- United States

- /

- Software

- /

- NasdaqCM:BTDR

Bitdeer Technologies Group (BTDR) Is Down 7.8% After New Securities Class Actions Question Chip Disclosures

Reviewed by Sasha Jovanovic

- In the past year, multiple law firms initiated and publicized securities class action lawsuits against Bitdeer Technologies Group, alleging that the company misled investors about delays and technical issues in its SEAL04 chip and SEALMINER A4 mining project between June 6, 2024 and November 10, 2025.

- A key contention in these lawsuits is that Bitdeer’s widening net losses, partly tied to higher ASIC R&D expenses, were not adequately aligned with earlier positive statements about its chip development roadmap, raising fresh questions about disclosure quality and execution risk.

- We’ll now examine how these allegations around SEAL04 development progress and disclosure practices may reshape Bitdeer’s previously optimistic investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Bitdeer Technologies Group Investment Narrative Recap

To own Bitdeer, you have to believe its push into proprietary ASICs and vertically integrated power can ultimately outweigh current losses, high capital needs, and execution risks. The SEAL04 and SEALMINER A4 lawsuits directly target that ASIC roadmap, and in the near term they add legal and disclosure uncertainty around what had been a central growth catalyst, while reinforcing concerns about rising R&D spend and the reliability of past communications.

The most relevant recent announcement here is Bitdeer’s November 10, 2025 Q3 update, where management reported widened net losses tied partly to higher ASIC R&D expenses and disclosed weaker than expected results that coincided with a sharp share price reaction. That same disclosure window is now central to the lawsuits, which allege a gap between those growing losses, the true SEAL04 development status, and earlier upbeat commentary about Bitdeer’s chip roadmap.

Yet investors should be aware that the combination of unresolved SEAL04 legal claims and already elevated ASIC R&D costs could...

Read the full narrative on Bitdeer Technologies Group (it's free!)

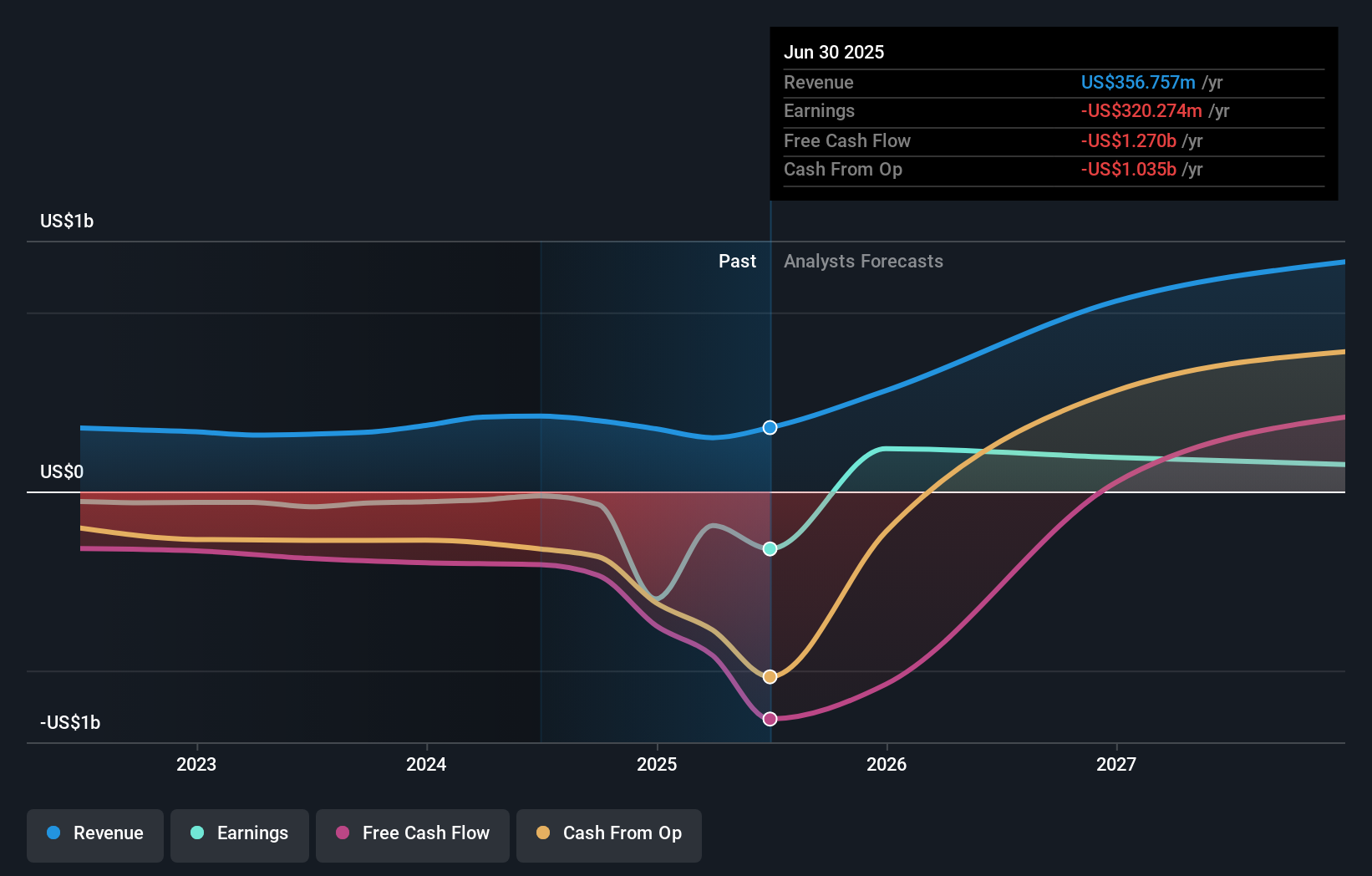

Bitdeer Technologies Group's narrative projects $1.8 billion revenue and $343.9 million earnings by 2028. This requires 71.6% yearly revenue growth and a $664.2 million earnings increase from $-320.3 million.

Uncover how Bitdeer Technologies Group's forecasts yield a $33.00 fair value, a 187% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community value Bitdeer between US$18.55 and US$309.72, underscoring how far apart individual expectations can be. Before you decide where you stand, remember that alleged disclosure issues around SEAL04 progress sit right at the heart of Bitdeer’s most important growth story and could affect how confidently the market treats any future ASIC related updates.

Explore 8 other fair value estimates on Bitdeer Technologies Group - why the stock might be a potential multi-bagger!

Build Your Own Bitdeer Technologies Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bitdeer Technologies Group research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bitdeer Technologies Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bitdeer Technologies Group's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bitdeer Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTDR

Bitdeer Technologies Group

Operates as a technology company for blockchain and high-performance computing (HPC) in Singapore, the United States, Bhutan, and Norway.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

Intuit Stock: When Financial Software Becomes the Operating System for Small Business

Meta’s Bold Bet on AI Pays Off

Robinhood Stock: Profitability Arrives, But Can Tokenization and Trading Growth Last?

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

The "Sleeping Giant" Stumbles, Then Wakes Up