- United States

- /

- Software

- /

- NasdaqGS:CCSI

Consensus Cloud Solutions, Inc. (NASDAQ:CCSI) Not Doing Enough For Some Investors As Its Shares Slump 26%

Unfortunately for some shareholders, the Consensus Cloud Solutions, Inc. (NASDAQ:CCSI) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 60% loss during that time.

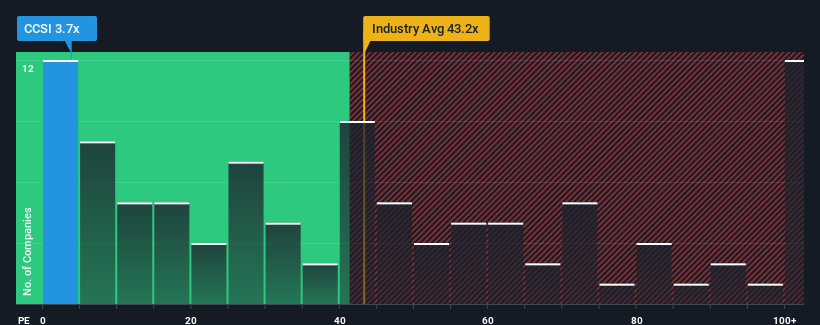

Since its price has dipped substantially, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 17x, you may consider Consensus Cloud Solutions as a highly attractive investment with its 3.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Consensus Cloud Solutions certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Consensus Cloud Solutions

How Is Consensus Cloud Solutions' Growth Trending?

In order to justify its P/E ratio, Consensus Cloud Solutions would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a decent 8.0% gain to the company's bottom line. Still, lamentably EPS has fallen 35% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 2.2% during the coming year according to the six analysts following the company. With the market predicted to deliver 12% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Consensus Cloud Solutions' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Consensus Cloud Solutions' P/E looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Consensus Cloud Solutions maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for Consensus Cloud Solutions you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CCSI

Consensus Cloud Solutions

Provides information delivery services with a software-as-a-service platform worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Norwegian Air Shuttle's revenue will grow by 73.56% and profitability will soar

Alphabet - A Fundamental and Historical Valuation

The Compound Effect: From Acquisition to Integration

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion