- United States

- /

- Biotech

- /

- NasdaqCM:HRTX

High Growth Tech Stocks to Watch in US Market February 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 4.8%, yet it remains up by 15% over the past year with earnings forecast to grow by 14% annually. In this context, identifying high growth tech stocks involves looking for companies that can capitalize on technological advancements and maintain robust growth trajectories despite short-term market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 29.10% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Bitdeer Technologies Group | 44.71% | 155.06% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.84% | 58.60% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 225 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

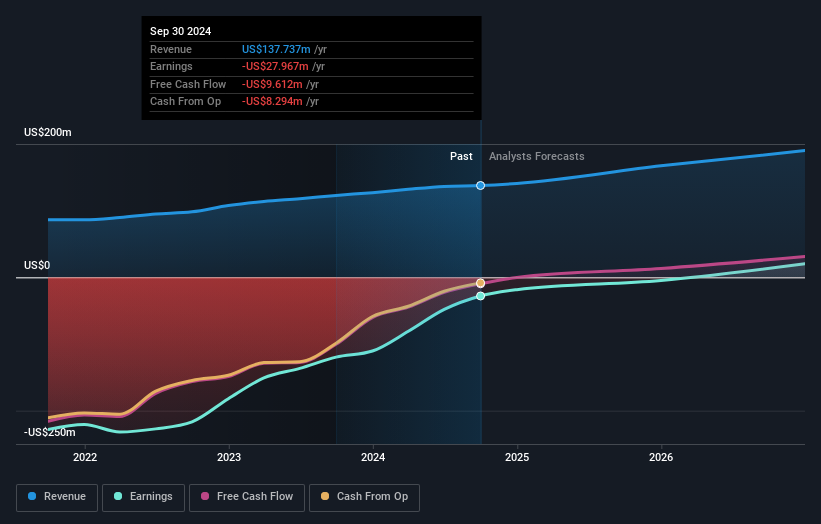

Heron Therapeutics (NasdaqCM:HRTX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Heron Therapeutics, Inc. is a commercial-stage biotechnology company dedicated to improving patient care through the development and commercialization of innovative therapies, with a market cap of $260.08 million.

Operations: The company is focused on developing and commercializing therapies that enhance medical care, with a market cap of approximately $260.08 million.

Heron Therapeutics, transitioning its headquarters to North Carolina's Research Triangle Park, a hub for high-tech research and development, underscores its strategic focus on innovation amidst a challenging financial landscape. Despite a volatile share price and previous unprofitability, Heron reported a significant reduction in net loss from $110.56 million in the previous year to $13.58 million in 2024, alongside positive earnings per share growth from -$0.8 to -$0.09 annually. Looking ahead, the company forecasts 2025 revenues between $153 million and $163 million, reflecting an anticipated growth trajectory supported by its strategic relocation and focus on expanding within the biotech sector's dynamic environment.

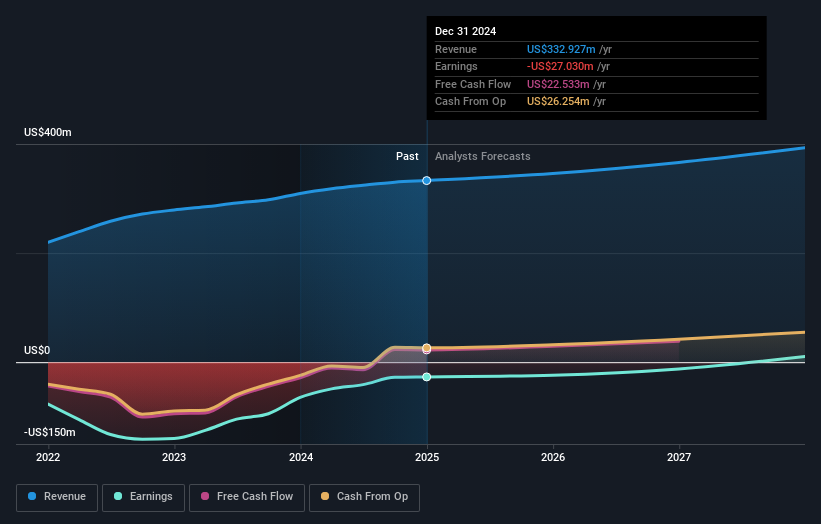

BigCommerce Holdings (NasdaqGM:BIGC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BigCommerce Holdings, Inc. provides a software-as-a-service platform catering to enterprises, small businesses, and mid-markets across multiple regions globally with a market cap of approximately $548.05 million.

Operations: The company generates revenue primarily through its software-as-a-service platform, with $332.93 million coming from the Internet Information Providers segment. Its operations span across various global regions, including the United States and Asia–Pacific.

BigCommerce Holdings has demonstrated resilience with a notable reduction in its net loss from $64.67 million to $27.03 million year-over-year, alongside a steady increase in sales, reaching $332.93 million by the end of 2024. This improvement is underpinned by strategic executive hires and product innovations like Catalyst, which optimizes ecommerce storefronts through integrated, marketing-friendly tools that enhance flexibility and performance without heavy development costs. With revenue expected to grow between $342.1 million and $350.1 million in 2025, BigCommerce is positioning itself strongly within the competitive ecommerce platform market despite slower-than-market average revenue growth projections of 5.1% annually compared to the U.S market's 8.7%.

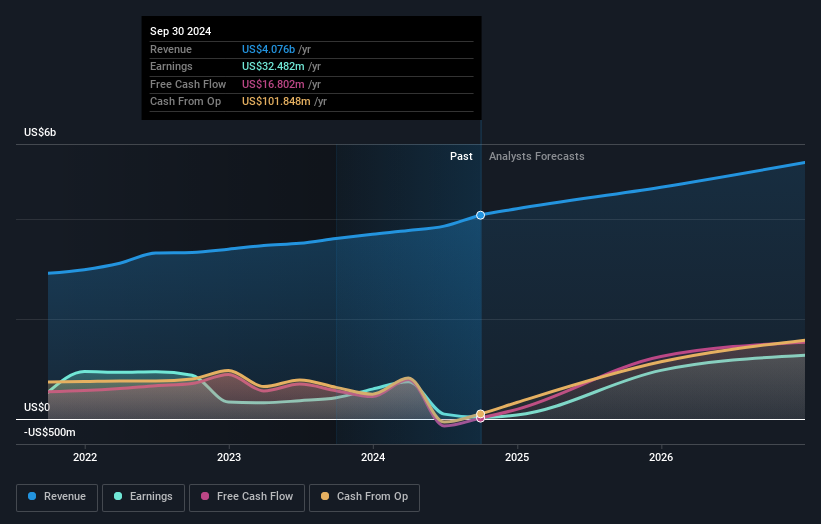

Incyte (NasdaqGS:INCY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Incyte Corporation is a biopharmaceutical company focused on discovering, developing, and commercializing therapeutics across the United States, Europe, Canada, and Japan with a market capitalization of approximately $14.38 billion.

Operations: Incyte generates revenue primarily from its biotechnology segment, which brought in $4.24 billion. The company operates within the biopharmaceutical industry, focusing on the discovery and commercialization of therapeutics across multiple regions including the United States, Europe, Canada, and Japan.

Incyte's recent strategic collaboration with Genesis Therapeutics underscores its commitment to leveraging cutting-edge AI in drug discovery, a move that could enhance its pipeline's potential. This partnership, complemented by an upfront payment of $30 million and possible future milestones totaling up to $295 million per target, positions Incyte at the forefront of innovation in small molecule medicine. Despite a challenging year with several program terminations and a net income drop to $32.62 million from $597.6 million, Incyte is navigating its R&D focus towards promising areas like chronic GVHD treatment with Niktimvo™, recently FDA-approved underlining its ongoing commitment to address high-need medical conditions through advanced biotechnological approaches.

- Click to explore a detailed breakdown of our findings in Incyte's health report.

Evaluate Incyte's historical performance by accessing our past performance report.

Key Takeaways

- Investigate our full lineup of 225 US High Growth Tech and AI Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heron Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HRTX

Heron Therapeutics

A commercial-stage biotechnology company, focuses on enhancing the lives of patients by developing and commercializing therapeutic that enhances medical care.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives