- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (NasdaqGS:APP) Sees 21% Price Drop Following Class Action Lawsuit Allegations

Reviewed by Simply Wall St

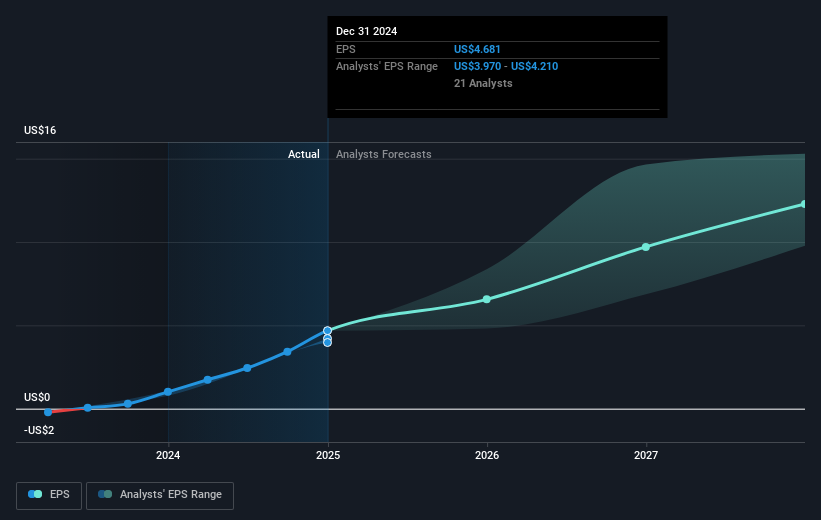

The recent legal troubles surrounding AppLovin (NasdaqGS:APP), including a class action lawsuit alleging securities law violations and accusations of unethical practices from Fuzzy Panda Research, have likely played a significant role in the company’s 21% share price decline over the past week. These allegations raise concerns over its business practices and growth claims, notably tied to its AXON 2.0 platform. Despite the broader market's tech rally led by companies like Tesla and Nvidia following promising CPI data, AppLovin continues to navigate its challenges, diverging from the sector's positive trend. The company's buyback program and solid fourth-quarter earnings seem overshadowed by legal and ethical scrutiny, contributing to the negative sentiment impacting its share price. As the Nasdaq rose with favorable inflation reports and a resurgence among other tech stocks, AppLovin stands out with its steep price fall amidst these contrasting market dynamics.

Over the recent three-year period, AppLovin has delivered a total shareholder return of 460.84%, a remarkable performance when considering the challenges it has faced. Notably, this outstrips both the US market and the US software industry over the past year. A key factor in its longer-term success has been significant earnings growth, with profits increasing substantially over the past year, driven by robust revenue growth and expanding profit margins. Enhancements to their AppDiscovery platform with advanced AI in August 2023 may also have positively impacted its performance efficiency.

Additionally, AppLovin's buyback strategy has played a role, particularly with buyback programs from October 2024 to February 2025 reducing the number of outstanding shares significantly. Furthermore, the company’s inclusion in the NASDAQ-100 Index in November 2024 provided a significant boost to its market profile, attracting broader investor interest during this period. These developments collectively reflect significant influences on AppLovin's impressive long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade AppLovin, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives