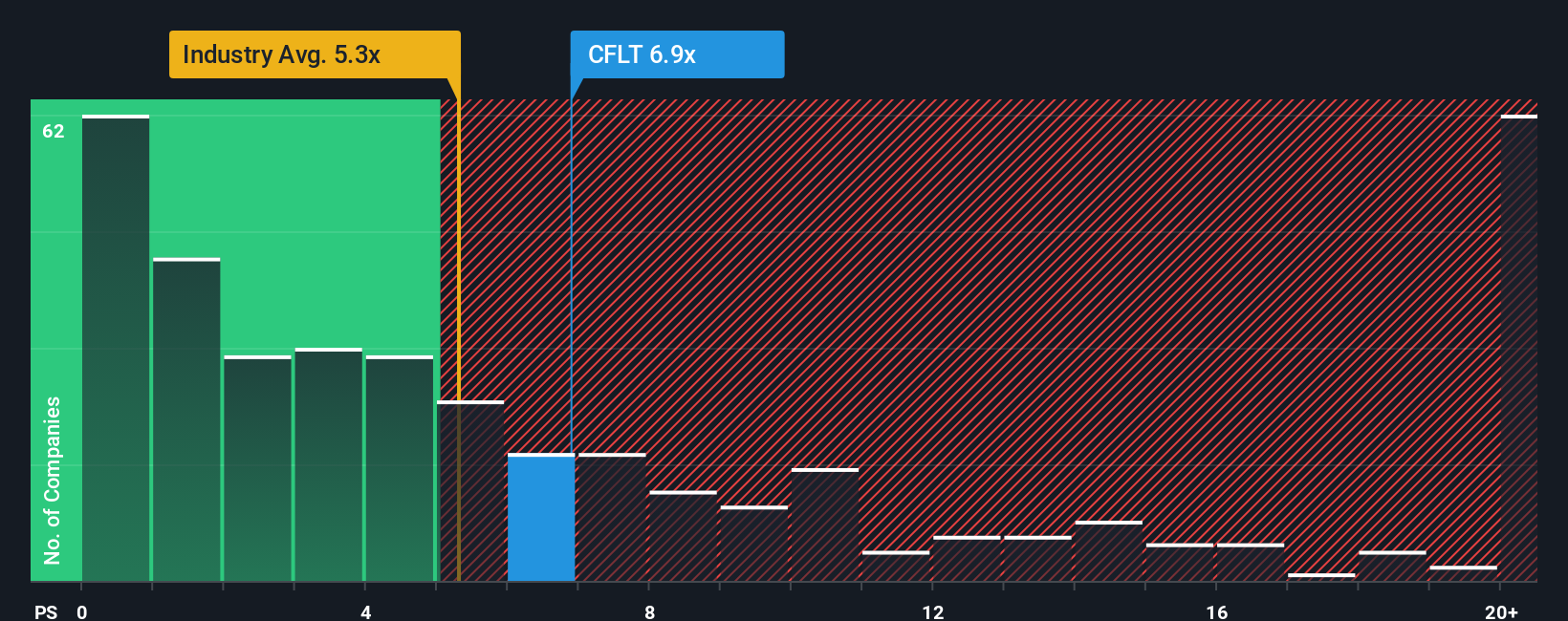

Even though analysts think Confluent is undervalued, our sales ratio lens offers a different angle. Confluent’s price-to-sales sits at 7x, which is higher than the US Software industry’s 4.7x and lower than similar peers at 9.1x. It is trading very close to its fair ratio of 7.8x, which suggests there may be limited room for significant change in either direction in the near term. Is the real opportunity already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Confluent Narrative

If you see things differently or want to dig into the numbers yourself, it only takes a few minutes to build your own take. Do it your way

A great starting point for your Confluent research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your strategy to just one stock? Get ahead with smart tools that spotlight opportunities other investors may overlook. Start now and stay a step ahead as markets shift.

- Spot payouts that can boost your portfolio by tapping into these 15 dividend stocks with yields > 3% with yields above 3% for steady income potential and resilient fundamentals.

- Target tomorrow’s winners among innovative tech by scouting these 25 AI penny stocks set to transform major industries with artificial intelligence breakthroughs.

- Capture value before it’s gone by viewing these 920 undervalued stocks based on cash flows selected for strong cash flows and pricing that could be ripe for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.