- United States

- /

- Software

- /

- NasdaqCM:BTBT

Bit Digital (BTBT) Announces Follow-on Equity Offering With Registered Direct Sale

Reviewed by Simply Wall St

Bit Digital (BTBT) filed for a follow-on equity offering on July 14, 2025, marking a key event in the past quarter that saw its share price rise by 87%. This move indicates the company's focus on growth and funding strategies. In contrast to the company's substantial price change, market trends have shown a relatively moderate 11% rise over the past year. The significant equity offering and its completion of securing $150 million highlight Bit Digital’s efforts to bolster its financial position, potentially contributing to the pronounced share price increase despite market flatness over the last seven days.

The recent follow-on equity offering announced by Bit Digital is set to bolster its growth and financial footing significantly. This filing, coupled with securing US$150 million, underscores the company's commitment to investing in infrastructure like WhiteFiber and acquisitions such as Enovum. These initiatives enhance Bit Digital's data center capabilities and vertically integrate its operations, likely driving significant revenue growth as outlined in the narrative. Analysts project an annual revenue growth rate of approximately 28.5%, faster than the overall market.

Over the past three-year period, Bit Digital's total shareholder return was 90.17%, illustrating strong performance contrasted against the company's recent one-year return, which underperformed the broader US software industry average of 19.2%. In the last twelve months, Bit Digital fell short of the broader market return of 11.4%, reflecting a more volatile share price. Despite this volatility, the recent share price increase of 87% aligns with the company's ambitious growth plans but still suggests substantial upside when considering the analyst price target of US$5.90. This target implies a potential near-term stock price growth of about 79.3% from the current US$3.29.

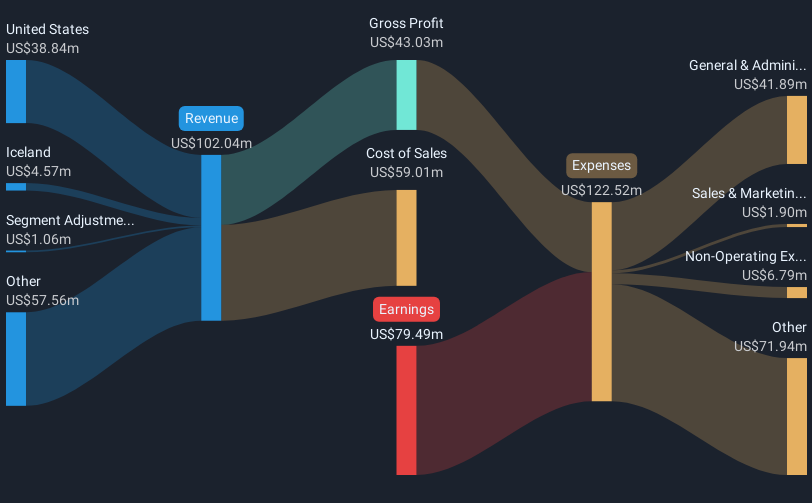

The shift from Bitcoin mining to AI infrastructure carry potential execution risks that could impact earnings and profit margins. Analysts estimate that earnings will reach US$41 million by 2028, up from the current negative earnings of US$79.49 million. These projections factor in the company's ongoing investments and potential revenue hurdles, such as reliance on GPU leasing and possible expenses related to tariffs. Ultimately, the pricing movement, in relation to the analyst consensus, reflects the anticipated impact of these operational changes on Bit Digital's future financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bit Digital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BTBT

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives