- United States

- /

- Software

- /

- NasdaqGM:APPN

Appian (APPN) Valuation in Focus Following Sector-Wide Selloff Triggered by Cloud Margin Concerns

Reviewed by Kshitija Bhandaru

Appian (APPN) shares slipped alongside peers after Oracle’s lower-than-expected cloud margins triggered a wave of selling across tech stocks. Wider industry concerns, rather than company news, appear to be guiding Appian’s latest price action.

See our latest analysis for Appian.

Appian’s share price has seen renewed pressure lately, sliding more than 7% over the last month and down 14.1% year-to-date, as tech stocks broadly reacted to renewed worries about cloud margins and future growth expectations. While this latest dip follows sector-wide trends, the bigger picture shows momentum has faded. Appian’s 1-year total shareholder return sits at -8.9%, underscoring the challenge for small-cap software names to turn the tide after a longer stretch of underperformance.

If shifts in the software market have you thinking about your next move, now’s the perfect time to broaden your search and see fast growing stocks with high insider ownership.

Given the recent sector-wide pullback and Appian’s extended streak of weak returns, is the current dip a real buying opportunity, or is the market simply reflecting cautious expectations for future growth?

Most Popular Narrative: 15.7% Undervalued

Compared to its last close price of $28.51, the most popular narrative sees Appian’s fair value at $33.80. This suggests upside remains. This market perspective is based on key assumptions fueling future expectations, setting the context for a deeper look.

Ongoing improvements in sales execution, leadership alignment, and sales & marketing productivity (highlighted by eight consecutive quarters of increased go-to-market efficiency) suggest potential for further margin expansion and enhanced operating leverage. These factors support long-term earnings growth.

Want to know the blueprint behind this valuation? Analysts blend revenue growth, margin expansion, and operating leverage into a scenario that defies current trends. The real surprises are in how these projections stack up against recent profitability and sector expectations. Find out exactly what’s driving the calculation behind this projected upside.

Result: Fair Value of $33.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing customer down-sells and fierce competition from larger software platforms could threaten Appian’s ability to achieve its projected growth.

Find out about the key risks to this Appian narrative.

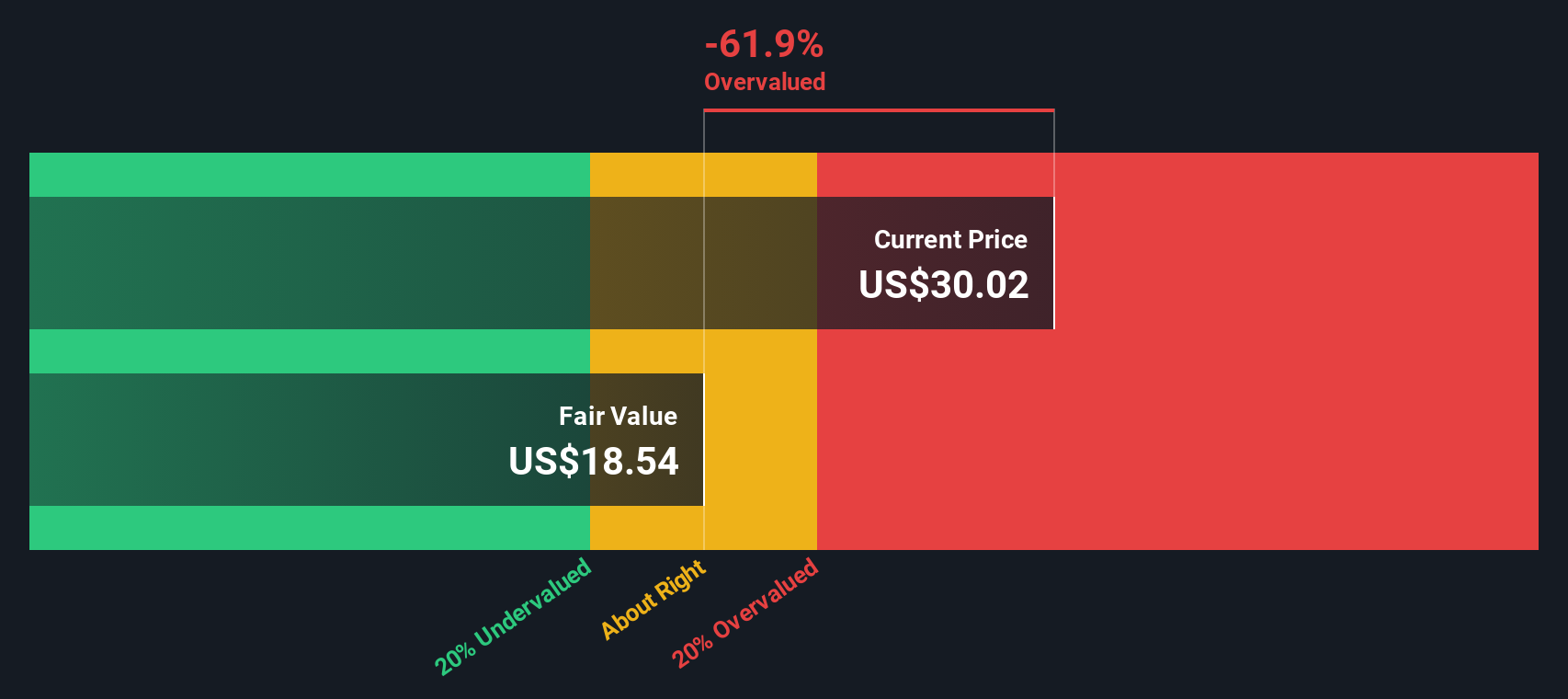

Another View: Discounted Cash Flow Signals Overvaluation

While analysts see room for upside based on future growth and margins, our DCF model tells a different story. According to the SWS DCF model, Appian's fair value is only $18.54, which is well below today’s price. This challenges the optimism of the analyst target. Which valuation gets it right?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Appian for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Appian Narrative

If these viewpoints do not quite fit your perspective, you can explore the numbers yourself and shape your own outlook on Appian in under three minutes, Do it your way.

A great starting point for your Appian research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors do not focus on a single opportunity. They consistently scan the market for the next big winner. Broaden your horizons and explore new ideas with these standout screens:

- Target steady income streams by reviewing these 19 dividend stocks with yields > 3%, where yields exceed 3% and financial strength helps safeguard your returns.

- Get ahead of tomorrow’s innovations and check out these 26 quantum computing stocks to uncover companies revolutionizing the world with quantum computing breakthroughs.

- Pinpoint hidden potential and value by sifting through these 892 undervalued stocks based on cash flows, connecting you to stocks poised for growth based on underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:APPN

Appian

Operates as a software company in the United States, Australia, Canada, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and internationally.

Slightly overvalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives