- United States

- /

- Machinery

- /

- NYSE:JBTM

BigCommerce Holdings And 2 Additional Stocks Estimated To Be Trading At A Discount

Reviewed by Simply Wall St

As the U.S. stock market grapples with volatility driven by tech sell-offs and tariff uncertainties, investors are increasingly on the lookout for opportunities amid these turbulent conditions. In such an environment, identifying undervalued stocks can be crucial for those seeking to capitalize on potential market mispricings, as these stocks may offer attractive entry points relative to their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SouthState (NYSE:SSB) | $99.28 | $193.86 | 48.8% |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | $29.66 | $59.06 | 49.8% |

| MINISO Group Holding (NYSE:MNSO) | $20.64 | $41.07 | 49.7% |

| Northwest Bancshares (NasdaqGS:NWBI) | $12.44 | $24.36 | 48.9% |

| Old National Bancorp (NasdaqGS:ONB) | $23.38 | $45.61 | 48.7% |

| Lantheus Holdings (NasdaqGM:LNTH) | $91.49 | $181.89 | 49.7% |

| Cadre Holdings (NYSE:CDRE) | $33.07 | $64.91 | 49% |

| JBT Marel (NYSE:JBTM) | $131.35 | $262.00 | 49.9% |

| Workiva (NYSE:WK) | $87.44 | $170.81 | 48.8% |

| BKV (NYSE:BKV) | $20.33 | $40.02 | 49.2% |

Here we highlight a subset of our preferred stocks from the screener.

BigCommerce Holdings (NasdaqGM:BIGC)

Overview: BigCommerce Holdings, Inc. provides a software-as-a-service platform catering to enterprises, small businesses, and mid-market clients across various regions globally, with a market cap of approximately $548.05 million.

Operations: Revenue for BigCommerce Holdings is derived from its Internet Information Providers segment, totaling $332.93 million.

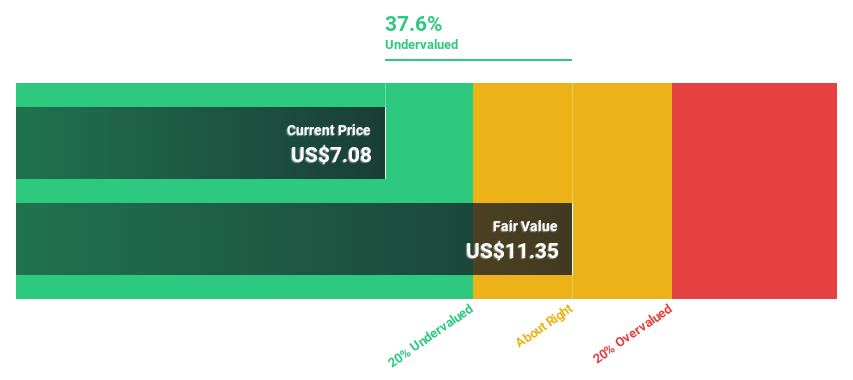

Estimated Discount To Fair Value: 37.3%

BigCommerce Holdings trades at US$7.09, significantly below its estimated fair value of US$11.3, presenting a potential undervaluation based on discounted cash flows. Despite slower revenue growth forecasts than the broader market, the company is expected to become profitable within three years with substantial earnings growth projected annually at 47.9%. Recent executive appointments and product innovations like Catalyst enhance strategic positioning, potentially driving future performance improvements in ecommerce capabilities and operational efficiency.

- According our earnings growth report, there's an indication that BigCommerce Holdings might be ready to expand.

- Dive into the specifics of BigCommerce Holdings here with our thorough financial health report.

GEO Group (NYSE:GEO)

Overview: The GEO Group, Inc. (NYSE: GEO) operates in the ownership, leasing, and management of secure facilities and reentry centers across the United States, Australia, the United Kingdom, and South Africa with a market cap of approximately $3.51 billion.

Operations: The company's revenue is primarily derived from its operations in secure facilities, processing centers, and community-based reentry facilities across the United States, Australia, the United Kingdom, and South Africa.

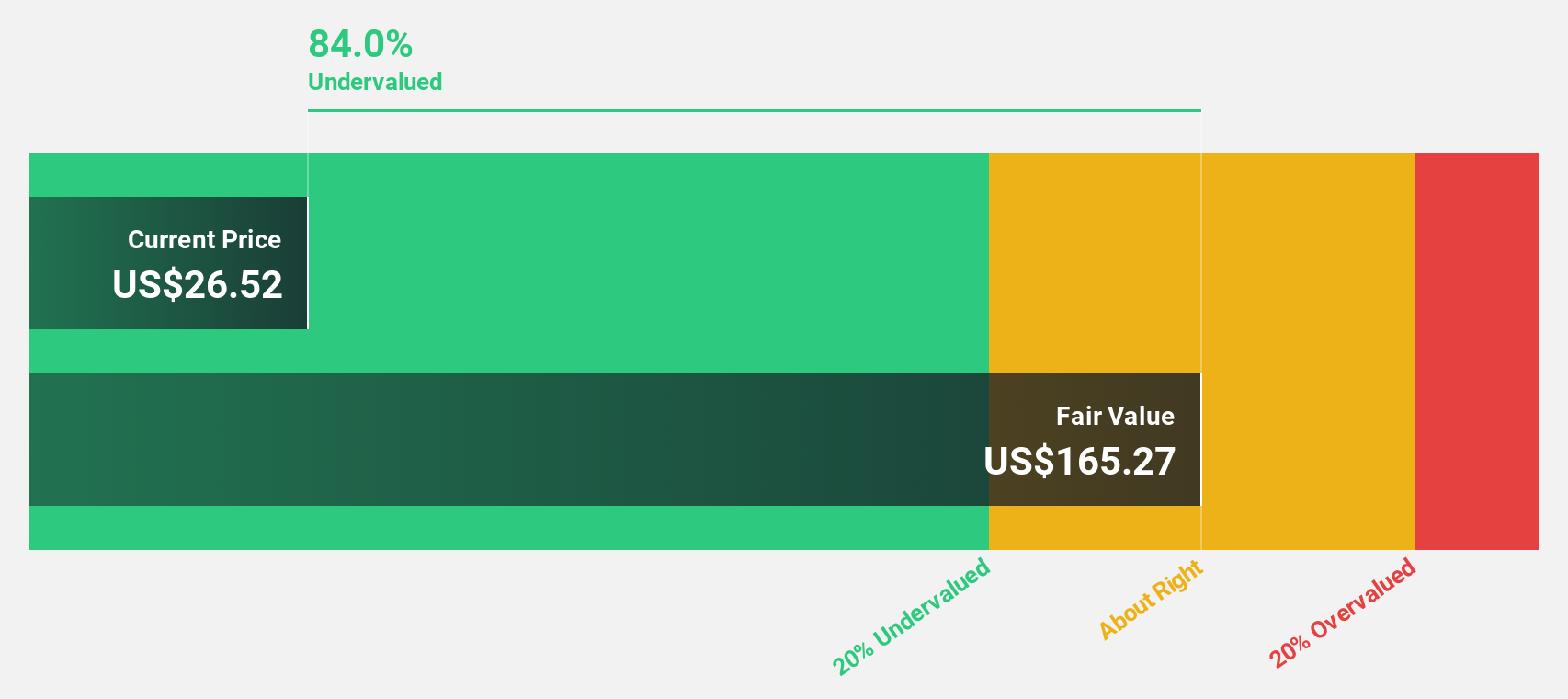

Estimated Discount To Fair Value: 24.8%

GEO Group trades at US$27.34, below its estimated fair value of US$36.36, indicating potential undervaluation based on cash flows. Despite lower profit margins and interest payments not well covered by earnings, GEO's earnings are forecast to grow significantly at 98.1% annually over the next three years. A new US$1 billion contract with ICE is expected to enhance revenue streams and stabilize financial performance as the company navigates executive changes and strategic investments in detention services.

- Upon reviewing our latest growth report, GEO Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of GEO Group stock in this financial health report.

JBT Marel (NYSE:JBTM)

Overview: JBT Marel Corporation offers technology solutions to the food and beverage industry across multiple regions, including North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America; it has a market cap of $7.08 billion.

Operations: The company generates revenue primarily through its John Bean Technologies (JBT) Food Tech segment, which accounts for $1.72 billion.

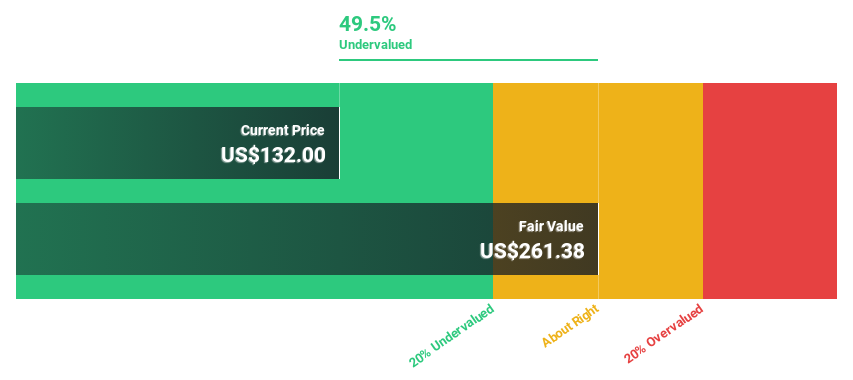

Estimated Discount To Fair Value: 49.9%

JBT Marel, trading at US$131.35, is significantly undervalued with a fair value estimate of US$262, reflecting potential based on cash flows. Despite a drop in profit margins from 7.8% to 4.9% and substantial shareholder dilution over the past year, earnings are expected to grow substantially at 53.6% annually over the next three years, outpacing market averages and supporting strong revenue growth forecasts of 26.8%. Recent dividend affirmations further underscore financial stability amidst evolving corporate strategies.

- The growth report we've compiled suggests that JBT Marel's future prospects could be on the up.

- Get an in-depth perspective on JBT Marel's balance sheet by reading our health report here.

Where To Now?

- Dive into all 195 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JBTM

JBT Marel

Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives