- United States

- /

- Software

- /

- NasdaqGS:AVPT

AvePoint (AVPT) Valuation in Focus After Annual Report Highlights AI Deployment Gaps and Rising Security Demand

Reviewed by Kshitija Bhandaru

AvePoint (AVPT) just released its annual report, highlighting a major disconnect between what companies hope to achieve with AI and the reality of actually putting it to work. More than 75% of organizations reported AI-related security breaches and long deployment delays, pointing to the practical challenges at the intersection of AI and data governance.

See our latest analysis for AvePoint.

AvePoint’s annual report arrives on the heels of a lively year, with recent fireside chats and a surge of interest in AI-driven data security making headlines. Even with some turbulence, such as a 9% dip in the past month and broader volatility since summer, the stock’s one-year total shareholder return of 20.9% shows longer-term investors are still well in the green. The multi-year gain hints at sustained growth potential as market momentum recalibrates.

If you’re curious about what else is reshaping the tech landscape, it’s the perfect time to discover See the full list for free.

But with robust revenue growth, a persistent discount to analyst targets, and analysts turning bullish, investors are left to wonder: is AvePoint still flying under the radar, or has the market already factored in its future gains?

Most Popular Narrative: 32% Undervalued

Comparing AvePoint’s narrative fair value to its latest close reveals a significant price gap, suggesting room for optimism among forward-looking investors. The stage is set for a closer look at what propels such an upbeat outlook and what could lie beneath the surface.

The accelerating enterprise adoption of AI tools like Microsoft Copilot, alongside increasing security and data governance challenges, is positioning AvePoint's data management and governance solutions as mission-critical. This is driving robust customer expansions and higher spending per customer, which can act as a catalyst for sustained revenue growth and stronger net retention rates.

What kind of growth projections could justify such a bold valuation? Hints: expectations revolve around rising margins, ambitious top-line targets, and a profit outlook tuned for premium tech multiples. Want to uncover the actual numbers behind that fair value? The full narrative lays out the assumptions Wall Street is betting on.

Result: Fair Value of $21.89 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent reliance on Microsoft and slow multi-cloud expansion could limit AvePoint's growth potential. This casts uncertainty on the bullish outlook.

Find out about the key risks to this AvePoint narrative.

Another View: The Multiples Perspective

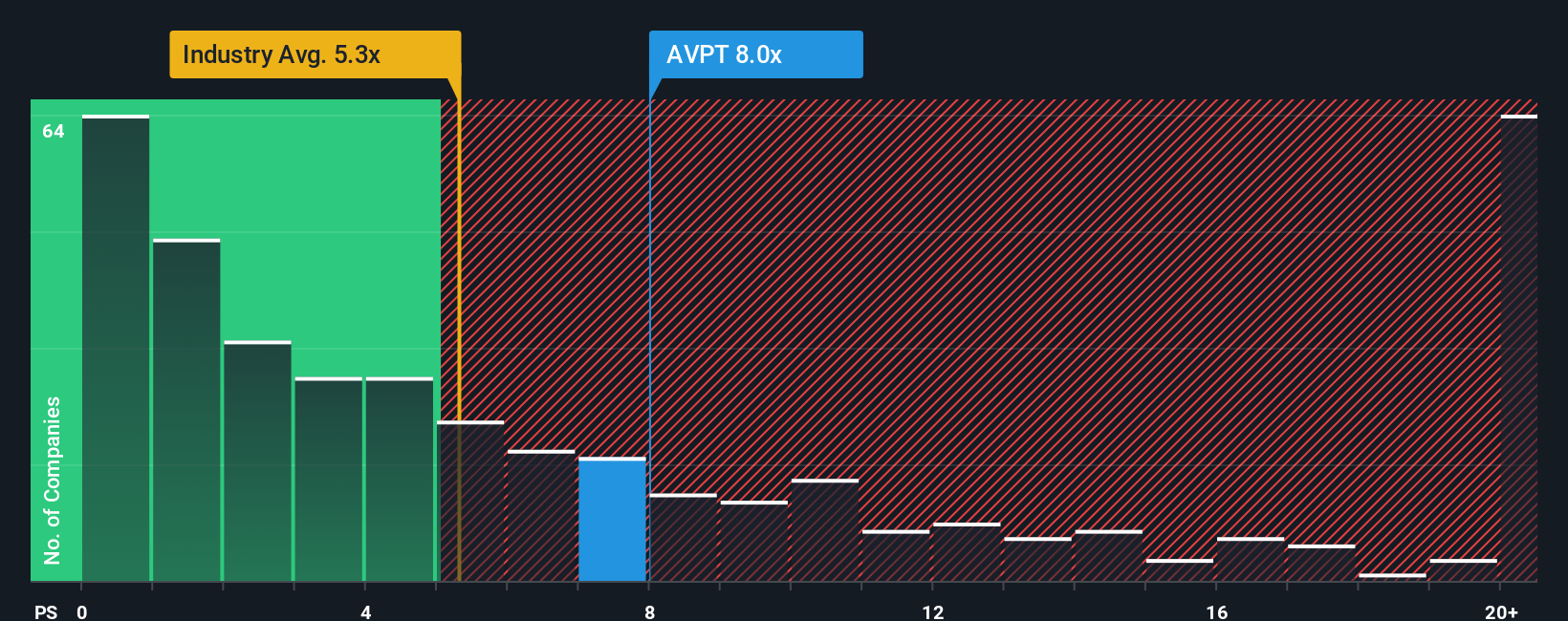

While AvePoint’s fair value looks attractive from a narrative and discounted cash flow standpoint, a different story emerges when we look at sales multiples. Its price-to-sales ratio of 8.4x is notably higher than the industry average of 5.3x and peers at 5.1x, and sits above its fair ratio of 6.4x. This premium could signal heightened risk if growth expectations slip, or an opportunity if the company truly outperforms. Does the stock deserve this valuation stretch, or is the market already factoring in the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AvePoint Narrative

If you’d rather chart your own course or want to back up your own take with the latest data, it’s easy to craft a personalized view in just a few minutes. Do it your way

A great starting point for your AvePoint research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

There’s a world of compelling investment stories waiting on Simply Wall Street. Don’t let standout opportunities slip by when you could be one step ahead.

- Unlock growth potential by checking out these 898 undervalued stocks based on cash flows, where strong cash flows reveal hidden gems the market hasn’t fully recognized.

- Boost your portfolio’s resilience with these 19 dividend stocks with yields > 3%, designed to pinpoint companies offering yields above 3% and consistent income streams.

- Get ahead of future trends by tapping into these 25 AI penny stocks, featuring innovators at the forefront of artificial intelligence shaping tomorrow’s technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVPT

AvePoint

Provides cloud-native data management software platform in North America, Europe, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives