- United States

- /

- Software

- /

- NasdaqGM:APPN

A Fresh Look at Appian (APPN) Valuation After Buyback Program and New AI Success

Reviewed by Simply Wall St

Appian (APPN) just rolled out news that has investors perking up: a fresh $10 million share buyback program, effective through 2027. Buybacks not only signal management’s confidence, but can also create real value for shareholders. In addition to this, last week’s headline highlighted MagMutual’s impressive results from implementing Appian’s AI-powered platform, including faster workflows and over $1 million in new revenue. It appears the company is delivering results where it matters.

The combination of buyback news and tangible customer success appears to have brightened investor sentiment, with Appian’s share price climbing 10% over the past month and locking in a 6.6% return over the last twelve months. Momentum is showing some strength after a slow start earlier this year, even as Appian continues to roll out new solutions and record a double-digit jump in revenue growth.

With the stock’s recent rise and clear signs that the business is driving results, some investors may be evaluating whether Appian is undervalued at these levels or if the market has already accounted for the current upside.

Most Popular Narrative: 5.2% Undervalued

According to the most widely followed narrative, Appian’s shares are currently trading below fair value. This suggests there is room for appreciation if projections play out.

Broad enterprise demand for application modernization and workflow automation is accelerating. AI is seen as a catalyst that dramatically lowers modernization costs and complexity, positioning Appian's platform for increased adoption, larger deal sizes, and improved revenue growth over the coming years.

Curious how analysts think Appian could make the leap to a higher valuation? The secret sauce involves ambitious future profit margins and a leap in revenue growth, all tied to bold expectations of industry outperformance. Wondering just how aggressive these assumptions are? The real story behind the valuation may surprise you.

Result: Fair Value of $33.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising generative AI tools and tough competition from larger vendors could limit Appian’s future revenue growth and may challenge its low-code automation advantage.

Find out about the key risks to this Appian narrative.Another View: A Different Angle Raises Questions

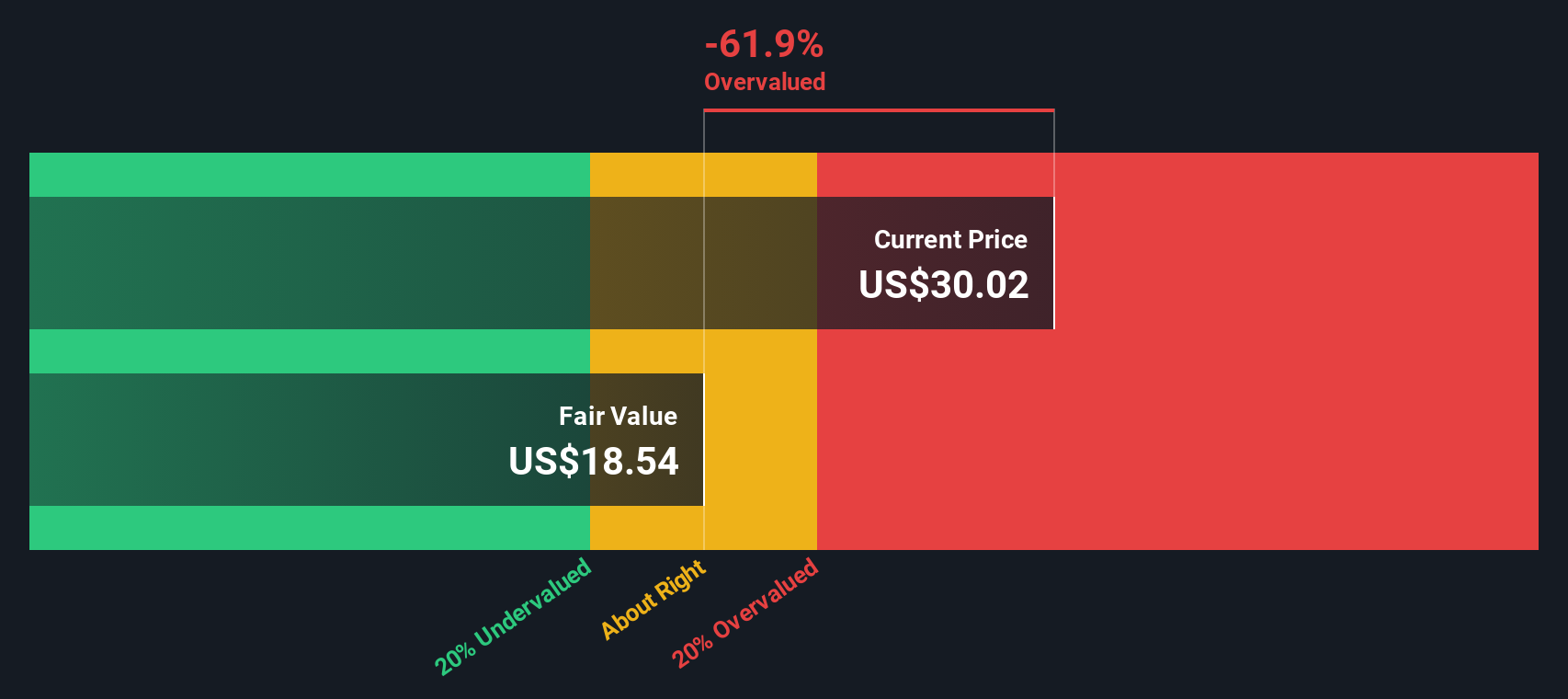

Looking at our DCF model, a more cautious valuation emerges. This suggests Appian may actually be priced above its underlying value. This result invites investors to question whether optimism is running too far ahead.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Appian Narrative

If you see things differently or want to back your own research, you can piece together your perspective in just a few minutes. Do it your way.

A great starting point for your Appian research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Stay ahead by targeting opportunities other investors might miss. Use these handpicked screens to spot strong trends, hidden value, or impressive income right now:

- Uncover growth potential in companies shaping tomorrow’s tech landscape by jumping into quantum computing stocks.

- Capture steady income by tapping into dividend stocks with yields > 3% that offer yields above 3% for consistent cash flow.

- Find hidden gems the market has overlooked with a scan for undervalued stocks based on cash flows powered by robust fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGM:APPN

Appian

Operates as a software company in the United States, Australia, Canada, France, Germany, India, Italy, Japan, Mexico, the Netherlands, Portugal, Singapore, Spain, Sweden, Switzerland, the United Kingdom, and internationally.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)