- United States

- /

- Software

- /

- NasdaqGS:AVPT

High Growth Tech Stocks In The US For August 2025

Reviewed by Simply Wall St

As of August 2025, the United States market has been buoyant, with the S&P 500 reaching a record high amid investor anticipation around Nvidia's earnings report and developments in Federal Reserve policies. In this dynamic environment, identifying high-growth tech stocks involves looking for companies that are well-positioned to capitalize on technological advancements and market trends while navigating economic shifts and policy changes effectively.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| ADMA Biologics | 20.60% | 23.25% | ★★★★★☆ |

| ACADIA Pharmaceuticals | 10.87% | 25.66% | ★★★★★☆ |

| Palantir Technologies | 25.17% | 31.57% | ★★★★★★ |

| Workday | 11.51% | 29.07% | ★★★★★☆ |

| Monopar Therapeutics | 76.01% | 54.38% | ★★★★★☆ |

| Circle Internet Group | 27.36% | 78.79% | ★★★★★☆ |

| RenovoRx | 65.52% | 68.63% | ★★★★★☆ |

| Gorilla Technology Group | 27.68% | 129.58% | ★★★★★☆ |

| Vanda Pharmaceuticals | 22.66% | 59.11% | ★★★★★☆ |

| Aldeyra Therapeutics | 42.88% | 74.81% | ★★★★★☆ |

Click here to see the full list of 69 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

CuriosityStream (CURI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CuriosityStream Inc. is a media and entertainment company that delivers factual content across various platforms, with a market cap of $257.21 million.

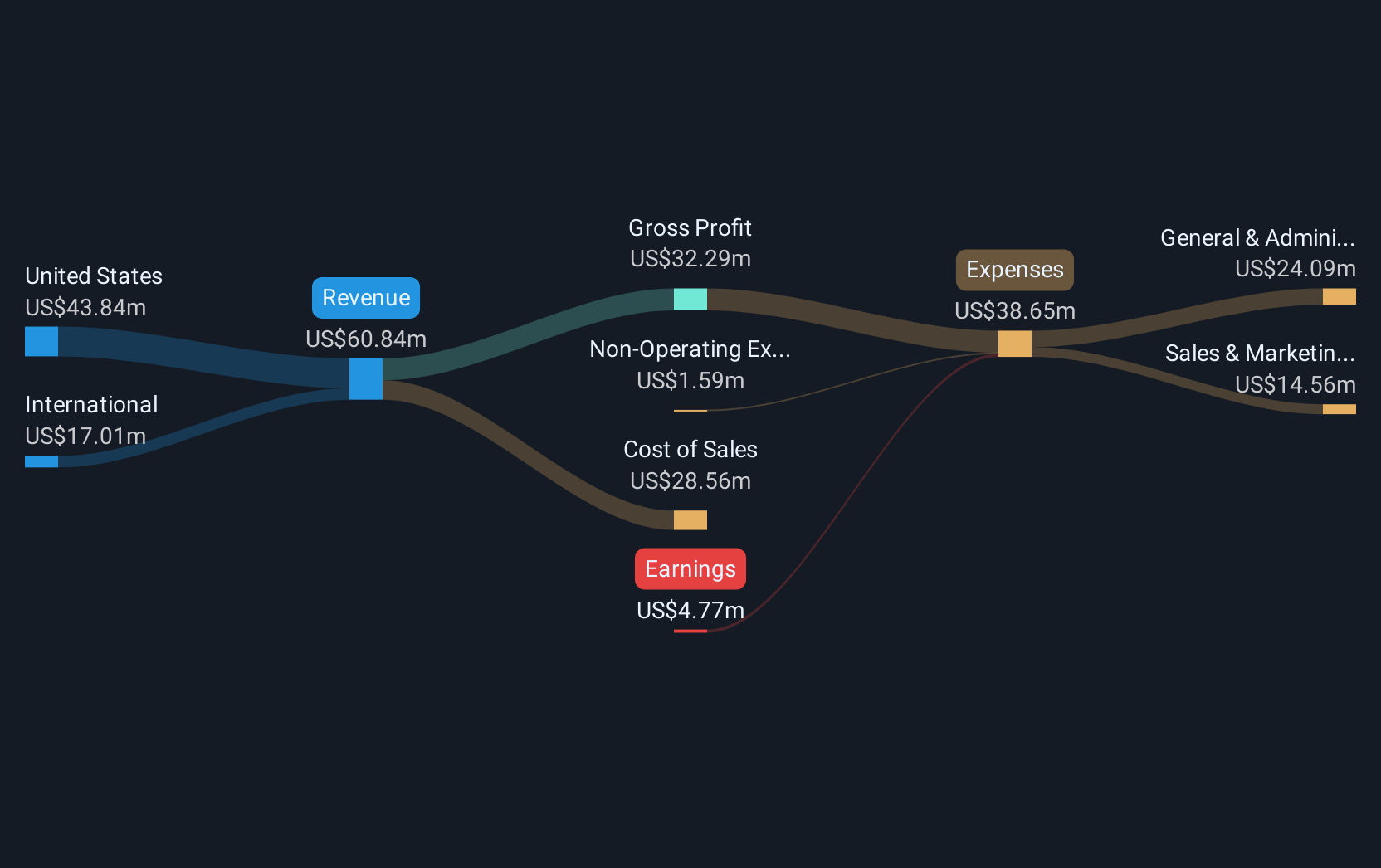

Operations: CuriosityStream generates revenue primarily from its Curiosity Stream segment, which reported $60.84 million. The company focuses on distributing factual content through diverse channels, contributing to its position in the media and entertainment industry.

CuriosityStream, a player in the factual entertainment sector, is leveraging strategic partnerships and follow-on equity offerings to fuel its growth. Recently, the company expanded its distribution through a significant agreement with DIRECTV and launched Curiosity NOW on MyFree DIRECTV, enhancing its reach across numerous U.S. households. This move aligns with CuriosityStream's focus on broadening accessibility to its non-fiction content amidst evolving pay-TV dynamics. Additionally, the company completed a $24.5 million equity offering at $3.5 per share, positioning itself to capitalize on emerging opportunities in the streaming space. With these developments, CuriosityStream continues to adapt and grow within the competitive landscape of digital media and entertainment.

- Click here to discover the nuances of CuriosityStream with our detailed analytical health report.

Evaluate CuriosityStream's historical performance by accessing our past performance report.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across various regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of approximately $3.35 billion.

Operations: With a market capitalization of approximately $3.35 billion, AvePoint, Inc. generates revenue primarily from its Software & Programming segment, which contributes $373.07 million.

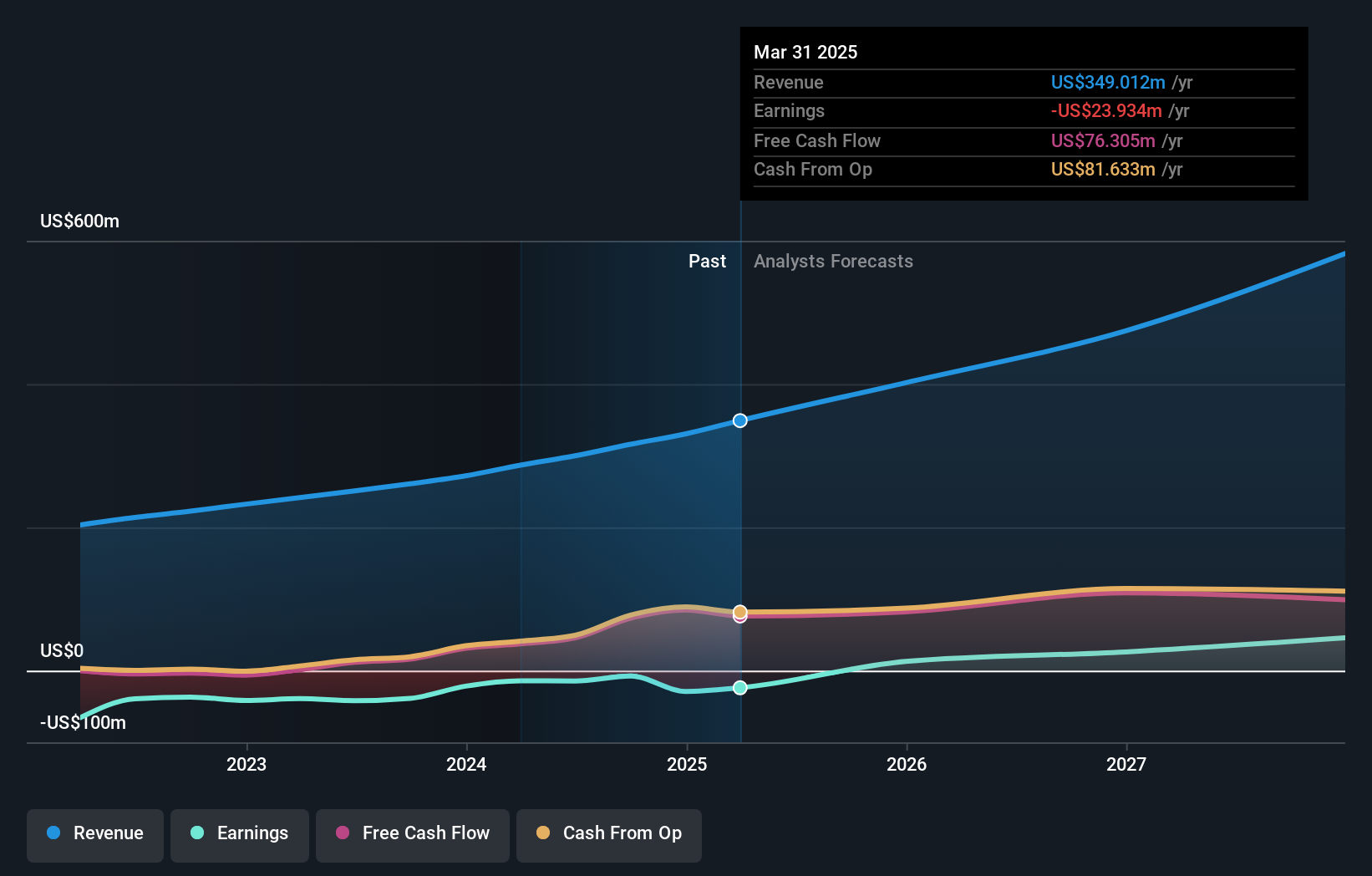

AvePoint's recent strategic moves, including a revamped Global Partner Program and significant earnings growth, underscore its adaptability in the high-growth tech sector. The company reported a substantial revenue increase to $102.02 million in Q2 2025 from $77.96 million the previous year, marking a pivotal turnaround from a net loss to a net income of $2.7 million. This financial rebound is complemented by AvePoint's forward-thinking innovations such as the new points-based partner system and enhancements in data security and governance—key areas as organizations increasingly prioritize AI readiness and compliance in multi-cloud environments. These developments not only bolster AvePoint’s market position but also enhance its ecosystem's sustainability by focusing on partner engagement over mere revenue metrics, setting the stage for continued growth in an evolving industry landscape.

- Navigate through the intricacies of AvePoint with our comprehensive health report here.

Gain insights into AvePoint's past trends and performance with our Past report.

VTEX (VTEX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform tailored for enterprise brands and retailers, with a market capitalization of $733.31 million.

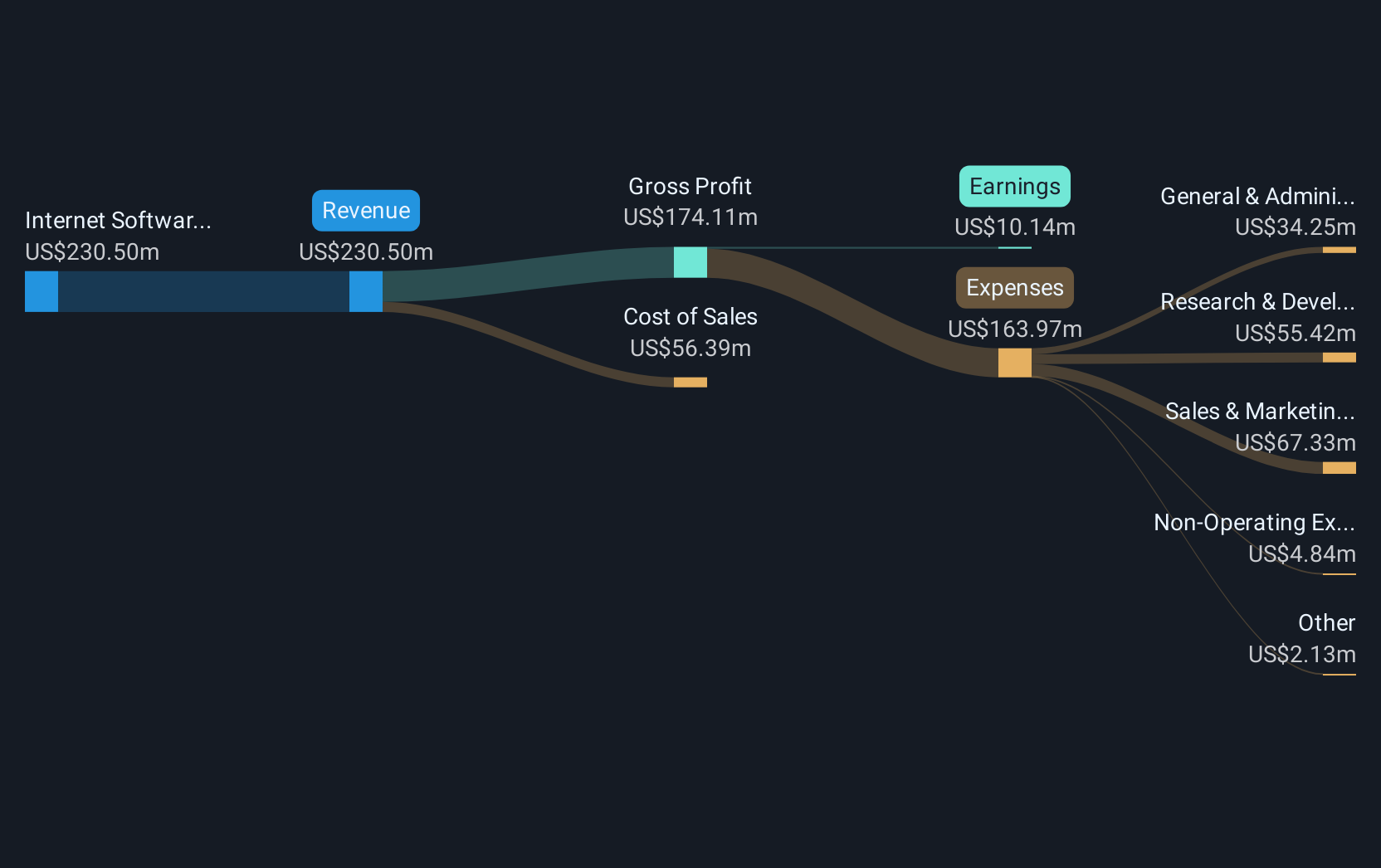

Operations: The company generates revenue primarily from its Internet Software & Services segment, totaling $230.50 million.

VTEX's recent performance and strategic initiatives position it intriguingly within the tech landscape. With a robust 54.4% earnings growth over the past year, outpacing the IT industry's average of 9.7%, VTEX demonstrates significant momentum. The company's R&D focus is evident in its latest product launches at VTEX Vision 2025, enhancing B2B capabilities and integrating advanced AI to streamline enterprise operations—critical as businesses increasingly seek efficient, scalable digital solutions. Moreover, VTEX has actively returned value to shareholders by repurchasing $30.38 million worth of shares under its recent buyback program, underscoring confidence in its financial health and future prospects.

- Get an in-depth perspective on VTEX's performance by reading our health report here.

Understand VTEX's track record by examining our Past report.

Turning Ideas Into Actions

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 66 more companies for you to explore.Click here to unveil our expertly curated list of 69 US High Growth Tech and AI Stocks.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives