- United States

- /

- IT

- /

- NasdaqGM:BIGC

April 2025's Leading Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the U.S. market navigates through a period of economic contraction and investor anticipation surrounding major tech earnings, the recent weak GDP report has added to the cautious sentiment across indices like the S&P 500 and Nasdaq Composite. In such a climate, growth companies with high insider ownership can be particularly appealing, as strong insider stakes often signal confidence in long-term potential despite short-term market fluctuations.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (NasdaqGS:SMCI) | 25.6% | 29.8% |

| Hims & Hers Health (NYSE:HIMS) | 13.2% | 22% |

| Duolingo (NasdaqGS:DUOL) | 14.4% | 37.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 12.2% | 65.1% |

| Niu Technologies (NasdaqGM:NIU) | 36% | 82.8% |

| Astera Labs (NasdaqGS:ALAB) | 15.8% | 61.4% |

| Clene (NasdaqCM:CLNN) | 19.4% | 64% |

| Upstart Holdings (NasdaqGS:UPST) | 12.6% | 100.9% |

| BBB Foods (NYSE:TBBB) | 16.2% | 29.6% |

| Credit Acceptance (NasdaqGS:CACC) | 14.4% | 33.8% |

Let's uncover some gems from our specialized screener.

BigCommerce Holdings (NasdaqGM:BIGC)

Simply Wall St Growth Rating: ★★★★☆☆

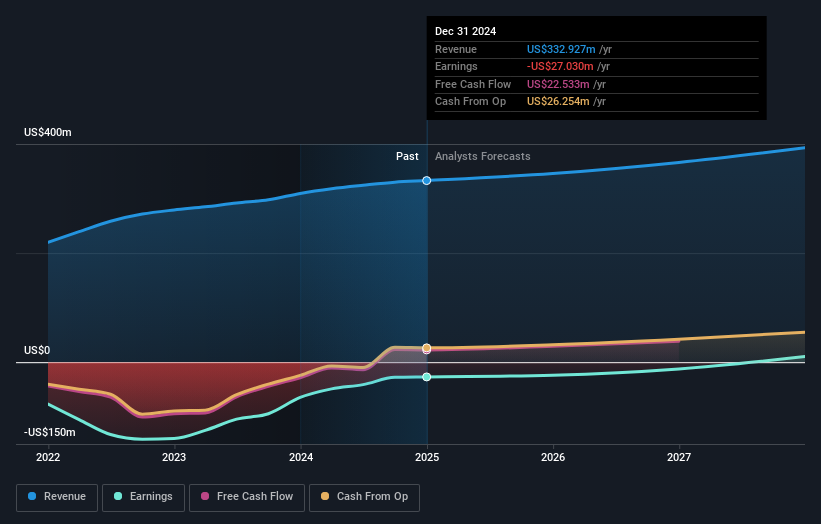

Overview: BigCommerce Holdings, Inc. provides a software-as-a-service ecommerce platform for brands and retailers across various regions worldwide, with a market cap of $418.82 million.

Operations: The company's revenue is primarily derived from its Internet Information Providers segment, totaling $332.93 million.

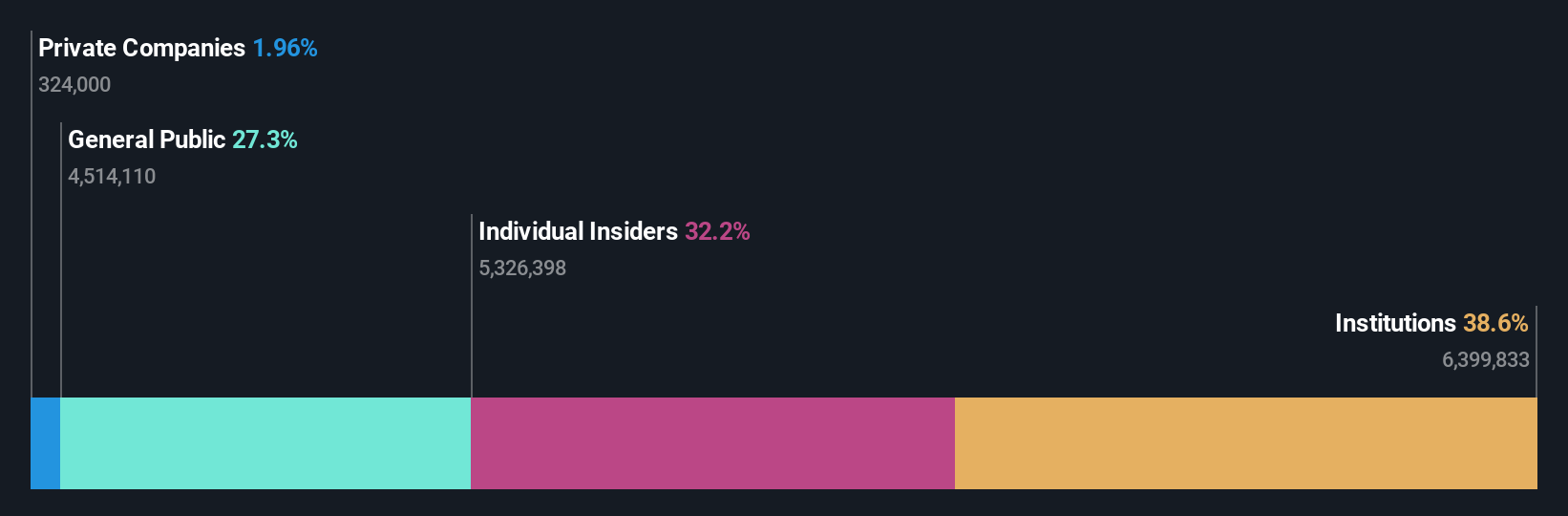

Insider Ownership: 16.3%

Return On Equity Forecast: 44% (2027 estimate)

BigCommerce Holdings shows promise in the growth sector with substantial insider buying and no significant selling over the past three months, indicating strong internal confidence. While its revenue growth forecast of 4.7% annually is below the US market average, it is expected to achieve profitability within three years, with a very high return on equity projected at 44%. Recent strategic alliances like the Distributed Ecommerce Hub enhance its B2B capabilities and position it well for scalable ecommerce solutions.

- Unlock comprehensive insights into our analysis of BigCommerce Holdings stock in this growth report.

- Our expertly prepared valuation report BigCommerce Holdings implies its share price may be lower than expected.

Capital Bancorp (NasdaqGS:CBNK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capital Bancorp, Inc. is the bank holding company for Capital Bank, N.A., with a market cap of approximately $471.05 million.

Operations: Capital Bancorp generates its revenue through its primary subsidiary, Capital Bank, N.A.

Insider Ownership: 31.9%

Return On Equity Forecast: N/A (2028 estimate)

Capital Bancorp demonstrates potential with earnings forecasted to grow 22.48% annually, outpacing the US market's 14.1%. Despite trading at 64% below estimated fair value and recent insider selling, its net interest income rose significantly to US$46.05 million in Q1 2025 from US$35.01 million a year ago, while net income doubled to US$13.93 million. The company has also announced a share repurchase program up to US$15 million expiring in February 2026, reflecting strategic capital management efforts.

- Click here and access our complete growth analysis report to understand the dynamics of Capital Bancorp.

- The valuation report we've compiled suggests that Capital Bancorp's current price could be quite moderate.

HCI Group (NYSE:HCI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: HCI Group, Inc. operates in the United States through its subsidiaries in property and casualty insurance, insurance management, reinsurance, real estate, and information technology sectors with a market cap of approximately $1.54 billion.

Operations: HCI Group's revenue is derived from its segments including Insurance Operations at $717.26 million, TypTap Group at $134.50 million, Real Estate at $14.07 million, and Reciprocal Exchange Operations at $30.76 million.

Insider Ownership: 15.7%

Return On Equity Forecast: 25% (2027 estimate)

HCI Group's insider ownership aligns with its strategic reorganization into two units, enhancing focus on insurance and technology solutions. Despite a recent dip in quarterly net income to US$2.58 million, full-year revenue rose to US$750.05 million with earnings per share increasing annually. Trading significantly below estimated fair value, HCI's projected earnings growth of 18.9% outpaces the US market average, supported by a high forecasted return on equity of 24.5%.

- Click to explore a detailed breakdown of our findings in HCI Group's earnings growth report.

- Our valuation report here indicates HCI Group may be undervalued.

Seize The Opportunity

- Navigate through the entire inventory of 199 Fast Growing US Companies With High Insider Ownership here.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 21 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if BigCommerce Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:BIGC

BigCommerce Holdings

Operates a software-as-a-service ecommerce platform for brands and retailers in the United States, North and South America, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives