- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (NasdaqGS:CDNS) Launches Groundbreaking DDR5 12.8Gbps Memory Solution

Reviewed by Simply Wall St

Cadence Design Systems (NasdaqGS:CDNS) launched the industry's first DDR5 12.8Gbps MRDIMM Gen2 memory IP system solution, aiming to address escalating demands in AI and data center applications. Despite this advancement, Cadence's share price declined 3% over the past week, aligning with the general market trend as the broader market saw a 4% drop. This suggests external factors, such as market-wide uncertainties and tariff concerns, played a significant role. Meanwhile, the Dow Jones surged 1,000 points mid-week, showing resilience following earlier steep declines, highlighting the volatile trading environment. Cadence's technology innovations might temper the broader negative movement but were not enough to counteract market challenges fully.

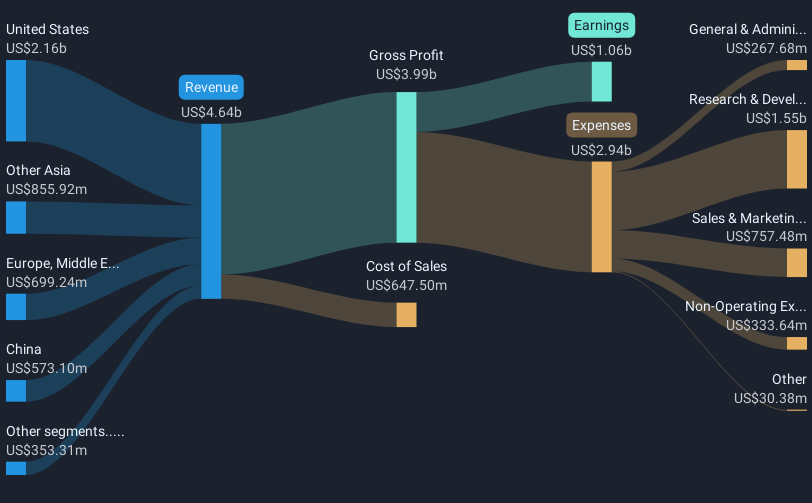

The introduction of Cadence's DDR5 12.8Gbps MRDIMM Gen2 memory IP system solution highlights the company's commitment to addressing the needs of the AI and data center industries. Despite the short-term decline in share price alongside market-wide fluctuations, the company's robust technological advancements and strategic partnerships, particularly with industry leaders such as NVIDIA, Qualcomm, and Marvell, underscore its potential for revenue and earnings growth. Over the past five years, Cadence's total shareholder return, including dividends, has been very large at 209.38%, indicating strong long-term performance.

Comparatively, over the past year, Cadence underperformed both the US Software industry and the broader market, which posted a 2.5% increase. The market's short-term dynamics notwithstanding, Cadence's technological innovations and partnerships could lead to enhanced revenue and earnings forecasts, as AI-driven solutions gain traction. However, challenges such as slowed growth in China and cautious expense management could pose risks to these forecasts. With a current share price of US$259.26, there remains a 16.7% discount to the consensus analyst price target of US$311.08, suggesting potential future appreciation if the company's projections align with growth expectations and market conditions stabilize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives