- United States

- /

- Software

- /

- NasdaqGS:BSY

Bentley Systems (BSY) Declares US$0.07 Dividend for Q3 2025

Reviewed by Simply Wall St

Bentley Systems (BSY) has reaffirmed its shareholder value commitment with a declared quarterly dividend of $0.07 per share, underscoring financial stability. Over the last quarter, Bentley's stock experienced a 7% rise, which aligns with the overall market's upward trend, as tech stocks, particularly in AI and infrastructure, benefited from an optimistic outlook. The company's strong 6-month revenue growth of 10% further bolstered investor confidence. Despite a slight decline in quarterly net income, efforts such as product innovation and client engagement initiatives in AI education likely provided added assurance amid broader market gains.

The recent dividend announcement from Bentley Systems underlines its financial stability and aligns with its commitment to shareholder value, contributing to a positive sentiment that helped propel a 7% rise in its share price. Over a three-year period, Bentley's total shareholder return, including dividends, stands at a substantial 59.39%, offering considerable gains to long-term investors. This performance, contrasted with its one-year underperformance compared to both the software industry (27.4%) and the broader US market (19.9%), highlights potential concerns amidst its otherwise strong long-term trajectory.

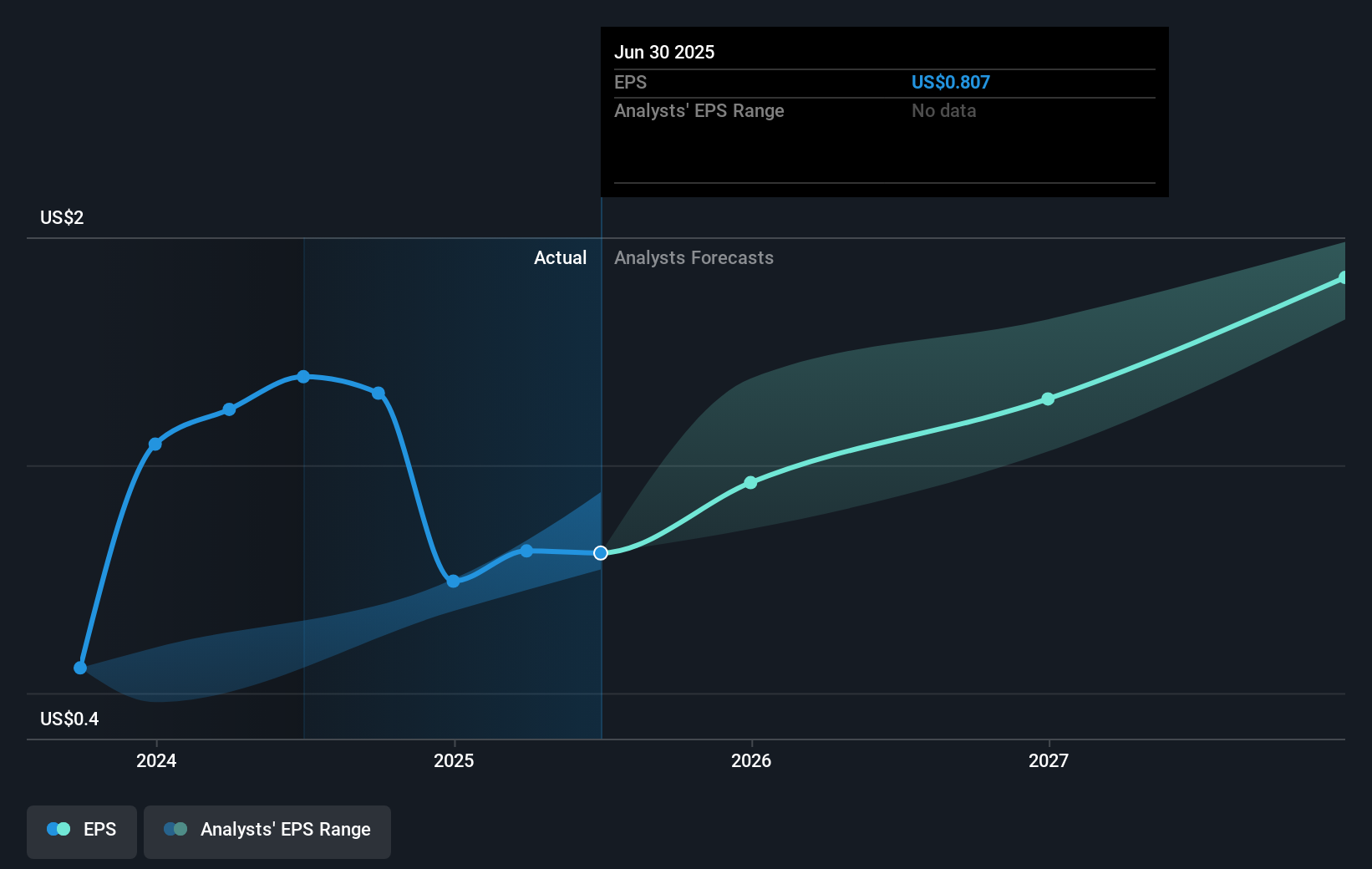

The sustained dividend policy and recent share price movement could positively influence revenue and earnings forecasts by reinforcing investor confidence in Bentley's strategic growth initiatives, capital commitment, and market positioning in AI and infrastructure software. Nevertheless, with a current share price of US$52.94, the analyst price target of US$59.08 suggests an 11.59% upside, which should induce both caution and optimism among investors. As Bentley navigates competitive pressures and market challenges, its growth potential will hinge on the successful execution of its strategic initiatives in emerging markets and its ability to maintain this momentum.

Learn about Bentley Systems' historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bentley Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BSY

Bentley Systems

Provides infrastructure engineering software solutions in the Americas, Europe, the Middle East, Africa, and the Asia-Pacific.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)