- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital (BTBT) Raises US$67 Million in Follow-On Equity Offering

Reviewed by Simply Wall St

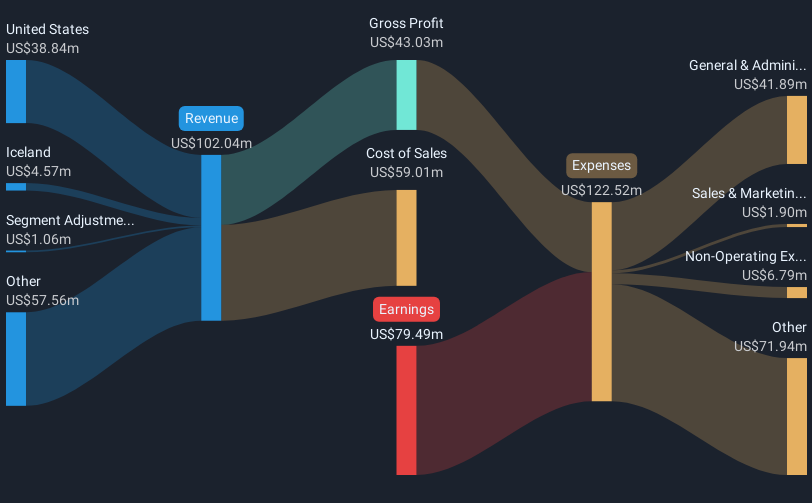

Bit Digital (BTBT) recently completed a follow-on equity offering, raising $67 million. This move, along with a prior $150 million offering, likely bolstered the company's financials, potentially influencing its 65% price increase last quarter. Despite a challenging Q1 with declining sales and a net loss, these capital-raising efforts could have added weight to positive market trends, which saw a 1.7% gain over the last week and an 18% rise over the year. While general market growth was significant, Bit Digital's capital injections likely played a key role in its standout performance.

The recent successful equity offerings by Bit Digital, raising a combined US$217 million, could bolster the company's initiatives in enhancing data center operations and expanding its presence in AI infrastructure. This financial strengthening holds the potential to positively impact revenue and earnings forecasts by supporting investments in GPU platforms and expanding strategic partnerships. The company's focus on integrating its HPC business and expanding data center capacity aligns with the aim to achieve higher operational efficiency, potentially improving future profit margins.

Over a three-year period, Bit Digital achieved a total shareholder return of 121.05%. This contrasts with its recent one-year performance, where it underperformed the US market that saw a return of 17.7% and the US Software industry, which returned 28.6%. Such a difference highlights the volatility and unique challenges the company has faced within its evolving business model. The current share price of US$3.36 presents a 44.6% discount to the analyst consensus price target of US$5.90, suggesting a potential upside based on anticipated growth and profitability targets.

Gain insights into Bit Digital's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives