- United States

- /

- Software

- /

- NasdaqGS:AVPT

Will AvePoint's (AVPT) New Equity Raise Shift Its Long-Term Capital Allocation Priorities?

Reviewed by Simply Wall St

- AvePoint, Inc. recently completed a follow-on equity offering of 13,290,360 shares of common stock, raising approximately US$259.2 million at an offering price of US$19.50 per share, following its filing of a universal shelf registration.

- This significant capital raise could influence AvePoint’s future capital allocation decisions while introducing questions about shareholder dilution and refreshed funding priorities.

- We’ll explore how AvePoint’s fresh equity raise and expanded capital base might alter the company’s forward-looking investment narrative and risk profile.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

AvePoint Investment Narrative Recap

To believe in AvePoint as a shareholder, you need to have confidence in the accelerating demand for integrated data governance and security solutions as enterprises face greater regulatory complexity, primarily in the Microsoft ecosystem. The recent US$259.2 million equity offering does not appear to materially change the short-term catalyst of increasing enterprise adoption of cloud data management, but does raise the risk of near-term shareholder dilution and questions about capital deployment. Among recent announcements, the raised full-year revenue guidance stands out. With the company projecting 23% to 24% year-over-year growth, this reinforces near-term optimism about demand momentum, and investors will likely be watching how the newly raised funds are deployed amid ongoing investments in AI-driven data governance and platform expansion. By contrast, prospective shareholders should also be aware that growing regulatory scrutiny and evolving data sovereignty laws present...

Read the full narrative on AvePoint (it's free!)

AvePoint's narrative projects $658.7 million revenue and $76.4 million earnings by 2028. This requires 20.9% yearly revenue growth and a $84.8 million increase in earnings from -$8.4 million today.

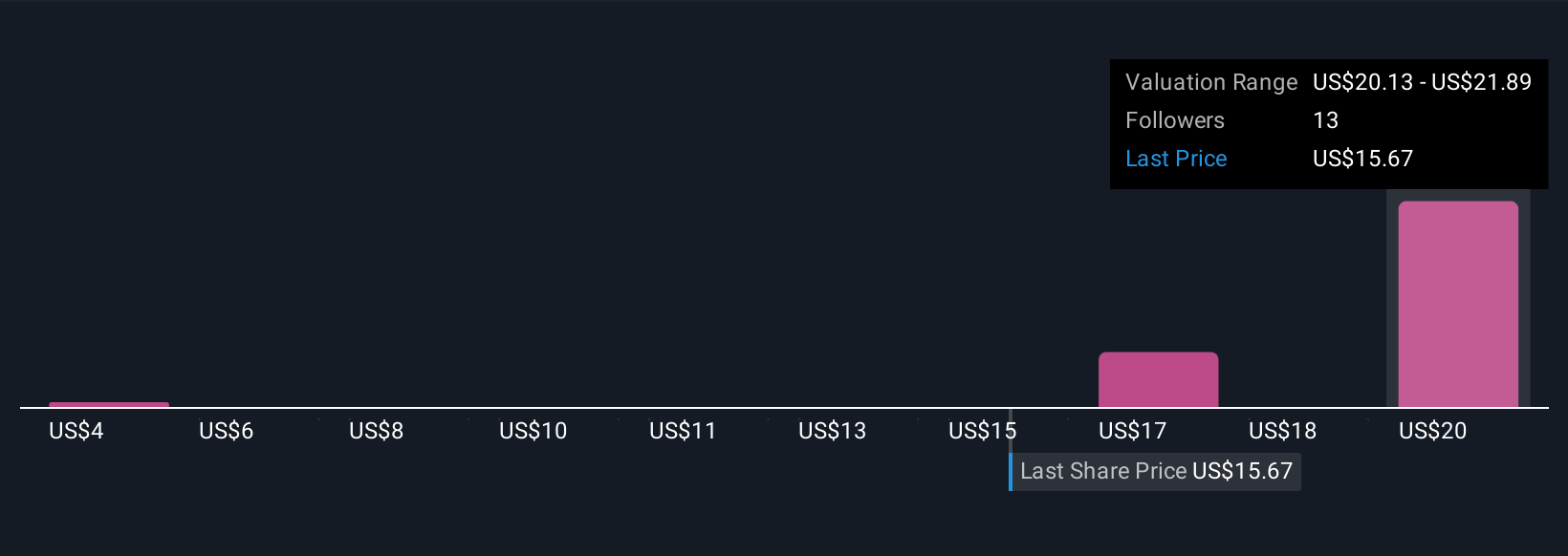

Uncover how AvePoint's forecasts yield a $21.89 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community have set fair value estimates for AvePoint between US$4.27 and US$21.89. With such a spread, especially in light of recent capital raising, the broad range of opinions underscores how regulatory risks and funding decisions may weigh differently on each investor's expectations.

Explore 3 other fair value estimates on AvePoint - why the stock might be worth less than half the current price!

Build Your Own AvePoint Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your AvePoint research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free AvePoint research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate AvePoint's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives