- United States

- /

- Software

- /

- NasdaqGS:BL

Will Activist Pressure and Rosenblatt’s Upbeat Coverage Change BlackLine's (BL) Narrative?

Reviewed by Sasha Jovanovic

- In November 2025, Engaged Capital sent a books-and-records demand to BlackLine’s board over its handling of multiple acquisition offers, including an actionable US$66-per-share proposal from SAP, and raised concerns about transparency, underperformance versus software peers, and stockholder engagement.

- Shortly afterward, Rosenblatt Securities initiated coverage on BlackLine with a positive fundamental view, adding fresh external scrutiny to a company already under pressure from an activist investor questioning its board’s decisions.

- Next, we’ll examine how Rosenblatt’s upbeat coverage, set against Engaged Capital’s governance challenge, reframes BlackLine’s existing investment narrative and risks.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

BlackLine Investment Narrative Recap

To own BlackLine, you generally need to believe in long term demand for finance automation and the company’s ability to convert that into steadier growth and better profitability. In the near term, the main catalyst remains execution on its enterprise focused go to market plans, while the biggest risk is pressure from large integrated ERP vendors. The latest activist challenge and upbeat brokerage coverage both increase attention on governance, but do not yet change those fundamentals in a material way.

Among recent developments, Engaged Capital’s Section 220 books and records demand stands out as most relevant here, because it squarely targets BlackLine’s governance and board level decision making at a time when investors are being asked to underwrite a multi year execution story. With Engaged openly considering board nominations and a possible proxy contest, the outcome of this process could influence how the company responds to competition from ERP suites and evaluates future partnership or acquisition proposals.

Yet investors should be aware that growing consolidation among ERP vendors could reshape BlackLine’s competitive position and pricing power...

Read the full narrative on BlackLine (it's free!)

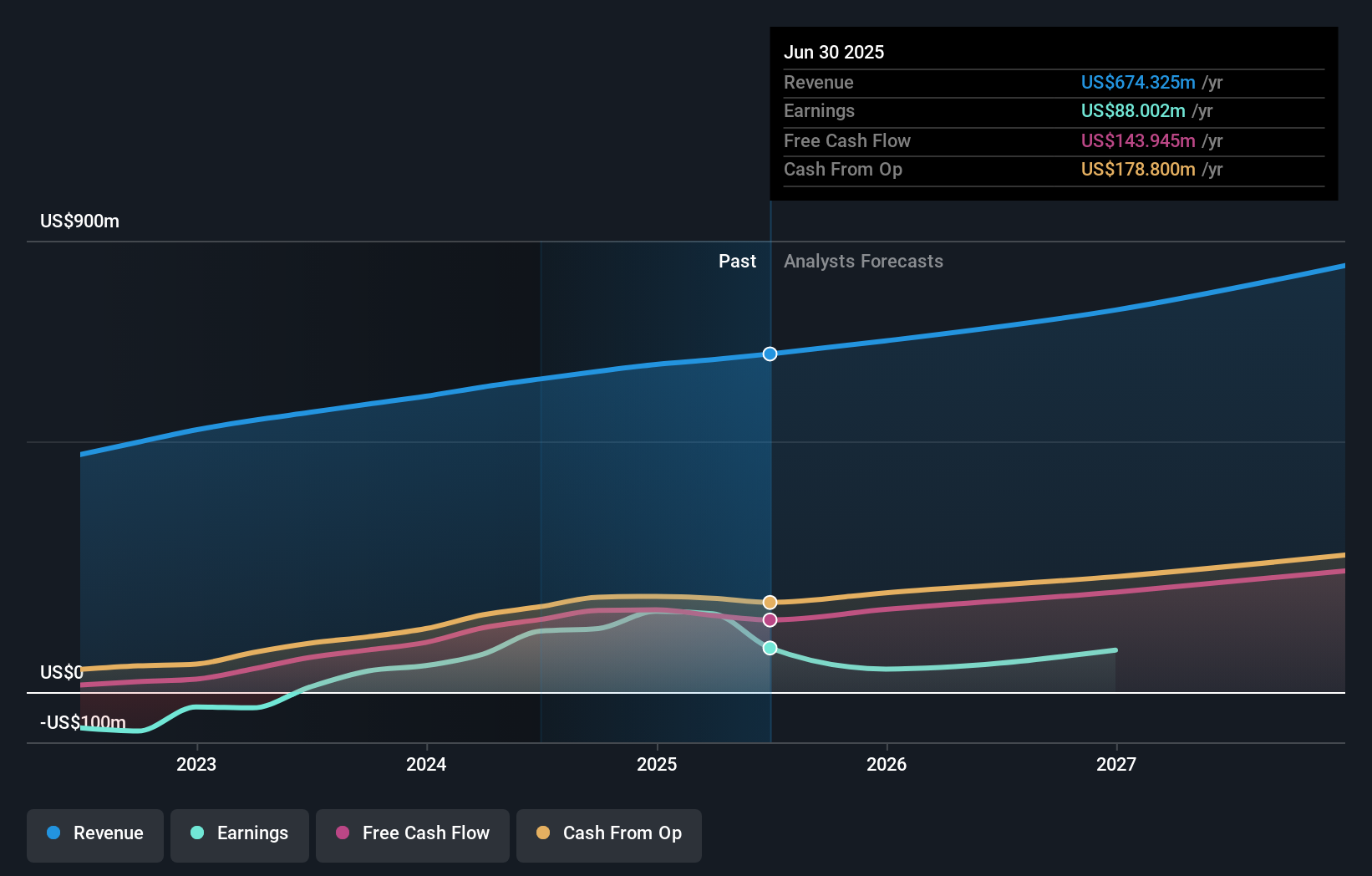

BlackLine's narrative projects $920.5 million revenue and $68.3 million earnings by 2028. This requires 10.9% yearly revenue growth and an earnings decrease of $19.7 million from $88.0 million today.

Uncover how BlackLine's forecasts yield a $61.83 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community currently estimate BlackLine’s fair value between US$38.46 and US$98.90, underlining how far views can diverge. Set against this spread, concerns about intensifying competition from integrated ERP vendors speak directly to the company’s ability to sustain growth and margins, so it is worth weighing several different viewpoints before forming your own.

Explore 4 other fair value estimates on BlackLine - why the stock might be worth as much as 68% more than the current price!

Build Your Own BlackLine Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackLine research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackLine research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackLine's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BlackLine might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BL

BlackLine

Provides cloud-based solutions to automate and streamline accounting and finance operations in the United States and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026