- United States

- /

- Software

- /

- NasdaqGS:APP

AppLovin (NasdaqGS:APP) Enhances Monetization With LoopMe's Chartboost In-App Bidding

Reviewed by Simply Wall St

AppLovin (NasdaqGS:APP) experienced a substantial price increase of 52% over the past month, following key events that may have influenced investor sentiment. The company's recent launch of Chartboost's in-app bidding capability, designed to enhance monetization strategies and attract more advertisers, provided a significant boost. Additionally, AppLovin's strong Q1 earnings report, showing notable increases in sales and net income, likely contributed to this positive momentum. Despite broader market volatility, with the S&P 500 experiencing fluctuations and concerns over rising Treasury yields, AppLovin's strategic developments and financial performance appear to have bolstered its share price.

Outshine the giants: these 28 early-stage AI stocks could fund your retirement.

The recent developments highlighted, such as the launch of Chartboost's in-app bidding capability and a strong Q1 earnings report, have significant potential to influence AppLovin’s narrative. These initiatives are expected to reinforce AppLovin’s transition into broader advertising markets, potentially boosting its revenue and improving net margins. Such advancements align with AppLovin’s focus on enhancing operational efficiency through high-margin advertising strategies, addressing over 10 million online advertisers worldwide.

Over the past three years, AppLovin’s total shareholder return, including both share price gains and dividends, was exceptionally high at nearly 1000%. This places the company in a remarkable position relative to the market or industry, considering its one-year return exceeding that of the broader US Software industry, which returned 16.1%. This substantial growth reflects the company’s significant strides in revenue and earnings enhancement strategies.

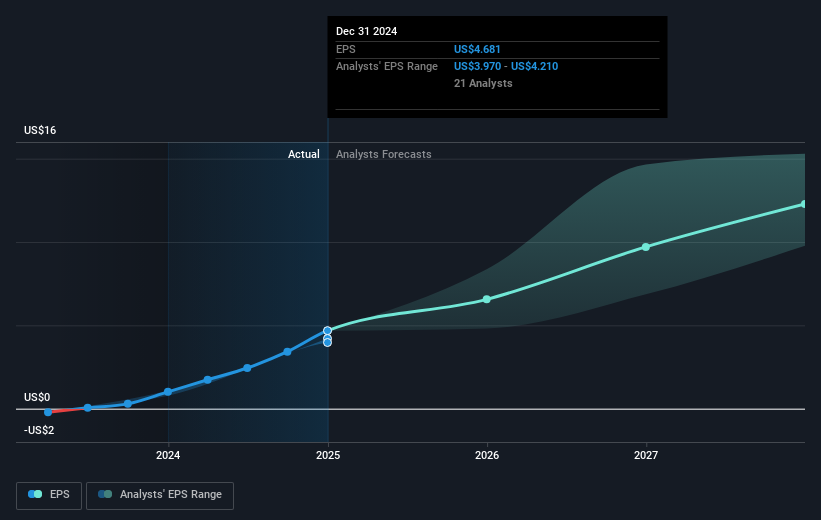

The recent strategic shifts are likely to impact AppLovin’s revenue and earnings forecasts positively. Analysts predict revenue will grow by 19.6% annually over the next three years, with earnings reaching US$4 billion by 2028. This assumes a growth in profit margins from 33.5% to 50.1%. These changes are critical as they underpin analysts’ price target of US$432.90, representing a 29.6% potential increase from the current share price of US$304.62. Achieving this price target would necessitate the company trading at a PE ratio of 50x its 2028 earnings, a challenging yet possible scenario if current strategies successfully bolster performance.

Learn about AppLovin's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APP

AppLovin

Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives