- United States

- /

- Software

- /

- NasdaqGS:CDNS

Cadence Design Systems (NasdaqGS:CDNS) Expands NVIDIA Partnership To Accelerate AI And Scientific Innovations

Reviewed by Simply Wall St

Cadence Design Systems (NasdaqGS:CDNS) experienced an 8% price increase over the past week, largely driven by the expansion of its partnership with NVIDIA. This collaboration, focused on advancements in accelerated computing and AI, underscores Cadence's role in addressing global technology challenges through enhanced engineering solutions. By integrating NVIDIA's Blackwell architecture, Cadence has improved its simulation capabilities, achieving significantly faster computational times. As U.S. major indexes like the Nasdaq Composite also showed gains, adding 1%, Cadence's uptick aligns with market-wide tech advancements, although it's worth noting its movement contrasts with broader index performance fluctuations linked to macroeconomic events, such as investor anticipation of the Fed's economic forecasts. Additionally, the company's foray into AI and molecular sciences in partnership with NVIDIA further bolsters its innovative edge in the tech sector, setting it apart amidst a market recently characterized by fluctuating stock trends and investor sentiment surrounding economic growth.

Over the past five years, Cadence Design Systems has delivered a remarkable total return of approximately 300.82%, showcasing its robust performance over an extended period. During this time, several factors have played a role in shaping the company's trajectory. A key development was its collaboration with NVIDIA, which significantly improved computational efficiency in fields such as aerospace, yielding reductions of up to 80 times in simulation times.

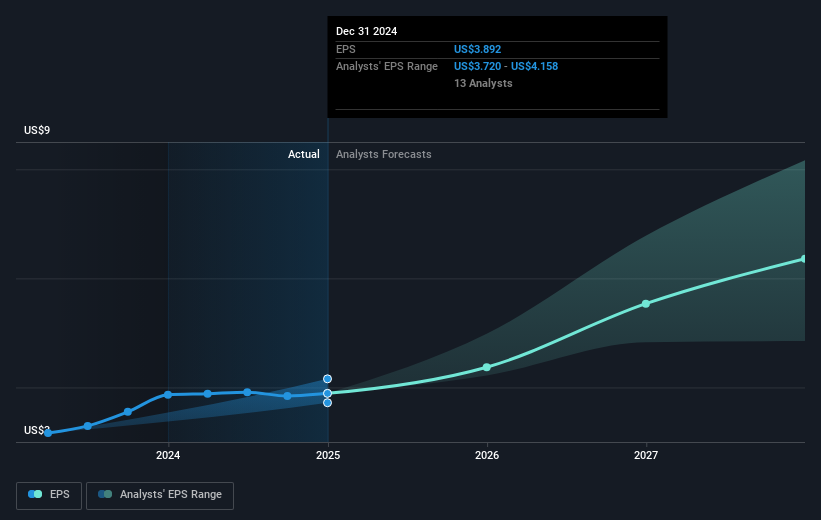

Additionally, Cadence engaged in share repurchase programs, acquiring significant amounts of its stock, which may have positively impacted shareholder value. Corporate guidance has consistently reflected optimistic revenue forecasts, with anticipated earnings reinforcing confidence in the company's sustained growth trajectory. Furthermore, partnerships with entities like Rapidus Corporation and AST SpaceMobile have expanded its technological reach, particularly in AI and space-related solutions. Collectively, these events underscore Cadence's strategic positioning and commitment to innovation within the tech sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CDNS

Cadence Design Systems

Provides software, hardware, and other services worldwide.

Excellent balance sheet with moderate growth potential.