- United States

- /

- Software

- /

- NasdaqGS:BSY

Could Bentley Systems' (BSY) S&P Inclusion Reveal a Shift in Its Competitive Positioning?

Reviewed by Sasha Jovanovic

- In recent weeks, Bentley Systems was added to multiple S&P indices, including the S&P 400, S&P 1000, and S&P Composite 1500, while also appointing Cate Lochead as Chief Marketing Officer.

- These developments highlight a period of increased market visibility and leadership focus on AI and software innovation for the company.

- We'll now explore how the company’s recent inclusion in the S&P indices may influence its long-term growth outlook and investment thesis.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bentley Systems Investment Narrative Recap

To be a shareholder in Bentley Systems, you need to believe in ongoing global infrastructure digitization and the company’s ability to stay ahead in software and AI innovation. The recent inclusion in S&P indices enhances visibility but is unlikely to materially affect the primary catalysts, such as large-scale digital transformation in engineering, or address the key risk, which is shifting industry standards and increased competition from cloud-native and open-source platforms. The appointment of Cate Lochead as Chief Marketing Officer, with her track record in promoting enterprise AI software, aligns directly with Bentley’s focus on AI-driven solutions, a core theme supporting current growth initiatives. This move is highly relevant as the sector’s productivity and transformation challenges make leadership in AI integration a central pillar for the company’s prospects. Yet, investors should also be aware that rising AI adoption could disrupt traditional user-based pricing models, fundamentally affecting...

Read the full narrative on Bentley Systems (it's free!)

Bentley Systems' outlook anticipates $1.9 billion in revenue and $443.2 million in earnings by 2028. This projection is based on a 9.7% annual revenue growth rate and reflects a $188.9 million increase in earnings from the current $254.3 million.

Uncover how Bentley Systems' forecasts yield a $59.08 fair value, a 16% upside to its current price.

Exploring Other Perspectives

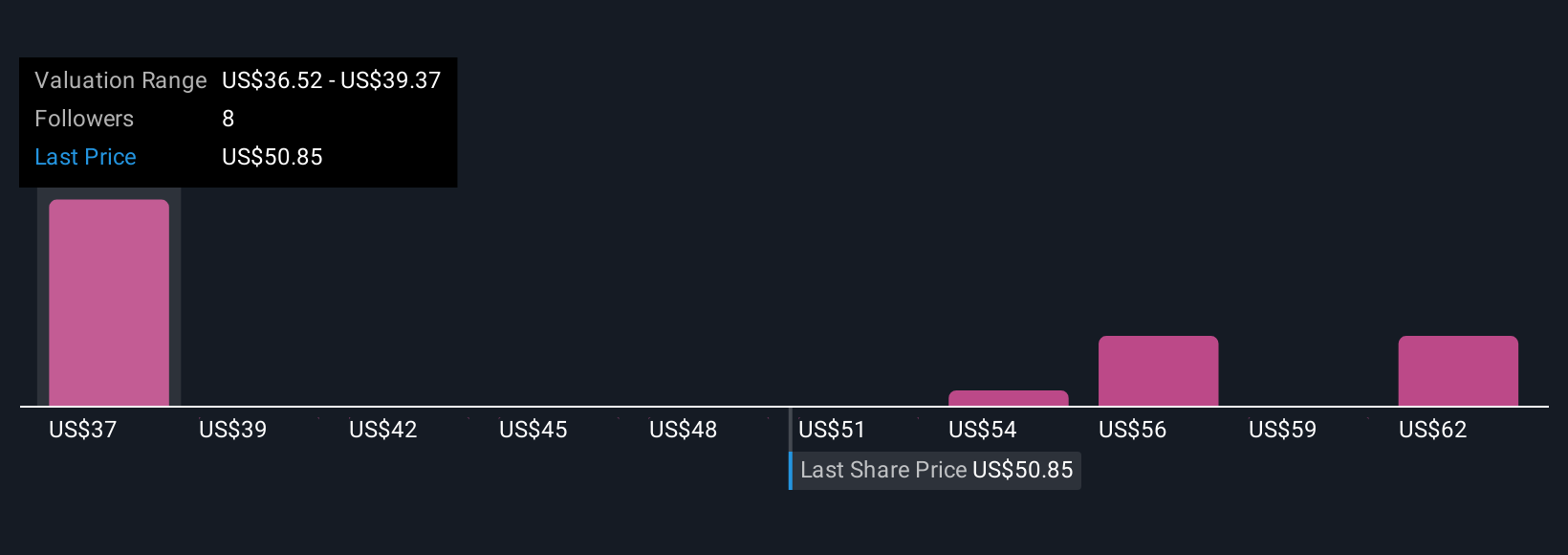

Four members of the Simply Wall St Community provided fair value estimates for Bentley Systems ranging from US$36.52 to US$65. While some see significant upside, forecasts of slowing revenue growth highlight how opinions on future performance can diverge significantly. Explore these perspectives to see how your view compares.

Explore 4 other fair value estimates on Bentley Systems - why the stock might be worth 28% less than the current price!

Build Your Own Bentley Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bentley Systems research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Bentley Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bentley Systems' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives