- United States

- /

- Software

- /

- NasdaqGS:CFLT

Confluent (CFLT): Assessing Valuation as F1 Partnership Showcases Real-Time Data Streaming Edge

Reviewed by Kshitija Bhandaru

Confluent (CFLT) just revealed a new multi-year partnership with the Visa Cash App Racing Bulls Formula 1 team, drawing attention to its data streaming platform in the competitive world of F1 racing. This collaboration places Confluent’s technology in a unique and high-speed spotlight.

See our latest analysis for Confluent.

Confluent’s splashy Formula 1 partnership arrives as the company weathers a fairly muted period for its stock, with the latest news only nudging the share price modestly. Over the past year, Confluent’s total shareholder return has been just 0.08%, while three-year total shareholder returns have remained in negative territory. Momentum has yet to pick up in a meaningful way, leaving investors watching for the next inflection point.

If you’re curious about other fast movers and emerging leaders, it is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

So, is Confluent currently flying under the radar with growth still ahead? Or has the stock’s recent price already accounted for all its future potential, leaving little room for upside?

Most Popular Narrative: 16.9% Undervalued

With Confluent’s widely watched narrative setting fair value significantly higher than its last close, the stock’s current level could be leaving room on the table. The valuation story hinges on whether growth across new AI and data streaming markets will accelerate from here or if speed bumps persist.

The proliferation of data volumes and the fundamental shift toward real-time, event-driven architectures are expanding Confluent's addressable market, positioning its platform as mission-critical for data-centric digital transformation across industries. This underpins sustained topline revenue growth and strong customer retention.

Want to uncover the real drivers shaping this price target? The foundation of this valuation is powered by bold assumptions, from remarkable revenue momentum to aggressive margin improvements. There is a model behind the number, but the details may surprise you. Scroll on to reveal the full formula behind Confluent’s narrative fair value.

Result: Fair Value of $24.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent slowdowns in Confluent Cloud growth or major customers opting for self-managed solutions could challenge the company's premium positioning and cloud revenue outlook.

Find out about the key risks to this Confluent narrative.

Another View: Looking at Price Ratios

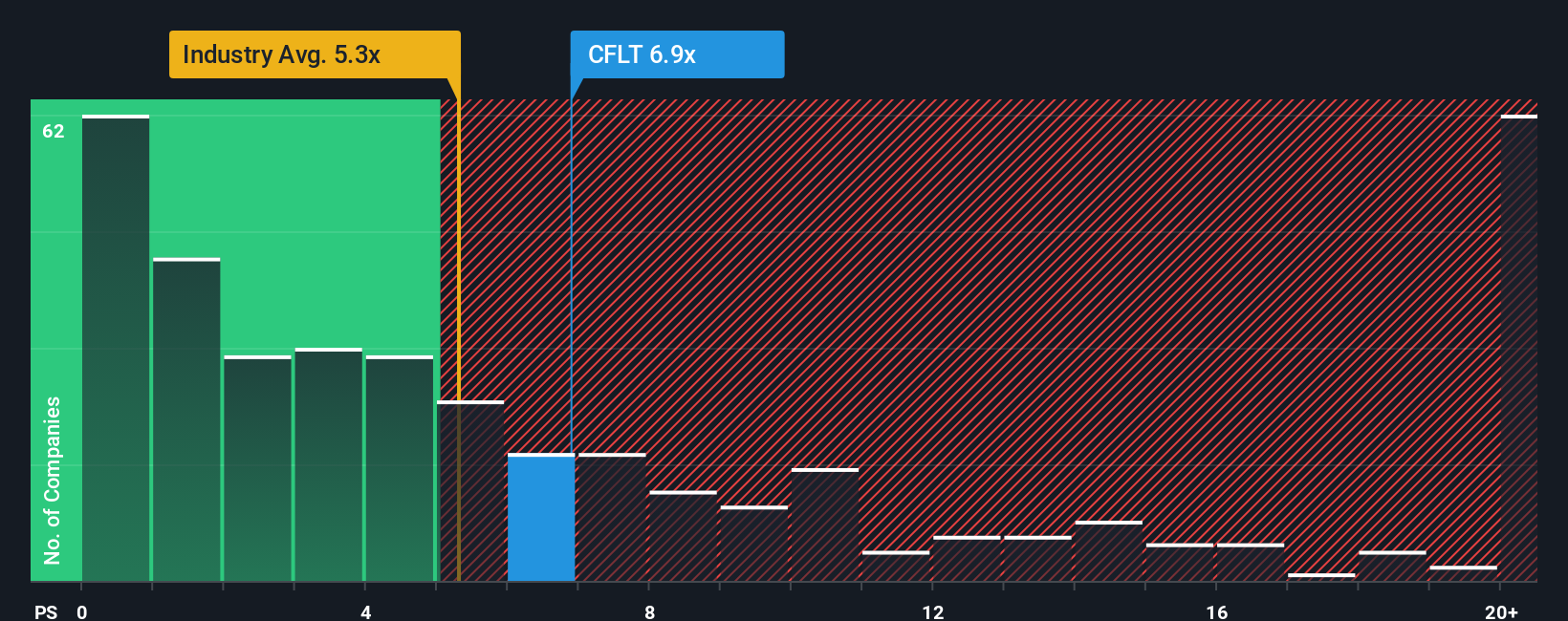

While some see Confluent as undervalued based on narrative fair value, the price-to-sales ratio tells a more nuanced story. Currently at 6.6x, the stock looks expensive compared to the US Software industry average of 5.3x, yet more affordable than its peer group at 9.1x. The fair ratio suggests the market could eventually settle at 7.4x. Does this mean there is still some runway for value, or could investors be settling for less upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Confluent Narrative

If this take on Confluent does not match your own convictions, or if you like to dig into the data firsthand, you can quickly assemble your personal view of the company in under three minutes. Do it your way

A great starting point for your Confluent research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More High-Potential Investments?

Seize this opportunity to shape the future of your portfolio by checking standout stocks and sectors most investors are missing. Don’t let your next great idea pass you by.

- Capitalize on rising yield trends and boost your income by reviewing these 19 dividend stocks with yields > 3% offering returns above 3%.

- Tap into tomorrow’s healthcare breakthroughs by researching these 31 healthcare AI stocks, which combines medicine and artificial intelligence.

- Position yourself at the forefront of finance by scanning these 78 cryptocurrency and blockchain stocks, a resource for innovation within digital currencies and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CFLT

Confluent

Operates a data streaming platform in the United States and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives