- United States

- /

- Software

- /

- NasdaqGS:CDK

We Think Shareholders May Want To Consider A Review Of CDK Global, Inc.'s (NASDAQ:CDK) CEO Compensation Package

CDK Global, Inc. (NASDAQ:CDK) has not performed well recently and CEO Brian Krzanich will probably need to up their game. At the upcoming AGM on 11 November 2021, shareholders can hear from the board including their plans for turning around performance. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for CDK Global

Comparing CDK Global, Inc.'s CEO Compensation With the industry

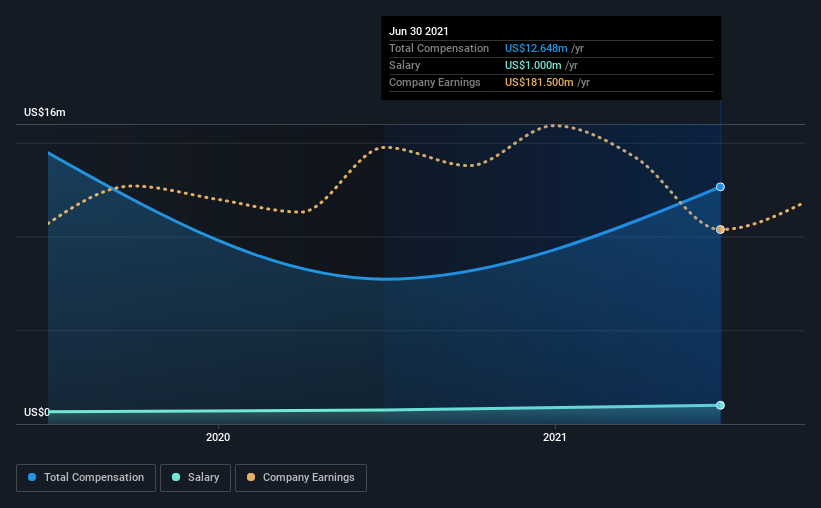

Our data indicates that CDK Global, Inc. has a market capitalization of US$5.2b, and total annual CEO compensation was reported as US$13m for the year to June 2021. Notably, that's an increase of 64% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.0m.

For comparison, other companies in the same industry with market capitalizations ranging between US$4.0b and US$12b had a median total CEO compensation of US$5.9m. Accordingly, our analysis reveals that CDK Global, Inc. pays Brian Krzanich north of the industry median. Moreover, Brian Krzanich also holds US$3.5m worth of CDK Global stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | US$1.0m | US$750k | 8% |

| Other | US$12m | US$7.0m | 92% |

| Total Compensation | US$13m | US$7.7m | 100% |

Talking in terms of the industry, salary represented approximately 12% of total compensation out of all the companies we analyzed, while other remuneration made up 88% of the pie. CDK Global sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

CDK Global, Inc.'s Growth

Over the last three years, CDK Global, Inc. has shrunk its earnings per share by 8.4% per year. It achieved revenue growth of 3.9% over the last year.

The decline in EPS is a bit concerning. The modest increase in revenue in the last year isn't enough to make us overlook the disappointing change in EPS. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has CDK Global, Inc. Been A Good Investment?

Given the total shareholder loss of 12% over three years, many shareholders in CDK Global, Inc. are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for CDK Global (1 is concerning!) that you should be aware of before investing here.

Important note: CDK Global is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:CDK

CDK Global

CDK Global, Inc., together with its subsidiaries, provides integrated data and technology solutions to the automotive, heavy truck, recreation, and heavy equipment industries in the United States and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026